Getting the keys to your Prime BTO flat is a milestone moment. But as you stand in that empty shell and imagine the life ahead, one question looms larger than the rest: How do I renovate this Prime flat wisely when there's a 14% subsidy clawback waiting at resale?

If you're looking at Berlayar Residences in Bukit Merah, Redhill Peaks, or Mount Pleasant Crest in Toa Payoh—the three Prime projects defining Singapore's 2026 housing landscape—you've probably noticed something troubling. The October 2025 launch of Berlayar shattered records with a 14% subsidy clawback, more than double the original 6% when Prime flats debuted in November 2021.

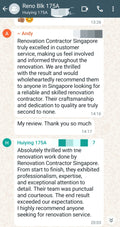

After nearly a decade helping Singapore homeowners navigate renovation decisions, we've worked with enough Prime BTO owners to recognize the pattern: most people assume renovation strategy is identical to Standard BTO, then realize mid-project that the 10-year Minimum Occupation Period, the income ceiling restrictions for future buyers, and that looming clawback fundamentally change everything.

This guide cuts through that confusion. We'll show you exactly how the 14% clawback impacts your renovation ROI, which material choices actually maximize resale value under these constraints, how to allocate a $35,000 budget strategically, and why "more expensive" doesn't mean "smarter" for Prime BTOs.

The Prime BTO Framework: Understanding What Makes It Different

Three Restrictions That Reshape Your Renovation Thinking

Prime Location Public Housing (PLH) flats occupy Singapore's most desirable locations—excellent connectivity, comprehensive amenities, proximity to the city center. But this premium positioning comes with trade-offs that directly affect your renovation strategy.

The 10-Year Minimum Occupation Period

Unlike Standard BTOs with 5-year MOP, Prime flats require 10 years before you can sell or purchase private property. Including the typical 4-5 year construction timeline, you're committing to this location for 14-15 years from application to resale. This extended timeline shapes everything:

-

Your renovation must serve you comfortably for a full decade

-

Material durability becomes non-negotiable (not trendy short-term picks)

-

Design must remain timeless—today's Instagram-worthy trend becomes 2035's dated look

-

Future-proofing (smart home infrastructure, electrical capacity) delivers actual returns over 10+ years

The Subsidy Clawback Upon First Resale

When you eventually sell after MOP, you return a percentage of your resale price or valuation (whichever is higher) to HDB. The rates have escalated dramatically:

-

November 2021 (original Prime launches): 6%

-

October 2024 (Queenstown Holland Village): 9%

-

July 2025 (Alexandra Vista/Peaks): 11%

-

October 2025 (Berlayar Residences): 14%—unprecedented

This isn't a minor factor. It directly erodes your renovation ROI. Every dollar of resale value your renovation creates gets taxed at this percentage. That $50,000 kitchen that adds $100,000 to resale value? After 14% clawback, you only capture $86,000—a 30% reduction compared to Standard BTOs with no clawback.

The $14,000 Income Ceiling for Future Buyers

Anyone purchasing your Prime flat on resale must have household income below $14,000/month. This income ceiling dramatically limits your buyer pool. The practical implication: you're selling to upper-middle-income families, not top earners who might pay premiums for ultra-luxury finishes.

Over-renovating for a luxury market you legally cannot access wastes capital.

The Prime BTO Renovation Paradox: Prestige Location, Strategic Restraint

Why Over-Renovating Hurts Your Bottom Line

The natural instinct when securing a premium location is to renovate upmarket—matching the prestige of the address with premium finishes everywhere. We've seen enough Prime BTO owners make this mistake to recognize the pattern clearly.

Three structural factors make aggressive over-renovation a financial mistake for Prime BTOs:

1. The Clawback Tax on Your Value-Add

Simple math: if your $40,000 renovation adds $80,000 to resale value, the 14% clawback deducts $11,200 from your proceeds. You capture $68,800 instead of $80,000—a 14% reduction in renovation ROI.

Compare that to Standard BTOs. The same $40,000 renovation adding $80,000gains you the full $80,000 (no clawback). Your Prime BTO renovation effectively returns 30% less per dollar invested compared to Standard BTOs.

This mathematical reality demands discipline: focus on quality fundamentals, not luxury flourishes.

2. Income Ceiling Limits Your Buyer Pool

DBS Bank's analysis notes: "In the case where you own a Prime flat, the selling price is likely to be depressed as higher earners—who could afford more attractive sale prices—are not included as they do not meet the resale buyer eligibility".

