Current HDB BTO Status: 2025-2026 Market Overview

HDB BTO completion dates have achieved remarkable predictability following the resolution of pandemic-related delays in early 2025. The Housing & Development Board expects to complete approximately 17,000 flats across 27 projects in 2025, marking a significant recovery from previous construction challenges. Furthermore, the construction pipeline for 2026-2027 demonstrates HDB's strengthened commitment to housing supply, with 55,000 BTO flats planned for launch between 2025 and 2027—representing a 10% increase from the initial commitment of 50,000 units.

The bto status tracking across Singapore's estates now reveals steady construction progress. Additionally, HDB has exceeded its five-year target by launching approximately 102,400 BTO flats from 2021 to 2025, surpassing the original commitment of 100,000 units. This achievement positions Singapore's public housing development on strong footing as the market transitions toward greater supply stability through 2026 and beyond.

Recently Completed Projects (June 2025)

Major Completions:

Yishun Boardwalk: 100% complete (June 2025 TOP)

Bishan Towers: 100% complete (June 2025 TOP)

Dakota One: 100% complete (June 2025 TOP)

Tampines GreenOpal: 100% complete (June 2025 TOP)

Sun Sails: 100% complete (June 2025 TOP)

Bartley Beacon: 100% complete (June 2025 TOP)

These successful completions demonstrate HDB's restored construction capabilities following pandemic-related disruptions. Moreover, the completion of all delayed projects by mid-2025 represents a turning point for Singapore's public housing delivery system.

Projects Nearing Completion (Q4 2025)

Monitoring Status:

Tampines GreenJade: 96% complete, September 2025 TOP

Nanyang Opal: 90% complete, December 2025 TOP

Tampines GreenQuartz: 88% complete, June 2026 TOP

Plantation Creek @ Tengah: 87% complete, June 2026 TOP

While these projects require continued monitoring, HDB's improved project management capabilities suggest minimal delays compared to pandemic-era challenges. Therefore, prospective homeowners can plan their move-in timelines with greater confidence.

Build to Order News: 2025-2026 Updates and Comprehensive Launch Schedule

Recent build to order news reveals HDB's ambitious supply expansion plans through 2027. The housing board increased its commitment by 10% to launch exactly 55,000 BTO flats across 2025-2027, providing diverse housing options across both mature and developing estates.

2025 BTO Launch Summary

Total 2025 Supply: 19,600 BTO flats across three sales exercises

Completed Launches: February (5,032 flats) and July (5,400 flats)

Final Exercise: October 2025 (9,144 flats across 10 projects)

Shorter Waiting Time Flats: 4,500 SWT units in 2025

The October 2025 exercise marked the year's final launch, featuring groundbreaking projects in two new estates: Mount Pleasant in Toa Payoh and Berlayar on the former Keppel Club site. Both projects received Prime classification, with Berlayar Residences commanding the highest subsidy clawback rate at 14%—reflecting its prestigious Greater Southern Waterfront location.

February 2026 BTO Launch Preview

HDB will launch approximately 4,600 flats in the first sales exercise of 2026. This launch, while smaller than 2025's exercises, provides strategic options across mature and non-mature estates:

Confirmed Locations:

Bukit Merah: Approximately 1,040 units (2-room Flexi, 3-room, 4-room) near Redhill Close and Jalan Bukit Merah

Tampines: Projects near Tampines MRT station with Standard classification anticipated

Toa Payoh: Second Mount Pleasant project potentially included

Sembawang: Around 750 units with 3-generation flats, first BTO in Sembawang North neighbourhood, 3-year estimated waiting time

Concurrent Sale of Balance Flats: Approximately 3,000 SBF units

Prospective applicants must have valid HDB Flat Eligibility (HFE) letters by 15 December 2025 to participate in the February 2026 exercise. HDB encourages early application submission to ensure documentation processing completes before the launch window opens.

2026-2027 Supply Pipeline

HDB's enhanced commitment includes approximately 35,000 new flats launching across 2026 and 2027—averaging about 17,600 flats annually. This sustained supply addresses multiple demand factors including echo boomer demographics, expanded singles eligibility, and evolving household preferences.

