For international investors seeking a secure, transparent, and world-class property market, Singapore stands out as one of Asia's most attractive destinations. The city-state's robust legal framework, stable political environment, and strategic location have long made it a magnet for foreign capital. However, purchasing residential property in Singapore as a foreigner involves navigating a complex web of regulations, stamp duties, financing restrictions, and procedural requirements. This comprehensive guide examines the complete legal and regulatory framework governing foreign property ownership in Singapore, drawing exclusively from official government sources and current regulations as of December 2025.

Who Is Considered a Foreign Person Under Singapore Law?

Under the Residential Property Act (RPA), Singapore's primary statute governing residential property ownership, a foreign person is defined as anyone who is not a Singapore citizen, a Singapore company with substantial local ownership, a Singapore limited liability partnership, or a Singapore society. This broad definition means that even Singapore Permanent Residents (PRs) are treated as foreign persons for certain property categories, particularly when seeking to purchase landed residential properties.

The distinction matters significantly because different categories of buyers face vastly different regulatory requirements, tax burdens, and property access rights. For regulatory purposes, buyers fall into three primary categories: Singapore Citizens (SCs), Singapore Permanent Residents (PRs), and foreigners (including all non-residents and non-citizens).

Property Types and Foreign Ownership Restrictions

Properties Foreigners Can Purchase Without Prior Approval

Foreign buyers enjoy relatively unrestricted access to certain property types in Singapore. Under the Residential Property Act administered by Singapore Land Authority, foreigners may purchase the following categories without seeking prior government approval:

Private Condominiums and Apartments: Foreign buyers can freely purchase condominium units and flat units in multi-story buildings (typically six stories or more). This category represents the vast majority of foreign residential property purchases in Singapore.

Strata Landed Houses in Approved Condominium Developments: These are landed houses (such as townhouses) that form part of a condominium development approved under the Planning Act. They can be purchased freely by foreigners.

Leasehold Estates in Landed Properties: Foreigners may lease landed residential properties for terms not exceeding seven years, including renewal options.

Executive Condominiums (After Minimum Occupation Period): Executive Condominiums (ECs) are hybrid properties that begin as subsidized public housing but transition to full private property status after ten years. Once fully privatized (typically after the tenth year from completion), foreigners may purchase these units without approval.

Commercial and Industrial Properties: Properties zoned exclusively for commercial or industrial use are not subject to foreign ownership restrictions under the RPA.

It bears emphasizing that since July 19, 2005, foreigners have been able to purchase private apartments and condominiums without obtaining prior approval from the Singapore Land Authority—a significant liberalization that opened Singapore's private property market to international investment.

Properties Requiring Government Approval

Landed residential properties remain substantially restricted for foreign ownership. Under the RPA, foreigners must seek and obtain approval from the Land Dealings Approval Unit (LDAU) at the Singapore Land Authority before purchasing the following property types:

- Vacant residential land

- Terrace houses

- Semi-detached houses

- Bungalows or detached houses

- Strata landed houses not within approved condominium developments

- Shophouses for non-commercial or mixed-use purposes

- Landed residential properties at Sentosa Cove

- Association premises, places of worship, workers' dormitories, and serviced apartments

- Properties on land zoned "Commercial & Residential" or "Residential"

The policy rationale behind these restrictions is clear: Singapore's government seeks to ensure that the limited supply of landed residential properties remains the primary preserve of Singapore Citizens, while allowing selected foreigners who demonstrate exceptional social commitment and significant economic contributions to also own landed homes.

Eligibility Criteria for LDAU Approval

The approval process for foreign buyers seeking to purchase landed properties is rigorous and discretionary. Each application is assessed on a case-by-case basis, with the Singapore Land Authority considering the following primary factors:

Permanent Residency Status: Applicants should be Permanent Residents of Singapore for at least five years. This requirement demonstrates sustained commitment to Singapore and integration into the local community.

Exceptional Economic Contribution: Applicants must demonstrate that they have made exceptional economic contributions to Singapore. This assessment considers factors such as employment income assessable for tax in Singapore, business investments, job creation, and other measurable economic impacts.