A $5,000 imported Italian tile backsplash appeals to a different buyer than someone earning $14,000/month. You're spending for buyers who legally cannot exist in your market.

3. The 10-Year Hold Creates Design Risk

Committing to 10+ years introduces life-stage uncertainty. What appeals to you as a young couple today may not suit the family you become, or the market preferences evolving over 15 years from application to resale. Hyper-customized luxury amplifies this risk; timeless functionality mitigates it.

The Winning Approach: Quality Timelessness

The successful Prime BTO renovation balances three objectives:

-

Sufficient quality matching the location's prestige

-

Broad appeal for a diverse buyer pool within income constraints

-

Cost discipline to avoid over-capitalization given clawback erosion

Budget Sweet Spot for 4-Room Prime BTO: $25,000–$40,000

This range consistently delivers:

-

Premium kitchen with quality cabinets and quartz countertops

-

Two fully renovated bathrooms with durable fixtures

-

Quality flooring (vinyl SPC or engineered wood)

-

Built-in wardrobes and optimized storage

-

LED lighting with select statement pieces

-

Basic smart home integration (digital locks, smart switches)

Going beyond $45,000 enters diminishing returns territory. Marginal gains shrink dramatically due to clawback erosion and buyer ceiling constraints.

Strategic Budget Allocation: The 40-30-20-10 Framework

For a $35,000 renovation (optimal midpoint), allocate this way:

40% to Wet Areas: $14,000

-

Kitchen: $8,000–$9,000

-

2 Bathrooms: $5,000–$6,000

Kitchen and bathroom renovations deliver the highest ROI (8-12% resale value increase) and are most scrutinized by buyers. This is where your investment shows real returns.

30% to Flooring + Built-ins: $10,500

-

Flooring: $7,000–$8,000

-

Built-in wardrobes: $2,500–$3,500

Flooring creates the visual foundation and must last 10+ years. Built-ins solve Singapore's perpetual storage challenge—every family values this.

20% to Smart Home + Electrical: $7,000

-

Smart home integration Tier 2: $2,500–$3,500

-

Additional power points: $1,000–$1,500

-

LED lighting throughout: $1,500–$2,000

-

Electrical upgrades: $1,000–$1,500

Future-proofing for your 2035-2040 resale market when smart home becomes baseline, not luxury. See 50+ smart home integration ideas specifically designed for Singapore homes.

10% to Contingency + Finishing: $3,500

-

Painting and finishing: $1,500–$2,000

-

Buffer for scope changes: $1,000–$1,500

-

Hardware and accessories: $500–$1,000

Renovation projects always encounter unexpected discoveries. This buffer prevents budget overruns.

Material Selection: High-ROI vs. Diminishing Returns

Kitchen: Your Highest-Return Investment Zone

Your kitchen is where your renovation budget earns legitimate returns.

Cabinet Materials—The Intelligent Choice

Quality melamine cabinets with modern matte finishes rival acrylic aesthetics at significantly lower cost. Standard BTO kitchen packages demonstrate this value proposition clearly.

-

Cost: $5,590–$6,190 (10ft run)

-

Durability: Moisture-resistant, 10+ year lifespan in humid Singapore climate

-

Appeal: Contemporary finishes satisfy broad buyer preferences

-

Maintenance: Easy cleaning, minimal upkeep

Melamine isn't "cheap"—it's sensible. It delivers premium appearance without luxury price tags. The money you save here funds better choices elsewhere.

Countertops—Non-Negotiable Quality

Quartz countertops represent the acceptable minimum standard for Prime locations.

-

Why quartz wins: Non-porous, stain-resistant, zero maintenance

-

Perceived quality: Buyers recognize this as a premium choice

-

10-year durability: Looks new after a decade of daily use

-

Cost integration: Typically $1,500–$2,500 within quality kitchen packages

Skip These (Diminishing Returns)

-

❌ Imported Italian tiles: +$3,000–$5,000 for marginal visual difference only

-

❌ Solid stone countertops: +$2,000–$4,000 with zero practical advantage over quartz

-

❌ Ultra-premium hardware: +$800–$1,500 with minimal impact on resale perception

Optimal Kitchen Budget: $8,000–$12,000 (4-room Prime BTO)

Bathrooms: Navigate the 3-Year Tile Restriction

New BTO flats restrict bathroom tile replacement for 3 years. HDB-provided waterproofing membranes must remain undisturbed. Removing tiles within 3 years voids your warranty.