Shorter Waiting Time (SWT) Expansion:

2026-2027 Target: 4,000 SWT flats annually (increased from previous 2,000-3,000 commitment)

Completion Timeline: Under three years from application to key collection

Construction Method: Pre-construction work begins before sales launch, reducing waiting periods

The SWT initiative benefits homebuyers requiring urgent housing, including growing families and those with immediate housing needs. Moreover, these projects demonstrate HDB's commitment to accelerating delivery timelines through improved construction planning and resource allocation.

Emerging Estates: Singapore's New Housing Frontiers (2025-2026)

Mount Pleasant Estate: Toa Payoh's Premium Addition

Mount Pleasant represents one of Singapore's most anticipated new housing developments, transforming the former Old Police Academy site into a vibrant residential neighbourhood. The estate will eventually house six BTO projects, with the inaugural Mount Pleasant Crest launching in October 2025.

Mount Pleasant Crest Details:

Total Units: 1,348 flats (2-room Flexi to 4-room)

Classification: Prime

Launch Date: October 2025

Estimated Waiting Time: 59 months (longest among October 2025 launches)

Location Advantages: Central location between Toa Payoh, Balestier, and Thomson; new MRT station serving residents

The Prime classification reflects Mount Pleasant's exceptional location attributes including excellent connectivity, comprehensive amenities, and proximity to Singapore's city center. However, Prime classification includes stricter resale conditions: 10-year minimum occupation period and subsidy recovery upon resale.

Future Mount Pleasant Projects:

Additional Mount Pleasant BTOs will launch progressively through 2026 and beyond, potentially including the February 2026 sales exercise. These subsequent projects will provide more housing options for families seeking central locations with mature estate amenities.

Berlayar Estate: Greater Southern Waterfront Pioneer

The Berlayar estate, built on the former Keppel Club golf course site, inaugurates the ambitious Greater Southern Waterfront transformation. This 48-hectare development will ultimately provide approximately 10,000 homes—comprising 7,000 HDB flats and 3,000 private residential units.

Berlayar Residences (First BTO):

Total Units: 870 flats (2-room Flexi, 3-room, 4-room) plus 200 rental flats

Classification: Prime

Launch Date: October 2025

Subsidy Clawback Rate: 14% (highest among all BTO projects)

Building Heights: 19 to 46 storeys

MRT Access: Between Telok Blangah and Labrador Park MRT stations

The estate name "Berlayar" (meaning "sailing" in Malay) honors the area's maritime heritage and waterfront location. Furthermore, Berlayar's design incorporates green corridors, nature-inspired elements, and biodiversity enhancement features reflecting environmental impact assessment recommendations.

Development Timeline:

Future Berlayar projects will launch progressively throughout 2026 and subsequent years, eventually fulfilling the complete vision of 7,000 public housing units. The estate represents HDB's commitment to creating vibrant waterfront communities integrating nature, heritage, and modern urban living.

Woodlands North Coast: Waterfront Living with JB Connectivity

Woodlands North Coast will transform 21 hectares into a dynamic mixed-use waterfront destination housing approximately 4,000 new homes. The area's development aligns with HDB's Remaking Our Heartland (ROH) plans announced in 2017 for Woodlands Regional Centre.

Key Features:

First BTO Launch: February 2025 (Woodlands North Verge)

Total Supply: 4,000 homes across multiple future projects

Classification: Standard (anticipated)

Unique Advantage: Singapore-Johor Rapid Transit System (RTS) terminus at Woodlands North MRT (operational end-2026)

Design Concept: "Housing by the Woods" maximizing scenic views of Admiralty Park and Woodlands Waterfront

The WoodsVista Gallery—a 1.9km walking and cycling path connecting Woodlands MRT to Woodlands Central—will enhance connectivity for residents. Phase one construction proceeds alongside UrbanVille @ Woodlands, with completion expected in 2026.

Woodlands North Coast's waterfront location offers residents unblocked views of the Straits of Johor while maintaining affordability through Standard classification. Moreover, the upcoming RTS Link provides unprecedented access to Johor Bahru, creating unique cross-border living opportunities.

Sembawang North: Northern Region Housing Expansion

Sembawang North will provide approximately 8,000 BTO flats plus 2,000 private homes across its development area. The estate represents significant housing supply expansion for families preferring northern locations near their parents.

