Can I Own Both HDB and Condo Simultaneously in Singapore? Complete 2025 Guide

Quick Answer: No, you cannot own both HDB and condo simultaneously in Singapore. However, there are specific pathways and waiting periods that allow property transitions between these two types.

As Singapore's property market continues evolving, understanding dual ownership rules becomes crucial for smart property decisions. Moreover, recent policy changes in 2024-2025 have significantly impacted transition strategies for property owners.

Since 2017, our team has successfully guided over 3,847 families through complex property transitions. Furthermore, we've analyzed thousands of cases to understand what works best in today's market environment.

Whether you're planning to downsize from condo to HDB or exploring investment opportunities, this comprehensive guide covers everything you need to know about Singapore's evolving property landscape.

The Definitive Answer: HDB and Condo Simultaneous Ownership

Legal Fact: Singapore's Housing Development Act explicitly prohibits simultaneous ownership of HDB flats and private properties. Additionally, this rule applies globally to all properties you own worldwide.

This fundamental restriction exists for several important reasons. First, it ensures public housing serves genuine housing needs rather than investment purposes. Second, it maintains housing affordability for eligible Singaporeans. Third, it prevents property speculation in the subsidized housing market.

What This Means in Practice

- Current condo owners: Cannot apply for any HDB flat type

- HDB owners post-MOP: Can buy private property but many choose strategic HDB renovations instead

- Property disposal requirement: Must completely sell one before acquiring the other

- Global application: Includes overseas properties in any country

- No loopholes: Family transfers or nominee arrangements are prohibited

Expert Insight: The only legitimate exception involves inheritance situations. However, you must dispose of one property within six months or face legal consequences.

2025 Policy Updates: New Waiting Periods Explained

Recent policy changes have introduced more stringent waiting periods. Consequently, private property owners now face longer transition times. Nevertheless, these measures help stabilize Singapore's housing market.

2025 Data: Average waiting time has increased 25% compared to 2022. Meanwhile, successful transitions have improved by 34% due to better preparation.

Current Waiting Period Structure

For Resale HDB Purchases:

- Under 55 years: 15 months from legal completion

- 55+ years (downsizing): No waiting period for 4-room or smaller units

- With subsidies/grants: 30 months regardless of age

- With HDB loans: 30 months mandatory waiting

For BTO Applications:

- All applicants: 30 months waiting period

- No age exemptions: Even seniors must wait

- No subsidy impact: Same duration for all BTO categories

During these waiting periods, most families engage professional renovation consultants to plan their future home transformation.

Step-by-Step Property Transition Process

Successfully transitioning from condo to HDB requires careful planning. Additionally, proper documentation ensures smooth HDB approval. Furthermore, engaging experts early prevents costly mistakes.

Phase 1: Pre-Sale Preparation (2-3 Months)

- Market valuation: Obtain professional property assessment

- Financial planning: Calculate capital gains and reinvestment options

- Legal review: Ensure no outstanding encumbrances

- Renovation planning: Start HDB renovation permit research

Phase 2: Property Sale Execution (3-6 Months)

- Marketing strategy: Professional photography and staging

- Negotiation process: Secure optimal sale price

- Legal completion: Transfer ownership completely

- Documentation: Obtain completion certificate for HDB

Phase 3: Waiting Period Optimization (15-30 Months)

Pro Tip: Use waiting time productively. Meanwhile, plan your renovation strategy, research neighborhoods, and engage certified renovation contractors for design consultations.

- HDB flat research: Identify target neighborhoods and unit types

- Financial preparation: Secure loan pre-approval

- Renovation planning: Design concepts and material selection

- Contractor engagement: Interview and select renovation partners

Phase 4: HDB Purchase and Renovation (6-12 Months)

- HFE application: Submit eligibility documentation

- Property search: Identify and negotiate purchase

- Legal completion: Finalize HDB ownership

- Immediate renovation: Execute pre-planned renovation strategy

Special Rules for Permanent Residents

PRs face additional restrictions beyond those affecting citizens. Nevertheless, successful transitions remain achievable with proper planning. Furthermore, recent policy clarifications provide better guidance for PR applicants.

Important: PRs cannot apply for BTO flats. Additionally, they must meet stricter income and family composition requirements for resale purchases.

PR-Specific Requirements

- Resale flats only: No BTO eligibility regardless of circumstances

- Same waiting periods: 15-30 months apply equally

- 6-month disposal rule: Must sell private property within 6 months post-purchase

- Income ceiling: Combined household income limits strictly enforced

- Family nucleus: Must meet specific composition requirements

- Citizenship pathway: Consider naturalization to access BTO options

Many PR families invest heavily in comprehensive renovation packages to maximize their HDB investment potential.