Strategic Two-Phase Approach

Years 0–3 (Initial Renovation)

-

Keep HDB tiles (no hacking)

-

Upgrade fixtures: quality shower sets, basins, toilet seats

-

Improve lighting: LED downlights, mirror backlighting

-

Add storage: wall-mounted cabinets, corner niches

-

Budget: $3,000–$5,000 per bathroom

Your bathroom feels contemporary without the clawback tax on tile replacement costs.

Year 3+ (Optional Full Renovation)

-

Complete tile replacement after warranty expires

-

Fresh waterproofing application

-

Premium fixture upgrades

-

Additional budget: $6,000–$8,000 for 2 bathrooms

This phased approach spreads cost and lets you live in the space before committing to final design.

High-ROI Bathroom Features

-

Large-format tiles (fewer grout lines, easier maintenance)

-

Shower screens over curtains (premium look, superior hygiene)

-

Soft-close toilet seats and quality taps (perceived quality matters)

-

Adequate ventilation (mold prevention critical in tropical climate)

Skip These

-

❌ Designer branded fixtures: +$2,000–$4,000 for branding alone

-

❌ Complex tile patterns: +$1,500–$3,000 labor cost, limited appeal

-

❌ Luxury tubs: +$5,000–$10,000, space constraints, maintenance headaches

Optimal Bathroom Budget: $10,000–$15,000 total (2 bathrooms, 4-room)

Flooring: Versatility + 10-Year Durability

Your flooring must serve comfortably for a decade while appealing to 2035–2040 buyers. Two clear winners emerge from the available options.

Best Choice: SPC Vinyl Flooring

-

Cost: $6,000–$10,000 (4-room BTO)

-

Why it dominates:

-

100% waterproof (critical for Singapore's humidity)

-

Highly durable, scratch and dent resistant

-

Diverse wood and stone pattern options

-

Comfortable underfoot, sound dampening

-

Easy maintenance over 10+ years

-

Can overlay existing screed in new BTOs

-

SPC vinyl represents the sweet spot: premium appearance at practical cost with genuine durability over your 10-year hold period.

Premium Alternative: Engineered Wood

-

Cost: $10,000–$15,000 (4-room BTO)

-

Advantages:

-

Authentic wood veneer (genuine warmth)

-

Stable in humid climates (superior to solid timber)

-

Can refinish multiple times over 10+ years

-

Adds perceived value

-

Choose engineered wood if you want authentic wood aesthetics and can justify the premium cost through lifestyle preference (not investment ROI).

Smart Hybrid Approach

-

SPC vinyl in wet-prone areas (kitchen, bathrooms, service yard)

-

Engineered wood in living room and bedrooms

-

Cost: $8,000–$12,000 (4-room BTO)

This strategy delivers visual warmth where families spend time while maintaining durability where moisture concerns are real.

Avoid Decisively

-

❌ Laminate flooring: Not waterproof, swells with moisture exposure

-

❌ Solid timber: $15,000–$25,000, high maintenance, humidity risks

-

❌ Tiles throughout: Cold, hard, psychologically less welcoming for residential living

Review comprehensive BTO renovation packages exploring flooring options in detail.

Smart Home Integration: Future-Proofing the 10-Year Hold

Why Smart Home Becomes Baseline Expectation

Your Prime BTO won't reach resale market until 2035–2040. By then, smart home integration will be baseline expectation, especially in prime locations attracting tech-savvy buyers.

Tengah Forest Town (Singapore's first smart-ready HDB town) establishes this precedent. Smart home delivers measurable returns:

-

Energy efficiency: 10-20% electricity reduction over 10 years

-

Enhanced security: Digital access, monitoring capabilities

-

Expected convenience: Your 2035-2040 buyers will assume this exists

-

Measurable resale premium: Smart-ready homes command higher prices

Three-Tier Smart Home Budget Framework

Tier 1: Essential Integration ($800–$1,500)

-

Digital lock: $400–$800

-

Smart lighting: $200–$400

-

Smart switches: $200–$300 (4–6 locations)

Benefit: Basic convenience and security. Eliminates key management hassles.

Tier 2: Comprehensive Smart Home ($2,500–$4,000) ← Recommended for Prime BTOs

-

All Tier 1 features

-

Smart AC control: $600–$1,000

-

Smart curtains/blinds: $400–$800

-

Security cameras: $300–$600

-

Smart doorbell: $200–$400

Benefit: Full climate and security automation. AC control delivers measurable savings. This tier perfectly aligns with our 20% electrical/smart home allocation in the 40-30-20-10 framework.