Development Overview:

First BTO Launch: 2025

Total BTO Supply: 8,000 flats

Private Housing: 2,000 units

Classification: Standard (anticipated)

Target Demographic: Families seeking proximity to parents in northern estates

The Sembawang North February 2026 launch will feature approximately 750 units including 3-generation flats—HDB's largest flat type designed for multigenerational living. With an estimated 3-year waiting time and location approximately 1km from Sembawang MRT station, these projects offer affordable options for families prioritizing intergenerational support.

Tengah BTO Completion Date: Forest Town Progress Through 2026

Tengah BTO completion date tracking demonstrates exemplary progress for Singapore's inaugural smart and sustainable "forest town". As of July 2025, close to 12,000 flats (approximately 40% of the planned 30,000 units) have been completed, with almost half of all Tengah flats scheduled for completion by end-2025.

Current Tengah Project Status (Updated October 2025)

Completed Projects:

Parc Woods @ Tengah

Launch Date: February 2021

Completion Status: 100% complete

Key Collection: Completed May 2025

Official TOP Date: March 2025

Projects Completing 2025:

Parc Residences @ Tengah

Estimated TOP: September 2025

Current Progress: 97% complete

Units: 1,044 flats (2-room Flexi to 5-room)

Garden Bloom @ Tengah

Estimated TOP: September 2025

Current Progress: 97% complete

Parc Flora @ Tengah

Estimated TOP: September 2025

Current Progress: 96% complete

Mid-Stage Construction (2026-2027 Completion):

Plantation Creek @ Tengah

Estimated TOP: June 2026

Current Progress: 87% complete

Tampines GreenQuartz

Estimated TOP: June 2026

Current Progress: 88% complete

Garden Waterfront I & II @ Tengah

Estimated TOP: March 2027

Current Progress: 69% complete

Parc Meadow @ Tengah

Launch Date: May 2023

Estimated TOP: June 2027

Current Progress: 54% complete

Units: 1,985 flats (2-room Flexi to 5-room)

Plantation Edge I & II

Launch Date: October 2023

Estimated TOP: December 2027

Current Progress: 42% complete

Features: Integrated with Jurong East 2 (JE2) MRT station and community amenities

Notably, multiple Tengah projects achieved on-time or early completion, validating HDB's enhanced delivery capabilities for Singapore's pioneering smart town. The successful execution demonstrates effective project management despite the complexity of integrating smart technologies, sustainable design features, and comprehensive community amenities.

Tengah MRT Connectivity (2026)

The Tengah Garden Residences' MRT station on the Jurong Region Line will complete in 2026, significantly improving connectivity for residents. This transportation enhancement connects Tengah directly to four Jurong Region Line stations, linking to Jurong Innovation District and Jurong Lake District.

Enhanced Family Cohesion Scheme (FCS): 2025-2026 Implementation

The Family Cohesion Scheme (FCS) represents a significant policy advancement for BTO applications, progressively rolling out from mid-2025. This scheme replaces and expands upon the Multi-Generation Priority Scheme (MGPS), providing more inclusive family support options.

FCS Key Components

Dual Priority System:

Living Together Component: Families living together can apply for larger units including 3-generation flats

Living Near Component: Families living near each other gain priority access to flats in the same BTO project

Enhanced Joint Applications:

Parents and children (regardless of marital status) can jointly ballot for two flats in the same BTO project, ensuring families can maintain proximity while respecting independence preferences.

Inclusive Eligibility:

Both singles and married couples benefit from the scheme, reflecting evolving family structures and living arrangements in modern Singapore. This inclusivity marks a significant departure from previous schemes limited to married applicants.

Implementation Timeline

October 2024: First component activated—singles gain priority access when buying 2-room Flexi flats near parents

October 2025: Second component launched—joint applications for two units in same project

End-2025: Full FCS implementation replacing MGPS

The transition period maintains existing priority schemes until complete FCS rollout, ensuring smooth policy adaptation for pending applications.