The processing time for LDAU applications generally takes approximately 30 working days from the date all relevant documents and information are received, though complex applications may require additional time. Applicants may submit applications for in-principle approval even before identifying a specific property to purchase.

Conditions Imposed Upon Approval

When approval is granted, it typically comes with strict conditions that applicants must observe:

Exclusive Residential Use: The property must be used solely as a dwelling for the owner and their immediate family. Renting out the property is prohibited.

Minimum Holding Period: The property cannot be sold within five years from the date of legal completion of the purchase. For properties under construction, the five-year period begins from the issuance of the Temporary Occupation Permit or Certificate of Statutory Completion, whichever comes first.

No Subdivision: The property cannot be subdivided without obtaining further approval from the authorities.

These conditions ensure that approved foreign buyers acquire landed properties for genuine residential purposes rather than speculative investment, thereby preserving the character and availability of landed housing for Singaporeans.

Taxation: Stamp Duties and Additional Costs

Buyer's Stamp Duty (BSD)

All property buyers in Singapore—regardless of citizenship or residency status—must pay Buyer's Stamp Duty (BSD) on residential property acquisitions. BSD is computed on the higher of the purchase price or the market value of the property.

As of December 2025, the BSD rates for residential properties administered by IRAS are structured on a progressive marginal basis (rates effective from February 15, 2023):

| Purchase Price or Market Value | BSD Rate |

|---|---|

| First S$180,000 | 1% |

| Next S$180,000 | 2% |

| Next S$640,000 | 3% |

| Next S$500,000 | 4% |

| Next S$1,500,000 | 5% |

| Remaining amount (above S$3,000,000) | 6% |

For non-residential properties, the top marginal rate is capped at 5% rather than 6%.

Example Calculation: For a condominium purchased at S$2,000,000:

- First S$180,000 @ 1% = S$1,800

- Next S$180,000 @ 2% = S$3,600

- Next S$640,000 @ 3% = S$19,200

- Next S$500,000 @ 4% = S$20,000

- Remaining S$500,000 @ 5% = S$25,000

- Total BSD = S$69,600

BSD must be paid within 14 days from the date of execution of the purchase document (typically the date of acceptance of the Option to Purchase or the Sale and Purchase Agreement).

Additional Buyer's Stamp Duty (ABSD)

Foreign buyers face a substantial additional tax burden in the form of Additional Buyer's Stamp Duty (ABSD), introduced as a property cooling measure to moderate foreign demand and maintain housing affordability for locals.

As of April 27, 2023, the ABSD rates administered by IRAS are as follows:

| Profile of Buyer | First Property | Second Property | Third and Subsequent Properties |

|---|---|---|---|

| Singapore Citizens | 0% | 20% | 30% |

| Permanent Residents | 5% | 30% | 35% |

| Foreigners | 60% | 60% | 60% |

| Entities (companies) | 65% | 65% | 65% |

For foreign buyers, the ABSD rate is a flat 60% on any residential property purchase, regardless of whether it is their first, second, or subsequent property. This represents a dramatic increase from the 30% rate that applied between December 16, 2021, and April 26, 2023.

Example: A foreign buyer purchasing a S$2,000,000 condominium will pay:

- BSD: S$69,600 (as calculated above)

- ABSD: S$1,200,000 (60% of S$2,000,000)

- Total Stamp Duties: S$1,269,600

The ABSD is calculated on the higher of the purchase price or market value, just like BSD. It must also be paid within 14 days of executing the purchase document.

Joint Purchases: When a property is purchased jointly by buyers of different profiles (for example, a Singapore Citizen and a foreigner), the highest applicable ABSD rate applies to the entire property value. In such cases, the 60% foreigner rate would apply to the full purchase price.

ABSD cannot be paid using Central Provident Fund (CPF) savings, unlike BSD, which can be paid partially with CPF funds subject to certain conditions.