Tier 3: Whole-Home Automation ($5,000–$8,000)

-

All Tier 2 plus:

-

Smart home hub: $200–$400

-

Voice integration throughout

-

Smart water heater: $400–$800

-

Multi-room audio: $800–$1,500

-

Smart sensors: $300–$600

Benefit: Premium future-proof experience. Positions your flat as move-in ready for 2035-2040 buyers.

Critical Implementation: Pre-Wire During Renovation

This step cannot be skipped. Running cables and installing junction boxes during renovation costs $300–$500. Retrofitting after costs $2,000–$4,000 and creates aesthetic compromises.

Your HDB licensed contractor must coordinate:

-

Adequate power points (minimum 15-20 in 4-room flat)

-

Cat6 ethernet cabling to key rooms

-

Strategic switch locations for smart integration

-

Wireless access point placement for full coverage

Case Study: The Prime Three Projects

Berlayar Residences—The Historic 14% Pioneer

Project Overview

-

Location: Former Keppel Club, Greater Southern Waterfront

-

Units: 880 flats (2-room Flexi to 4-room)

-

Subsidy Clawback: 14% (unprecedented)

-

4-room Price: ~$788,000

-

Key Collection: Q2 2030 (56-month wait)

Why 14% Clawback?

Berlayar is Singapore's first BTO in the Greater Southern Waterfront—a 30km, 2,000-hectare transformation yielding 9,000 homes. The unprecedented subsidy reflects transformative location potential (Circle Line 6 opening H1 2026), waterfront premium, first-mover advantage, and analyst projections showing 4-room flats "easily $1.5M+" by 2041.

Optimal Renovation Strategy

Budget: $30,000–$38,000 (4-room)

The 14% clawback demands restraint, BUT the transformative trajectory justifies quality investment. You're setting the aesthetic benchmark for the estate.

Recommended Allocation

-

Kitchen: $10,000

-

2 Bathrooms: $12,000

-

Flooring: $9,000

-

Built-in wardrobes: $4,000

-

Lighting: $2,000

-

Smart home Tier 2: $3,000

Total: $40,000

Projected ROI

-

Renovation: $40,000

-

Value-add at 2041 resale: $90,000–$120,000

-

Post-clawback contribution: $77,400–$103,200

-

Net ROI: 93–158% over 15-year hold

Critical Success Factor: Timeless contemporary design. Avoid 2025 trend traps (excessive slat panels, bold accent walls). Focus on neutral palettes, quality materials, functional layouts that appeal to 2040 buyers.

See complete Berlayar Residences renovation guide.

Redhill Peaks—The Established Prestige

Project Overview

-

Location: Jalan Bukit Merah (opposite Gateway Theatre)

-

Units: 1,021 flats

-

Subsidy Clawback: 12%

-

Context: Mature estate, established amenities

Optimal Renovation Strategy

Budget: $28,000–$35,000 (4-room)

The 12% clawback (2% lower than Berlayar) allows slightly more investment. Mature estate buyers expect move-in ready quality.

Total: $35,500

Projected ROI

-

Renovation: $35,000

-

Value-add: $75,000–$95,000

-

Post-clawback: $66,000–$83,600

-

Net ROI: 89–139% over 10+ years

Critical Success Factor: Balance quality with discipline. Redhill's mature context means buyers have alternatives—your renovation must offer contemporary convenience without over-capitalizing.

Mount Pleasant Crest—The New Estate Premium

Project Overview

-

Location: Mount Pleasant Road (Novena/Toa Payoh District 11)

-

Units: 1,348 flats

-

Subsidy Clawback: 12%

-

Context: First BTO in new Mount Pleasant estate (6,000 total flats planned)

Optimal Renovation Strategy

Budget: $28,000–$36,000 (4-room)

The 12% clawback + strong Toa Payoh comparables (among Singapore's highest concentration of million-dollar HDB resales) support quality investment.

Total: $38,500

Projected ROI

-

Renovation: $36,000

-

Value-add: $85,000–$110,000

-

Post-clawback: $74,800–$96,800

-

Net ROI: 108–169% over 10+ years

Critical Success Factor: Leverage new estate status with contemporary design establishing the aesthetic benchmark. Address common pain points in older Toa Payoh flats (storage, layout optimization).

Browse Mount Pleasant Crest renovation packages starting from $5,500.