HDB Resale Market Outlook: 2026 Supply Surge

Minimum Occupation Period (MOP) Projections

The number of flats reaching five-year MOP will increase dramatically through 2026-2028, significantly impacting resale supply dynamics:

2025: 8,000 units (11-year low)

2026: 13,500 units (almost 70% increase)

2027: 15,000 units

2028: 19,500 units (highest projected)

This supply surge stems from pandemic-delayed BTO completions finally reaching MOP eligibility. The low 2025 supply reflects the 2019-2020 construction slowdown, while subsequent years benefit from resumed building activity.

Estates with Highest MOP Supply (2024-2026)

Between 2024 and 2026, these estates will see the most flats reaching MOP:

Punggol: 5,016 units

Tampines: 4,590 units

Toa Payoh: 3,733 units

Queenstown: 3,704 units

Sembawang: 3,089 units

The concentration of MOP flats in mature estates like Toa Payoh and Queenstown will likely increase million-dollar flat transactions, as these locations command premium pricing.

15-Month Wait-Out Period Review

National Development Minister Chee Hong Tat indicated the 15-month wait-out period for private property owners buying HDB resale flats may be relaxed or removed earlier than 2027. This cooling measure, introduced September 2022, aimed to moderate rapid HDB appreciation and ensure first-timer affordability.

Key Factors Supporting Policy Review:

Increased BTO supply from 2026 onward moderating demand pressure

Over 50,000 BTO units launching 2025-2027 supporting market stability

Resale price growth slowing (0.9% in Q2 2025, down from 1.6% in Q1)

If implemented, the policy change would grant private property owners immediate access to HDB resale markets after selling their properties, eliminating the current 15-month interim housing requirement. However, any adjustments will prioritize protecting first-time buyer affordability and market stability.

BTO Classification Framework: Standard, Plus, Prime

The classification system introduced October 2024 replaced the previous "mature vs. non-mature" estate distinction with location-attribute-based categories. This framework ensures flats in attractive locations remain accessible across income levels while preventing excessive "lottery effects" from location-based windfalls.

Standard Flats

Location: Largest supply category across Singapore, may have 1-2 good locational attributes

Cost: Most budget-friendly with standard subsidies

MOP: 5 years

Resale Restrictions: Least restrictive; whole flat rental allowed post-MOP; no income ceiling for resale buyers

Standard flats form the foundation of Singapore's public housing supply, providing affordable homeownership options across both mature and developing estates. Learn more about Standard, Plus, and Prime classifications on the official HDB classification framework page.

Plus Flats

Location: Choicer locations with good connectivity, proximity to city center, comprehensive amenities, or unique features (e.g., waterfront)

Cost: Higher than Standard but includes additional subsidies

MOP: 10 years

Subsidy Recovery: Required upon resale (lower than Prime)

Resale Income Ceiling: S$14,000 for both families and singles

Rental Restriction: Whole flat rental not allowed even after MOP

Buyer Requirements: At least one Singaporean; 30-month wait-out for private property owners

Plus classification balances location advantages with affordability protection mechanisms, ensuring these desirable homes remain accessible to middle-income families.

Prime Flats

Location: Choicest locations—centrally located with excellent connectivity, comprehensive amenities, or unique attributes

Cost: Highest pricing with most generous subsidies

MOP: 10 years

Subsidy Recovery: Highest clawback percentage (up to 14% for Berlayar Residences)

Resale Income Ceiling: S$14,000 for families; S$7,000 for singles

Rental Restriction: Whole flat rental prohibited permanently

Buyer Requirements: Must meet full BTO eligibility criteria; at least one Singaporean; 30-month wait-out for private property owners

Prime flats in Mount Pleasant and Berlayar estates command premium locations justifying the strictest resale conditions. The high subsidy clawback rates discourage speculative purchases while maintaining long-term affordability. For detailed information, visit the HDB MyNiceHome classification guide.

BTO Tracker: Essential Progress Monitoring Tools

Reliable bto tracker platforms help homeowners monitor construction progress and plan move-in timelines effectively. Combining official and third-party resources provides comprehensive project visibility.

Official HDB Tracking Options

My HDBPage

Personalized flat progress updates

Probable completion date information

Pictorial construction updates

Requires Singpass login for access

HDB Flat Portal

Ballot results checking

Financial planning calculators

Flat selection appointment access

General project information and announcements

Access the official HDB FlatPortal for your personalized BTO tracking.