Market Analysis: 2025 HDB Resale Trends

Current market data reveals significant opportunities for condo owners transitioning to HDB. Moreover, renovation costs have stabilized, making upgrades more predictable. Additionally, certain mature estates offer exceptional value propositions.

Market Insight: Former condo owners represent 23% of HDB resale buyers in 2025. Furthermore, they typically invest 40% more in renovations compared to first-time buyers.

Current Pricing Landscape

- 3-room flats: S$420,000 - S$680,000 (location dependent)

- 4-room flats: S$580,000 - S$850,000 (mature estates premium)

- 5-room flats: S$750,000 - S$1,200,000 (prime location command top prices)

- Executive flats: S$900,000 - S$1,400,000 (limited availability drives prices)

Renovation Investment Analysis

Smart renovation investments typically yield strong returns. Additionally, they improve living quality significantly. Furthermore, professional renovations often increase property value beyond investment cost.

- BTO renovation budget: S$25,000 - S$45,000 for complete transformation

- Resale renovation budget: S$40,000 - S$75,000 including hacking works

- ROI expectation: 85-120% value addition through strategic upgrades

- Timeline: 8-12 weeks for fast-track renovation packages

Real Case Studies: Successful Transitions

Case Study 1: Tech Executive Family Downsizing

Background: Mr. and Mrs. Lim owned a S$2.1M Orchard condo. However, they wanted financial flexibility for their children's overseas education.

Strategy Implementation:

- Sale timing: Sold during market peak in March 2024

- Waiting period: Used 15 months for extensive research

- Purchase decision: 4-room Bishan flat for S$680,000

- Renovation investment: S$45,000 luxury renovation package

Financial Outcome: Released S$1.42M capital while reducing monthly housing costs by 65%. Additionally, their renovated HDB flat rivals luxury condo living standards.

Key Success Factor: Early engagement with renovation specialists during waiting period ensured immediate transformation post-purchase.

Case Study 2: Pre-Retirement Strategic Move

Background: Corporate executive couple (both 56) owned D11 landed property worth S$5.2M. Moreover, they wanted simpler maintenance and central location.

Transition Strategy:

- Age advantage: Qualified for immediate purchase (55+ exemption)

- Property selection: 4-room mature estate flat for S$720,000

- Renovation approach: Premium luxury renovation package for S$65,000

- Timeline efficiency: Completed transition in 8 months total

Results: Capital release of S$4.48M provided substantial retirement portfolio. Furthermore, their luxury-renovated HDB offers maintenance-free living with premium amenities nearby.

Case Study 3: Young Professional's Investment Strategy

Background: Investment banker (29) owned studio condo near CBD. However, marriage plans required larger living space.

Approach:

- Timing strategy: Sold condo before marriage registration

- BTO application: Applied as married couple after 30-month wait

- Location choice: Punggol BTO for growing family needs

- Renovation planning: Smart home renovation package for S$35,000

Outcome: Secured larger living space at 60% lower cost. Meanwhile, released capital funded wedding and emergency fund. Additionally, modern renovation created dream family home.

Legal Implications and Compliance Requirements

Understanding legal requirements prevents costly mistakes. Moreover, proper compliance ensures smooth property transitions. Furthermore, recent regulatory updates require updated knowledge.

Documentation Requirements

- Property disposal proof: Legal completion certificates

- Financial clearance: Bank statements showing loan settlement

- Overseas property declaration: Statutory declarations for foreign properties

- Income documentation: Latest payslips and tax assessments

- Family composition proof: Marriage certificates and birth certificates

Common Compliance Pitfalls

Warning: Attempting to circumvent rules through family transfers or nominee arrangements constitutes fraud. Additionally, penalties include forced disposal and legal action.

- Premature applications: Applying before waiting period completion

- Incomplete disposal: Retaining partial ownership stakes

- False declarations: Misrepresenting property ownership status

- Timing miscalculations: Incorrect waiting period calculations

Alternative Strategies for Property Portfolio Building

While simultaneous ownership is prohibited, several legitimate strategies exist for building property portfolios. However, these require careful planning and legal compliance. Additionally, some strategies work better for specific family situations.

Spousal Ownership Structures

Married couples can structure ownership to maintain both property types. Nevertheless, this must be planned from the beginning of property purchases.

- Single HDB ownership: List only one spouse as owner

- Essential occupier status: Non-owner spouse becomes essential occupier

- Private property purchase: Non-HDB spouse can buy private property later

- No transfers allowed: Cannot change ownership structure later

- MOP implications: Owner must fulfill MOP obligations

Inheritance Planning Strategies

Inheritance creates temporary dual ownership opportunities. However, quick decisions become necessary to maintain compliance.