Contractor Selection: Non-Negotiable Requirements

HDB Licensing: Absolutely Non-Negotiable

HDB regulations mandate that only contractors in the Directory of Renovation Contractors (DRC) can legally work on public housing.

Using unlicensed contractors results in:

-

Up to $5,000 in fines

-

Inability to obtain renovation permits

-

Complications during future flat resale

-

Zero insurance coverage for accidents

-

No recourse for poor workmanship

Verification is straightforward: Check HDB's Directory of Renovation Contractors. Verify license validity and confirm insurance coverage (public liability).

What Your Contractor Must Provide

1. Complete HDB Permit Handling

-

Application submission to HDB

-

Follow-up on approval (2–3 week timeline)

-

Compliance with all HDB renovation guidelines

-

Final inspection coordination

2. Transparent Fixed-Price Quotation

-

Itemized breakdown by scope

-

Material specifications (brand, model, quantity clearly stated)

-

Labor costs separated from materials

-

Payment milestone schedule (typically 20% / 40% / 40%)

-

Clear exclusions list

3. Professional Warranty Coverage

-

Minimum 12-month defects warranty

-

Specific terms for carpentry, waterproofing, electrical, tiling

-

Clear rectification process and timeline

RCS Renovation Contractor Singapore provides comprehensive HDB renovation packages with transparent pricing and full warranty coverage.

Red Flags to Avoid

❌ Unusually low quotations (20–30% below market): Indicates cut corners or hidden costs

❌ Vague material specifications: No accountability

❌ Cash-only or large upfront deposits (>30%): Risk of contractor disappearing

❌ Pressure tactics: Professional contractors don't rush decisions

❌ No proper contract: No legal recourse

Common Prime BTO Renovation Mistakes to Avoid

Mistake 1: Over-Customization for Personal Taste

The Error: Custom features reflecting highly specific preferences—unusual colors, elaborate ceiling designs, built-ins for specific hobbies.

Why It Hurts: The $14,000 income ceiling limits your buyer pool. Over-customized flats take longer to sell and command lower premiums.

The Fix: Design for broad appeal. Neutral palettes, functional layouts, quality over quirky. Ask: "Would 80% of potential buyers appreciate this?"

Mistake 2: Skimping on Electrical Points

The Error: Accepting minimal electrical points to save $800–$1,200.

Why It Hurts: Modern households need 15–20 power points in a 4-room flat. Insufficient points mean visible extension cords everywhere—kills aesthetics.

The Fix: Budget $1,500–$2,000 for additional points:

-

Kitchen: minimum 8 points

-

Living room: 6–8 points

-

Bedrooms: 4–6 points each

-

Bathrooms: 2 points each

Mistake 3: Choosing Trendy Over Timeless

The Error: Designing for 2025's hottest trends—bold accent walls, Instagram-worthy statement ceilings.

Why It Hurts: You're renovating for 10+ year hold and 2035–2040 resale. Today's trends become tomorrow's dated looks.

The Fix: Timeless contemporary principles:

-

Neutral base palettes (warm beiges, soft greys, whites)

-

Quality materials over decorative flourishes

-

Functional layouts prioritizing storage

-

Accent through furniture (easily changed) not fixed features

Review 2026 interior design trends balancing current aesthetics with timeless appeal.

Mistake 4: Underestimating the Clawback Impact

The Error: Budgeting $50,000–$60,000 for luxury renovation assuming proportional resale gains.

Why It Hurts: The 12–14% clawback taxes your entire renovation ROI.

Example:

-

$60,000 luxury kitchen adds $100,000 resale value

-

After 14% clawback: You capture $86,000 (effective ROI: 43%)

-

$40,000 quality kitchen adds $85,000 resale value

-

After 14% clawback: You capture $73,100 (effective ROI: 83%)

The Fix: Run post-clawback ROI calculations for major decisions. Ask: "Does this upgrade deliver value after clawback erosion?"

Renovation Timeline: From Key Collection to Move-In

Complete Timeline (Prime BTO)

Phase 1: Pre-Key Collection (Months -3 to 0)

-

Month -3: Finalize contractor, sign contract

-

Month -2: Design discussions, material selections

-

Month -1: HDB permit application

-

Weeks -2 to -1: Permit approval (2–3 weeks)

Phase 2: Post-Key Collection (Months 0-3)

-

Week 1: Key collection, unit inspection

-

Weeks 2–5: Electrical, plumbing rough-in

-

Weeks 5–8: Carpentry fabrication and installation

-

Weeks 8–10: Flooring installation

-

Weeks 10–11: Painting and finishing

-

Week 12: Final inspection, defects rectification

Total Duration: 10–12 weeks for comprehensive BTO renovation

See realistic HDB renovation timelines with 25–40% faster completion strategies.