Third-Party BTO Tracking Platforms

BTO HQ

Current completion percentages by project

User-submitted development updates

Latest progress observations from residents

Community-sourced construction insights

RecordBTO

Aggregated project progress data

Real-time construction milestone updates

Comprehensive historical launch database

Estimated TOP dates with regular revisions

Recommended Tracking Strategy

Monthly Check-ins: Review My HDBPage updates, monitor construction photo updates, track completion percentage changes, note timeline adjustments

Quarterly Reviews: Compare progress against initial estimates, assess delay or acceleration potential, update financial planning, prepare for upcoming milestones

Pre-Completion Preparation (3-4 months before TOP): Activate utility accounts early, secure fire insurance coverage, arrange final payments, schedule renovation contractors

Probable Completion Date and Key Collection Process

Understanding probable completion date terminology and the key collection timeline ensures smooth transitions to homeownership.

Key Date Definitions

Probable Completion Date (PCD)

Initial estimate provided at BTO launch

Subject to change based on construction progress

Used for planning purposes with built-in buffer time

May adjust based on unforeseen circumstances

Estimated TOP Date

Updated completion projection reflecting current progress

More accurate than original PCD

Regularly revised as construction advances

Posted on My HDBPage for registered buyers

Actual TOP Date (Temporary Occupation Permit)

Final official completion confirmation

Triggers key collection appointment scheduling

Marks project handover to homeowners

Enables legal occupation and move-in

Key Collection Timeline

Pre-Collection Phase (2-4 weeks before TOP)

HDB sends appointment notification via email and SMS

Appointment details available on My HDBPage

Final document preparation period

Outstanding payment arrangements finalized

Collection Day Requirements

Original NRIC for all registered applicants

Marriage certificate (if applicable)

Fire insurance documentation (mandatory for HDB loans)

Settlement of all outstanding payments

Post-Collection Responsibilities

Monthly service and conservancy charges

Housing loan repayments

Annual property tax obligations

Compliance with minimum occupation period requirements

Financial Preparation Checklist

Payment Methods:

Cash payments for applicable administrative fees

CPF savings utilization for down payment and monthly installments

Housing loan arrangements (HDB or bank)

Resale levy settlement (if applicable for second-timers)

Required Insurance:

Fire insurance (compulsory for HDB loans)

Home contents insurance (recommended)

Home Protection Scheme coverage

Mortgage-reducing insurance for loan protection

BTO Renovation Planning: Transform Your Dream Home (2025-2026)

Once you've collected your keys, professional renovation transforms your BTO flat into a personalized living space. However, successful renovation requires careful planning of costs, timelines, and contractor selection.

Understanding 2025-2026 BTO Renovation Costs

BTO renovation costs vary significantly based on flat size, scope of work, and material quality. Transparent pricing from established contractors helps homeowners budget effectively:

3-Room BTO Renovation:

Basic Package: S$30,000 - S$35,000

Complete Package: S$38,500 - S$52,100

Premium Package: S$48,000+

4-Room BTO Renovation:

Standard Package: S$42,600 - S$55,000

Enhanced Package: S$55,000 - S$66,000

Premium Package: S$70,000 - S$72,000

5-Room BTO Renovation:

Complete Package: S$52,100 - S$65,000

Premium Package: S$65,000 - S$75,000

Executive Package: S$80,000+

BTO renovations typically cost 20-30% less than resale flat renovations because new units require minimal demolition work and have no aging infrastructure requiring replacement. For comprehensive cost breakdowns, read our detailed guide on BTO Renovation Cost Singapore 2025: From $30K + HDB Guide.

Essential HDB Renovation Permit Requirements (2026)

All HDB renovation work must comply with strict permit regulations to ensure building safety and legal compliance.

Works Requiring HDB Renovation Permit:

Structural alterations (wall demolition or construction)

Floor modifications requiring material removal

Electrical work (major installations, new power points)

Air-conditioning unit installation

Bathroom and toilet wet works

Window and door modifications

Mandatory Contractor Requirements:

Must be registered in HDB's Directory of Renovation Contractors (DRC)

Current registration status verification required

Experience with HDB guidelines essential

Public liability insurance coverage

Knowledge of permit application procedures

Permit Application Timeline:

Standard applications: Up to 3 weeks from submission

Simple renovations: 3-7 days for straightforward projects

Complex structural work: 3-4 weeks or longer

For complete permit guidance, visit our comprehensive HDB Renovation Permit in Singapore: Complete 2025 Guide.