Seller's Stamp Duty (SSD)

To discourage property speculation and short-term flipping, Singapore imposes Seller's Stamp Duty (SSD) on residential properties sold within a specified holding period. As of July 4, 2025, the government extended the SSD holding period and increased rates.

For residential properties purchased on or after July 4, 2025, the SSD holding period is four years, with the following rates:

| Holding Period | SSD Rate |

|---|---|

| Up to 1 year | 16% |

| More than 1 year and up to 2 years | 12% |

| More than 2 years and up to 3 years | 8% |

| More than 3 years and up to 4 years | 4% |

| More than 4 years | No SSD payable |

For properties purchased between March 11, 2017, and July 3, 2025, the holding period remains three years with slightly lower rates (12%, 8%, 4%).

SSD is calculated on the higher of the actual selling price or market value at the time of sale. This duty applies equally to all sellers—citizens, PRs, and foreigners alike—and is designed to discourage short-term speculative behavior.

Financing Restrictions and Loan-to-Value Limits

Eligibility for Home Loans

Foreigners are legally eligible to apply for home loans from banks and financial institutions in Singapore. However, they face significantly stricter conditions compared to Singapore Citizens and PRs.

Key requirements for foreign buyers seeking mortgage approval include:

Valid Immigration Status: Holding an Employment Pass (EP), S Pass, or other valid work authorization significantly improves loan approval prospects. Banks prefer borrowers with stable, long-term presence in Singapore.

Stable Income: Most banks expect foreign applicants to have annual incomes ranging from S$50,000 to S$100,000, depending on the loan quantum. Self-employed individuals must provide additional documentation such as tax returns and audited financial statements.

Strong Credit History: A clean credit record both in Singapore and in the applicant's home country is essential. Banks will typically conduct credit checks through credit bureaus.

Substantial Down Payment: Foreigners typically cannot access CPF savings for property purchases (CPF is restricted to Singapore Citizens and PRs), meaning they must have sufficient cash reserves for the down payment and stamp duties.

Loan-to-Value (LTV) Ratio Limits

The Loan-to-Value (LTV) ratio determines the maximum percentage of a property's value that can be financed through a mortgage loan. The Monetary Authority of Singapore (MAS) sets these limits as part of its prudential lending framework.

For residential property loans, the maximum LTV ratio depends on the number of outstanding housing loans:

| Number of Outstanding Loans | Maximum LTV Ratio (Standard) | Maximum LTV Ratio (Extended Tenure)* |

|---|---|---|

| First property (no outstanding loans) | 75% | 55% |

| Second property (1 outstanding loan) | 45% | 25% |

| Third and subsequent properties | 35% | 15% |

*Extended tenure applies when the loan tenure exceeds 30 years or extends beyond the borrower's 65th birthday.

Minimum Cash Down Payment: For loans with an LTV of 75%, borrowers must pay a minimum of 5% in cash, with the remaining 20% payable in cash and/or CPF (though foreigners cannot use CPF). For loans with LTV of 55% or lower, the minimum cash down payment is 10%.

Example: For a S$2,000,000 property with no outstanding loans and standard LTV of 75%:

- Maximum loan amount: S$1,500,000 (75%)

- Minimum down payment: S$500,000 (25%)

- Of which minimum cash: S$100,000 (5%)

- Remaining S$400,000 can theoretically be paid via CPF (not available to foreigners)

- Foreign buyers must pay the full S$500,000 down payment in cash

Total Debt Servicing Ratio (TDSR)

In addition to LTV limits, banks must observe the Total Debt Servicing Ratio (TDSR) when assessing loan applications. As of December 2025, the TDSR is capped at 55% of a borrower's gross monthly income.