The 3-Year Bathroom Constraint

New BTOs restrict bathroom tile hacking for 3 years. Strategic approach:

Initial (Years 0–3): Upgrade fixtures, lighting, storage only

Year 3+: Full tile replacement after warranty expires

This spreads cost and lets you live in the space before committing to bathroom design changes.

Financing Your Prime BTO Renovation

CPF Housing Grant Maximization

Prime BTO buyers receive Enhanced CPF Housing Grant (EHG) up to $120,000 (income-dependent), reducing cash needs for purchase and preserving liquidity for renovation.

Renovation Loan Options (2026 Rates)

| Bank | Interest Rate | Max Tenure | Max Amount |

|---|---|---|---|

| CIMB | 4.15% p.a. | 5 years | $50,000 |

| DBS | 4.88% p.a. | 5 years | 6x monthly income |

| OCBC | 4.98% p.a. | 5 years | $80,000 |

| Maybank | 5.28% p.a. | 5 years | $50,000 |

Example: $35,000 loan at 4.88% over 5 years

-

Monthly installment: $657

-

Total interest paid: $4,420

-

Total repayment: $39,420

When Renovation Loans Make Sense

✅ Preserves emergency cash reserves

✅ Spreads cost over 5 years (manageable payments)

✅ Allows upfront quality investment without liquidity strain

When to Pay Cash Instead

✅ Sufficient savings after BTO downpayment

✅ Avoiding interest costs (saves $4,000–$6,000)

✅ Stronger contractor negotiating position

Moving Forward: Your Prime BTO Renovation Success

After nearly a decade helping Prime BTO owners navigate renovation decisions, we recognize a clear pattern: the winners aren't those who spend the most, but those who spend the smartest.

Your Prime BTO renovation strategy should reflect the same long-term thinking that led you to secure a prime location in the first place. The 14% clawback isn't a penalty—it's a pricing signal guiding you toward optimal renovation investment.

The material choices matter. The budget allocation matters. The future-proofing matters.

But most critically, your contractor matters. Choose someone who understands Prime BTO dynamics, who delivers transparent pricing without hidden surprises, who manages HDB permits professionally, and who builds relationships based on genuine expertise.

Ready to Transform Your Prime BTO Strategically?

RCS Renovation Contractor Singapore has spent nearly a decade perfecting their approach to Prime BTO renovations. We understand the subsidy clawback dynamics, we provide transparent fixed pricing within strategic budgets, and we deliver comprehensive packages that prevent the budget overruns plaguing the industry.

Explore RCS's comprehensive BTO renovation packages designed for transparent quality.

Your Prime BTO investment is too significant to leave to chance. Choose Singapore's most trusted contractor who understands not just how to renovate, but how to renovate strategically for Prime BTOs.

Contact RCS for your free consultation today. Your dream home is one conversation away.

Quick Reference: Prime BTO Renovation Checklist

Financial Planning

-

Verify total Prime BTO cost and down payment requirements

-

Confirm CPF Housing Grant eligibility and amount

-

Calculate emergency fund remaining after renovation budget

-

Explore renovation loan options (compare rates and terms)

Contractor Selection

-

Verify HDB DRC registration status

-

Review past Prime/Plus BTO project portfolio

-

Confirm insurance coverage (public liability)

-

Request detailed itemized quotation

-

Call 2–3 recent client references

Pre-Renovation Planning

-

Finalize design vision (focus on timeless, not trendy)

-

Create material specifications (laminates, tiles, fixtures)

-

Plan electrical infrastructure (minimum 15–20 points)

-

Design smart home integration (choose Tier 1 or 2)

-

Schedule HDB permit application 4 weeks before key collection

Budget Allocation

-

Allocate 40% to kitchen and bathrooms

-

Allocate 30% to flooring and built-in storage

-

Allocate 20% to smart home and electrical upgrades

-

Allocate 10% to contingency and finishing

Timeline Management

-

Key collection week

-

Permit approval (2–3 weeks after submission)

-

Renovation execution (10–12 weeks typical)

-

Final inspection and defects rectification

-

Move-in and warranty documentation

Last Updated: January 7, 2026 | Reading Time: 22 minutes | Research Sources: 50+ verified sources analyzing Prime BTO dynamics, material durability, and Singapore renovation trends