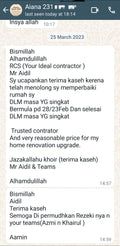

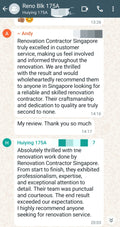

Professional BTO Renovation Services

RCS Renovation Contractor Singapore has been Singapore's trusted HDB renovation specialist since 2017, offering comprehensive BTO packages with transparent pricing and no hidden fees.

Key Service Highlights:

Comprehensive Packages: Starting from S$30,000 for 3-room BTOs with complete kitchen, bathroom, flooring, and built-in solutions

HDB Permit Handling: Professional management of all paperwork and approval processes

Extended Warranty: Comprehensive 12-month warranty protection on all works

Transparent Pricing: No hidden costs or surprise charges throughout project

Licensed Expertise: HB-11-5877Z registration ensuring full HDB compliance

Expert BTO Renovation Resources

Comprehensive Planning Guides:

The Great BTO Renovation Race: Timing Your Sprint to Success - Complete timeline planning for new homeowners

HDB BTO Renovation Budget Singapore 2025: Expert Guide - Detailed cost breakdowns and saving strategies

BTO Renovation Singapore 2025: From $30K | Honest Guide - HDB-approved contractors and compliance requirements

BTO vs Resale Renovation Costs in Singapore 2025: Smart Guide - Comprehensive cost comparison for informed decisions

5 Room BTO Renovation Cost Singapore – Honest Price Guide 2025 - Detailed pricing breakdown for larger flats

Specialized Package Collections:

3-Room BTO Renovation Packages - Comprehensive solutions for compact flats

4-Room BTO Renovation Packages - Popular family-friendly options

HDB Resale and BTO Renovation Packages - Flexible renovation solutions for all flat types

Contractor Selection and Comparison:

Best HDB Renovation Contractors 2025 | Avoid Scams Now! - Comprehensive rankings and verification strategies

Top 10 HDB Renovation Contractors Singapore 2025 - Industry analysis and pricing comparisons

Best Renovation Company in Singapore 2026 - Future-ready contractor evaluation

Top 12 HDB Contractors in Singapore (2025 List & Pricing) - Licensed contractor directory with transparent pricing

Comprehensive Renovation Guides:

2025 Singapore HDB Renovation Guide: Costs, Tips & Contractors - Complete contractor selection guide

2025 Singapore Home Renovation Guide: Costs, Packages & Tips - Holistic renovation planning resource

Ultimate Singapore Home Renovation Guide 2025 | Cost & Tips - Market trends and contractor insights

Singapore Renovation Guide 2025: HDB, BTO & Condo Complete - Cross-property-type renovation strategies

Area-Specific Guides:

Queenstown HDB Renovation Contractor 2025-2026 - Specialized guidance for older estates

Toa Payoh HDB Renovation Guide 2025-2026 - Mature estate renovation expertise

Additional HDB Resources:

HDB Home Improvement Programme Guide 2025 | HIP Singapore - Understanding HDB's upgrading initiatives

Office Renovation Singapore 2025: Complete Guide & Costs - Commercial renovation for home-based businesses

Standard BTO Renovation Timeline

Weeks 1-2: Design finalization and HDB permit applications

Weeks 3-4: Material ordering and site preparation

Weeks 5-8: Main construction work (kitchen, bathroom, flooring)

Weeks 9-10: Electrical work and air conditioning installation

Weeks 11-12: Quality inspections, touch-ups, and final handover

Professional BTO renovation typically requires 8-12 weeks from start to completion. Working with experienced contractors ensures on-time delivery, quality workmanship, and full HDB compliance.