The TDSR calculation includes all monthly debt obligations, not just the proposed housing loan:

TDSR = (Total Monthly Debt Repayments / Gross Monthly Income) × 100%

Total monthly debt repayments include:

- Proposed housing loan instalments

- Existing housing loans (if any)

- Car loans

- Personal loans

- Credit card minimum payments

- Student loans

- Any other recurring debt obligations

Example: An applicant with gross monthly income of S$10,000 has existing monthly debt obligations of S$2,000 (car loan and credit cards). Under the 55% TDSR:

- Maximum total monthly debt: S$5,500 (55% of S$10,000)

- Available for housing loan: S$3,500 (S$5,500 - S$2,000)

Banks also apply a stress test by calculating TDSR using an interest rate floor of 4% per annum, regardless of the actual interest rate offered. This ensures borrowers can still service their loans if interest rates rise.

For variable-income earners (freelancers, self-employed, commission-based workers), banks may apply a haircut of 30%, meaning only 70% of assessed income is considered for TDSR calculations.

Public Housing (HDB) Restrictions

HDB flats are Singapore's public housing and are not available for purchase by foreigners who are not PRs. HDB eligibility is strictly reserved for Singapore Citizens and PRs under specific schemes.

The only exception is for foreigners married to Singapore Citizens, who may apply to purchase HDB resale flats (not new Build-To-Order flats) under the Non-Citizen Spouse Scheme, subject to stringent eligibility criteria including income ceilings and citizenship requirements.

Property Purchase Procedure and Timeline

Step-by-Step Process for Private Property Acquisition

The typical timeline for purchasing a resale condominium or private property in Singapore spans approximately 8 to 12 weeks from the date the Option to Purchase is granted to completion. The process follows these key stages:

Phase 1: Financial Planning and Preparation (Pre-Offer)

Before beginning property viewings, foreign buyers should:

- Determine total budget including purchase price, stamp duties (BSD and ABSD), legal fees, and renovation costs

- Obtain In-Principle Approval (IPA) from banks for financing, which provides clarity on the maximum loan quantum available

- Engage a property agent (optional but recommended) registered with the Council for Estate Agencies (CEA)

- Engage a qualified conveyancing lawyer early to handle legal due diligence

Phase 2: Property Search and Due Diligence

Conduct thorough due diligence on shortlisted properties:

- Verify seller's ownership through title searches conducted via the Singapore Land Authority or through your lawyer

- Check for encumbrances, caveats, mortgages, or legal disputes on the property title

- Review property tax statements and maintenance records

- Conduct professional property inspections for structural defects, especially for older resale properties

- Verify zoning and permitted use with the Urban Redevelopment Authority (URA)

- Confirm compliance with all regulatory requirements

Phase 3: Making an Offer and Securing the Option to Purchase

Once a suitable property is identified:

- Negotiate the purchase price with the seller

- Pay an Option Fee (typically 1% of the purchase price in cash) to secure an Option to Purchase (OTP)

- The OTP grants exclusive rights to purchase the property for a specified period, typically two weeks (14 days)

- The OTP is a legally binding document setting out key terms including purchase price, completion timeline, and any special conditions

Phase 4: Exercising the Option and Signing the Sale and Purchase Agreement

Within the option period:

- Secure a formal Letter of Offer (LO) from the bank confirming loan approval

- Instruct your conveyancing lawyer to prepare the Sale and Purchase (S&P) Agreement

- Exercise the OTP by signing the S&P Agreement and paying the Exercise Fee (typically 4% of the purchase price, less the 1% Option Fee already paid)

- Total deposit at this stage: 5% of purchase price

Phase 5: Paying Stamp Duties

Within 14 days of exercising the OTP:

- Pay BSD and ABSD through the e-Stamping portal operated by IRAS

- Stamp duties can be paid online using internet banking, credit cards, or CPF funds (for BSD only, and not available to most foreigners)

- Late payment attracts penalties

Phase 6: Legal Completion and Handover

Approximately 8 to 12 weeks after exercising the OTP:

- Complete all legal documentation through your conveyancing lawyer

- Pay the remaining down payment (typically 20% of purchase price, less the 5% already paid)

- The bank disburses the loan amount (up to 75% of property value) directly to the seller's lawyer

- Legal title is transferred and registered at the Singapore Land Authority

- Collect keys and conduct final inspection before accepting the property

Legal and Professional Costs

Conveyancing Lawyer Fees: Engaging a conveyancing lawyer is essential for property transactions in Singapore. Legal fees typically range from S$1,500 to S$3,500 for standard private property purchases, depending on transaction complexity and property value. Some law firms offer fixed-fee packages that include search fees, registration fees, and mortgage stamp fees.