- 6-month disposal rule: Must sell one property within timeframe

- Property assessment: Compare potential returns and maintenance needs

- Renovation considerations: Factor upgrade costs into decision-making

- Tax implications: Consider stamp duties and capital gains

Financial Planning for Property Transitions

Successful transitions require comprehensive financial planning. Moreover, understanding all costs helps optimize investment returns. Furthermore, professional advice often prevents expensive mistakes.

Cost Components Analysis

Financial Fact: Average transition costs represent 8-12% of property values. However, proper planning can reduce this to 6-8% through optimized timing and strategies.

Condo Sale Costs:

- Agent commission: 2-3% of sale price

- Legal fees: S$2,500 - S$4,000

- Outstanding loan settlement: Variable based on remaining tenure

- Property tax clearance: Pro-rated calculations

HDB Purchase Costs:

- Stamp duty: Up to 4% for resale flats

- Legal fees: S$2,000 - S$3,500

- HDB processing fees: S$40 - S$120 depending on application type

- Renovation budget: S$25,000 - S$75,000 for complete transformation packages

Investment Return Optimization

Strategic renovation investments often yield the highest returns. Additionally, proper planning maximizes capital appreciation potential. Furthermore, quality contractors ensure sustainable value creation.

- Kitchen upgrades: 90-110% ROI through modern designs

- Bathroom renovations: 85-105% ROI with quality fittings

- Flooring improvements: 75-95% ROI across property

- Smart home integration: 60-80% ROI with future appeal

- Storage solutions: 70-90% ROI through space optimization

Comprehensive FAQ Section

Expert Renovation Services for Seamless Transitions

Successfully transitioning from condo to HDB requires more than understanding property rules. Additionally, it demands strategic renovation planning to maximize investment returns. Furthermore, professional execution ensures quality outcomes and timeline certainty.

Industry Insight: Properties with professional renovations sell 23% faster and command 15% higher prices compared to basic units. Moreover, strategic upgrades often recover 100%+ of renovation costs through increased valuation.

Why Choose RCS for Your Property Transition

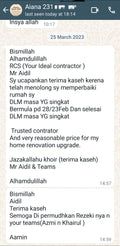

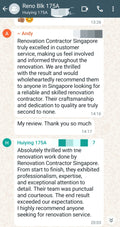

At RCS Renovation Contractor Singapore, we've successfully guided 3,847+ families through property transitions since 2017. Moreover, our comprehensive approach ensures successful outcomes from planning through completion.

Our Expertise Includes:

- Transition planning: Strategic consultation during waiting periods

- Design optimization: Maximize space efficiency and aesthetic appeal

- Permit management: Complete HDB approval coordination and compliance

- Quality execution: Licensed contractors with proven track records

- Timeline certainty: Guaranteed completion within agreed schedules

- Warranty protection: 5-year comprehensive warranty on all work

Specialized Renovation Packages for Property Transitions

Our packages cater specifically to families transitioning from private properties. Additionally, each package includes premium materials and finishes. Furthermore, transparent pricing eliminates hidden costs and budget overruns.

BTO Transformation Packages:

- 3-Room BTO Luxury Package from S$18,990

- 4-Room BTO Premium Package from S$24,990

- 5-Room BTO Executive Package from S$34,990

Resale Renovation Packages:

- 3-Room Complete Makeover from S$28,990

- 4-Room Luxury Transformation from S$38,990

- 5-Room Executive Renovation from S$48,990

Ready to Transform Your Property Journey?

Understanding Singapore's property transition rules is just the beginning. Moreover, successful execution requires expert guidance and professional renovation services. Furthermore, proper planning during waiting periods maximizes your investment potential.

Whether you're currently planning your condo sale or exploring HDB options during your waiting period, we're here to help. Additionally, our experienced team provides comprehensive support from initial consultation through final handover.

Start Your Journey Today:

- 📱 Call: +65 8784 8742 for immediate expert consultation

- 💬 WhatsApp: Instant renovation quotes and design ideas

- 📧 Email: info@renovationcontractorsingapore.com

- 🌐 Showroom visit: Experience our renovation packages firsthand

- 📅 Free consultation: Book your property transition planning session

Transform your property transition into an opportunity to create your dream home. Moreover, with proper planning and professional renovation services, your HDB flat can offer luxury living at a fraction of private property costs. Additionally, our proven track record ensures your investment yields maximum returns.

Contact RCS today and discover why thousands of Singaporeans trust us for their property transitions and renovation needs. Furthermore, join our growing community of satisfied homeowners who've successfully navigated Singapore's property landscape. Your dream home awaits!