Why Choose Professional BTO Renovation Services

Transparent Pricing: No hidden costs or surprise fees throughout project

HDB Compliance: All permits and approvals handled professionally

Quality Materials: Premium finishes within budget parameters

Comprehensive Warranty: Extended protection for peace of mind

Established Track Record: Proven experience since 2017

Project Management: Dedicated coordination ensuring timely completion

Contact RCS Renovation Contractor Singapore:

Website: renovationcontractorsingapore.com

Phone: +65 8784 8742

Email: rcs@renovationcontractorsingapore.com

Future BTO Outlook: 2026-2027 Projections

Singapore's BTO landscape continues evolving with enhanced policies and improved delivery systems supporting homeownership aspirations.

Supply Pipeline Enhancement (2025-2027)

Total BTO Supply: 55,000 flats (10% increase from original 50,000 commitment)

Geographic Distribution: Mount Pleasant, Woodlands North Coast, Sembawang North, Berlayar estate, and established towns

Shorter Waiting Time Flats: 4,000 SWT units annually in 2026-2027

Classification Mix: Good distribution of Standard, Plus, and Prime flats catering to diverse needs and budgets

This sustained supply addresses multiple demographic factors including echo boomer generation entering homebuying age, expanded singles eligibility, and preference shifts toward smaller household sizes.

Technology Integration and Smart Features

Digital Progress Tracking: Enhanced My HDBPage with automated updates

Streamlined Applications: Real-time application rate updates on HDB Flat Portal

Extended HFE Validity: 9-month validity period providing more application flexibility

8-Day Application Window: Extended period enabling more informed decision-making

Policy Evolution and Affordability Support

Enhanced CPF Housing Grant (EHG):

Families: Up to S$120,000 (increased from previous levels)

Singles: Up to S$60,000

Plus/Prime Additional Subsidies: Maintaining affordability despite premium locations

Family Care Scheme Benefits:

Joint ballot opportunities for parents and children

Priority access regardless of marital status

Strengthening intergenerational family support

Application Process Improvements:

Non-selection rate dropped from 40% to 19% after October 2023 policy changes

Shortlisting reduced from 300% to 200% of supply starting February 2025

Almost all flats booked within first 200% of supply

Conclusion: Navigating Your BTO Journey with Confidence

Successful BTO homeownership through 2025-2026 requires proactive information management, realistic timeline expectations, and strategic planning. The convergence of enhanced supply, improved construction efficiency, and supportive policies creates favorable conditions for prospective homeowners.

Key Takeaways for 2025-2026

Supply Stability: 55,000 BTO flats launching 2025-2027 with 4,000 annual SWT units providing shorter waiting times

New Housing Frontiers: Mount Pleasant, Berlayar, Woodlands North Coast, and Sembawang North offering diverse location options

MOP Supply Surge: 13,500 flats reaching MOP in 2026 (almost double 2025 levels) expected to moderate resale prices

Enhanced Family Support: Family Care Scheme enabling closer intergenerational living arrangements

Classification Framework: Standard, Plus, Prime system ensuring location-appropriate affordability protection

Improved Predictability: Pandemic delay resolution and strengthened project management enhancing completion reliability

Strategic Recommendations

Track Progress Proactively: Combine official HDB channels (My HDBPage) with third-party trackers for comprehensive visibility

Plan Renovation Early: Engage licensed contractors during waiting period to ensure smooth post-collection execution

Understand Classification Impact: Evaluate MOP requirements, subsidy clawbacks, and resale restrictions before application

Leverage Priority Schemes: Utilize Family Care Scheme benefits for proximity living with parents or children

Maintain Financial Readiness: Secure HFE letters early, prepare CPF utilization plans, arrange insurance coverage before key collection

For professional BTO renovation services with transparent pricing and comprehensive HDB compliance, visit RCS Renovation Contractor Singapore or contact +65 8784 8742 for your free consultation. Transform your BTO flat into your dream home with Singapore's most trusted renovation specialist since 2017.

Data Sources and Validation:

This comprehensive guide incorporates information from official HDB press releases (2025-2026), Ministry of National Development announcements, verified property tracking platforms, and licensed renovation contractors. All BTO launch dates, completion projections, and policy updates reflect the latest available data as of October 2025. Readers should verify current information through official HDB channels at hdb.gov.sg and homes.hdb.gov.sg for the most up-to-date project status, completion dates, and application requirements.