Property Agent Commission: If you engage a buyer's agent, commission fees typically range from 1% to 2% of the purchase price, though buyers often do not pay agent commissions directly (the seller typically pays both agents). Nevertheless, budget considerations should account for this.

Property Valuation Fees: Banks typically charge S$300 to S$500 for property valuation reports, which are required to determine the maximum loan quantum.

Practical Advice and Due Diligence Steps

Essential Checks Before Purchase

Foreign buyers must exercise comprehensive due diligence to avoid costly mistakes:

Title Verification: Always conduct a title search through the Singapore Land Authority to verify:

- The seller is the registered legal owner with authority to sell

- There are no outstanding mortgages, charges, or caveats on the property

- There are no pending legal disputes or court orders affecting the property

- The property boundaries and lot numbers are accurate

Verify Property Type and Zoning: Confirm that the property type matches your eligibility—foreigners without LDAU approval cannot purchase landed properties. Check the property's zoning with URA to ensure it aligns with your intended use.

Financial Modeling: Calculate the total acquisition cost including:

- Purchase price

- BSD (typically 3-6% of purchase price for most properties)

- ABSD (60% for foreigners)

- Legal fees (approximately S$2,000-S$3,500)

- Valuation and administrative fees

- Renovation costs (if applicable)

- Ongoing property tax and maintenance fees

Review the Option to Purchase Carefully: Ensure the OTP includes all agreed terms, especially:

- Completion timeline

- Fixtures and fittings included

- Any warranties or representations by the seller

- Clauses allowing for a second inspection before completion

Common Pitfalls for Foreign Investors

Based on common experiences, foreign buyers should be particularly cautious about:

Underestimating Total Costs: Many foreign buyers focus solely on the purchase price and underestimate the substantial ABSD burden (60%) and other transaction costs. Always budget comprehensively.

Inadequate Due Diligence: Failing to conduct thorough title searches and property inspections can result in discovering hidden defects, legal disputes, or ownership issues after purchase.

Misunderstanding Financing Constraints: Foreign buyers often overestimate their borrowing capacity. Without CPF savings and facing strict LTV and TDSR limits, ensure financing is secured early.

Ignoring Exit Strategy: Consider resale prospects and SSD implications. Properties sold within four years incur substantial SSD penalties (4-16% of selling price).

Not Engaging Qualified Professionals: Working with licensed property agents, experienced conveyancing lawyers, and reputable banks is essential to navigate Singapore's complex regulatory environment.

Currency Risk: Foreign buyers should consider exchange rate volatility when repatriating funds or servicing loans in foreign currencies.

Regulatory Compliance and Ongoing Obligations

After purchase, foreign owners must comply with ongoing obligations:

Property Tax: Annual property tax is levied on all properties based on Annual Value (estimated annual rental value). Owner-occupied properties enjoy concessionary rates, while non-owner-occupied investment properties face higher progressive rates.

Maintenance and Management Fees: Condominium owners must pay monthly maintenance and sinking fund contributions to the Management Corporation Strata Title (MCST).

Rental Regulations: If renting out the property, ensure compliance with URA regulations regarding minimum rental periods and tenant eligibility.

Planning for Renovation After Purchase

Once you have successfully navigated Singapore's property acquisition process and secured your residential investment, the next critical step is transforming your new property into a comfortable, functional home or a high-value rental asset. Whether you are planning to occupy the property yourself or lease it to tenants, professional renovation services can significantly enhance both livability and investment returns.

Why Professional Renovation Matters

Singapore's residential properties—particularly resale units and older condominiums—often benefit substantially from modernization and customization. Professional renovation services ensure that your property meets contemporary aesthetic standards, complies with local building regulations, and maximizes space efficiency. For foreign investors planning to rent out their properties, well-executed renovations can command premium rental yields in Singapore's competitive rental market.

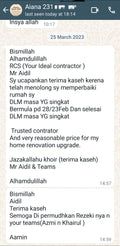

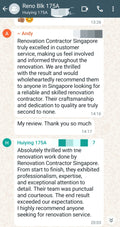

Introducing Renovation Contractor Singapore

Renovation Contractor Singapore is a licensed, experienced renovation specialist serving both HDB and private condominium owners across Singapore. With a proven track record of delivering high-quality residential renovations, the company offers comprehensive packages tailored to various property types and budgets.

Renovation Services and Packages

Renovation Contractor Singapore provides a full spectrum of renovation solutions, including:

Private Condominium Renovation Packages:

- Studio and 1-Bedroom Condos: Light to moderate renovation packages ranging from S$15,400 to S$37,300, covering painting, flooring, basic carpentry, and fixture upgrades.

- 2-Bedroom Condominiums: Comprehensive renovation packages from S$25,000 to S$48,200 for newly completed units, or S$47,900 to S$71,100 for resale units requiring more extensive work.

- 3-Bedroom and Larger Condos: Full-scope renovation including kitchen overhaul, bathroom upgrades, flooring replacement, carpentry, electrical rewiring, and painting. Costs typically range from S$50,000 to S$100,000+ depending on finishes and customization.

Specialized Service Categories:

- Kitchen Renovation: Starting from S$5,590 for basic kitchen cabinet packages, with complete kitchen transformations including countertops, appliances, tiling, and plumbing ranging from S$15,000 to S$30,000.

- Bathroom Renovation: Packages from S$9,990 covering complete bathroom makeovers including hacking, waterproofing, tiling, sanitary fittings, and fixtures.

- Whole-House Renovation: For 2-bedroom to 5-room units, comprehensive packages range from S$32,990 to S$65,000, including all wet and dry areas, flooring, painting, carpentry, electrical works, and project management.

Popular Renovation Products and Solutions

For foreign property owners looking to maximize their investment returns through strategic renovations, Renovation Contractor Singapore offers specialized products and solutions:

2-Bedroom Condo Renovation Package: Comprehensive package starting from S$25,000 that includes full kitchen renovation with premium cabinetry, two bathroom upgrades with modern fixtures, vinyl flooring throughout, custom carpentry for storage solutions, electrical rewiring, painting, and professional project management. This package is specifically designed for resale condominiums that foreign buyers commonly purchase.

3-Bedroom Condo Renovation Package: Full-scope renovation starting from S$50,000 featuring complete kitchen transformation, three bathroom makeovers, premium flooring options, extensive built-in carpentry, upgraded electrical and lighting systems, premium paint finishes, and comprehensive warranty coverage. Ideal for larger investment properties targeting premium rental markets.

Studio Condo Renovation Package: Efficient renovation solution starting from S$15,400 designed for compact spaces, including space-saving kitchen solutions, modern bathroom fixtures, optimized storage solutions, quality flooring, fresh paint, and smart layout planning to maximize rental appeal.

What's Included in Renovation Packages

Renovation Contractor Singapore's packages typically include:

- Professional Design Consultation: Complimentary consultation worth S$300, including site visit, measurements, and 3D renderings with revisions

- Project Management: Comprehensive coordination of vendors, scheduling, and site supervision throughout the renovation period

- Materials and Labor: All necessary materials, skilled installation, and craftsmanship

- Regulatory Compliance: Assistance with renovation permits and approvals from building management or HDB

- Post-Completion Services: Complete cleanup, debris removal, and handover of warranty documentation

- 12-Month Warranty: Comprehensive warranty coverage on all workmanship, materials, and installations

Realistic Cost Expectations

Based on current market rates in Singapore (2025), foreign property owners should budget the following indicative amounts for condominium renovations:

| Property Type | Light Renovation | Moderate Renovation | Extensive Renovation |

|---|---|---|---|

| Studio/1-Bedroom Condo | S$15,000 - S$20,000 | S$20,000 - S$30,000 | S$30,000 - S$50,000 |

| 2-Bedroom Condo | S$25,000 - S$35,000 | S$35,000 - S$50,000 | S$50,000 - S$70,000 |

| 3-Bedroom Condo | S$40,000 - S$55,000 | S$55,000 - S$75,000 | S$75,000 - S$100,000+ |

Light renovation typically involves cosmetic updates such as painting, vinyl flooring installation, minor carpentry, and fixture replacements. Moderate renovation includes structural modifications like hacking non-load-bearing walls, complete floor replacement, upgraded cabinetry, and moderate electrical rewiring. Extensive renovation encompasses major transformations including complete room overhauls, plumbing and electrical system upgrades, premium finishes, and custom carpentry throughout.

Timeline for Renovation Projects

Standard renovation timelines vary based on scope:

- Kitchen-only renovation: 1-2 weeks

- Bathroom-only renovation: 2-3 weeks

- Whole-house renovation (2-3 bedroom condo): 6-8 weeks

- Extensive full-house overhaul: 8-12 weeks

Renovation Contractor Singapore provides guaranteed completion timelines with professional project coordination to minimize delays and disruption.

Why Choose Renovation Contractor Singapore?

Transparent Pricing with No Hidden Costs: All package quotes include detailed line-item breakdowns covering materials, labor, permits, and project management. Clients receive comprehensive quotations upfront with no surprise charges.

Licensed and Experienced Contractors: The company employs licensed professionals familiar with Singapore's building codes, safety regulations, and best practices for both HDB and private condominium renovations.

Comprehensive Warranty Protection: All renovation work comes with a 12-month warranty covering workmanship defects, material failures, and system functionality issues, with responsive after-sales service.

Design Flexibility: Whether you prefer the faster overlay method (applying new materials over existing surfaces) or the more comprehensive hacking method (complete removal and replacement), Renovation Contractor Singapore accommodates various approaches to suit your budget and timeline.

Expert Insights and Resources

For foreign property owners seeking comprehensive guidance on renovation planning, budgeting, and execution, Renovation Contractor Singapore maintains an extensive knowledge base:

Renovation Insights Blog: Access detailed articles covering renovation costs, design trends, contractor selection, permit requirements, and project management best practices specifically for Singapore properties.

Complete Condo Renovation Guide: Comprehensive resource covering every aspect of condominium renovation including cost breakdowns, timeline expectations, permit procedures, and design considerations for maximizing rental returns.

Renovation Packages Comparison Guide: Detailed comparison of different renovation package options, helping property owners select the most appropriate scope and budget for their investment objectives.

Getting Started with Your Renovation

For foreign property owners ready to begin their renovation journey:

- Schedule a Free Consultation: Contact Renovation Contractor Singapore to arrange a complimentary site visit and consultation worth S$300.

- Receive Customized Quotation: After assessing your property and discussing your requirements, receive a detailed written quotation with transparent pricing and timeline estimates.

- Review Design Proposals: Work with the design team to finalize 3D renderings, material selections, and layout configurations that meet your aesthetic preferences and functional needs.

- Approve and Commence: Once the proposal is approved, the renovation team handles all permits, coordinates with building management, and begins work according to the agreed timeline.

Visit Renovation Contractor Singapore for comprehensive information on available renovation services, recent project portfolios, customer testimonials, and to request a free consultation. Their experienced team understands the unique needs of foreign property owners and can guide you through every step of transforming your Singapore property into a valuable, comfortable asset.

Disclaimer

Disclaimer: This article is intended for informational purposes only and does not constitute legal, financial, or investment advice. Property laws, stamp duty rates, and financing regulations in Singapore are subject to change. Foreign buyers should consult qualified legal professionals, licensed property agents, and financial advisors before making any property investment decisions. All regulatory information cited is accurate as of December 2025 based on official Singapore government sources including the Singapore Land Authority, Inland Revenue Authority of Singapore, and Ministry of Law Singapore.