Getting a bank loan in Singapore, especially from United Overseas Bank (UOB), is a safe and reliable financial solution for various needs—from home renovations and property purchases to personal expenses. This comprehensive guide explains how to legally apply for a UOB bank loan, what requirements you need to meet, and important tips to ensure a smooth, risk-free application process.

Understanding UOB Bank Loans

UOB Bank Loan refers to financing products offered by United Overseas Bank Limited, one of Singapore's largest and most trusted banks regulated by the Monetary Authority of Singapore (MAS). UOB provides various loan types tailored to customer needs, including personal loans, home loans, renovation loans, and construction loans.

As a fully licensed financial institution, UOB operates under Singapore's Banking Act 1970 and is strictly supervised by MAS to ensure consumer protection and financial system integrity. This means every UOB loan product is guaranteed to be safe, legal, and transparent with clear terms and conditions.

Types of UOB Bank Loans Available

1. UOB Personal Loan

UOB Personal Loans are designed for personal needs such as debt consolidation, medical expenses, or home renovation. The current promotion valid until 31 October 2025 offers up to 2% cash rebates for approved personal loan amounts of at least S$15,000 with tenure of 3-5 years.

Key Features:

-

Interest rates: Starting from 1.52% per annum (EIR from 2.92% per annum)

-

Instant approval: Applications submitted between 8:30 AM and 9:00 PM are processed instantly for existing customers

-

Zero processing fees: No administrative charges for all tenures

-

Fast disbursement: Funds transferred immediately after approval

-

Flexible tenure: 1 to 5 years to suit your needs

-

Monthly repayment: As low as S$20 per month (based on S$1,000 loan at 1.52% p.a. for 60 months)

-

Loan amount: Up to 12 times your monthly income (subject to MAS regulations)

Eligibility Requirements:

-

Existing UOB Credit Card/CashPlus customer (or can apply simultaneously)

-

Singapore Citizen or Permanent Resident

-

Age: 21 to 65 years old

-

Minimum annual income: S$30,000

Important Conditions:

-

No upfront documents required for existing UOB Credit Card or CashPlus customers, but ensure your account is active and all particulars including income are up-to-date

-

Early cancellation fee: S$150 or 3% of outstanding balance (whichever is higher)

-

Late payment penalties apply if full payment is not received by statement due date

-

Funds cannot be disbursed to UOB credit facilities (Credit Card or CashPlus account)

For more information, visit: https://www.uob.com.sg/personal/borrow/personal-financing/personal-loan.page

2. UOB Home Loan (Private Property)

UOB property loans are available for purchasing private residential properties with attractive promotional packages. The bank offers various home loan packages including fixed rate and floating rate options.

Key Features:

-

Loan-to-Value (LTV): Up to 75% of property price or valuation (whichever is lower)

-

Maximum tenure: Up to 35 years or age 75, whichever is earlier

-

Competitive interest rates: Various packages including 3-year fixed, 5-year fixed, and SORA-based floating rates

-

Refinancing options: Available for existing property loans

-

Promotional incentives: Cash rebates, legal fee subsidies, and valuation fee waivers (terms apply)

Eligibility Requirements:

-

Age: 21 to 65 years old at application

-

Singapore Citizens, PRs, or foreigners (different LTV limits apply)

-

Total Debt Servicing Ratio (TDSR): Maximum 55% of gross monthly income

-

Minimum down payment: 25% (minimum 5% in cash, balance can be CPF)

-

Stable income and good credit history

Documents Required:

-

NRIC/Passport (front and back)

-

Latest 3 months computerized payslips or 2 years NOA for self-employed

-

Latest 15 months CPF contribution history

-

Latest 3 months bank statements

-

Option to Purchase (OTP)

-

Property valuation report

-

HDB floor plan (for HDB properties)

For more details, visit: https://www.uob.com.sg/personal/borrow/property-loans/private-home-loan.page

3. UOB Renovation Loan

Specifically designed for home renovation projects, UOB renovation loans help you finance your dream home makeover without draining your savings.

Key Features:

-

Loan amount: Maximum 6 times monthly salary or S$30,000 (whichever is lower)

-

Interest rates: Starting from approximately 5.43% per annum

-

Repayment tenure: Up to 5 years

-

Processing fee: Typically waived during promotional periods

-

Quick approval: 1-2 business days for decision

-

No collateral required: Unsecured loan

How to Use:

-

Kitchen and bathroom renovation

-

Flooring and painting works

-

Built-in furniture and carpentry

-

Electrical and plumbing upgrades

-

Complete home makeover

Eligibility:

-

Singapore Citizen or Permanent Resident

-

Age: 21 to 65 years old

-

Minimum annual income: S$30,000

-

Good credit standing

For renovation loan comparisons and more information, visit: https://www.moneysmart.sg/personal-loan/renovation-loan

4. UOB HDB Home Loan

For those purchasing HDB flats, UOB offers specialized HDB home loans with competitive rates tailored to public housing requirements.

Key Features:

-

LTV ratio: Up to 75% for first loan (subject to MAS regulations)

-

CPF usage: Can use CPF Ordinary Account for down payment and monthly installments

-

Competitive rates: Both fixed and floating rate packages available

-

Tenure flexibility: Up to 25 years or remaining lease (whichever is shorter)

For HDB home loan details, visit: https://www.uob.com.sg/personal/borrow/property-loans/hdb-home-loan.page

Step-by-Step Guide: How to Apply for UOB Bank Loan Legally

Step 1: Determine Your Loan Needs

First, assess your financial situation and determine exactly how much you need to borrow. Consider:

-

Purpose of loan: Personal expenses, home purchase, or renovation?

-

Amount needed: Calculate the exact amount required

-

Repayment ability: Can you comfortably afford monthly installments?

-

Loan tenure: How long do you need to repay?

Use online loan calculators to estimate monthly repayments before applying. Most banks including UOB provide calculators on their websites.

Step 2: Check Your Eligibility

Before applying, verify that you meet all eligibility criteria:

-

Confirm your age falls within the acceptable range (21-65 years)

-

Check your annual income meets minimum requirements

-

Ensure you have Singapore Citizenship or PR status

-

Review your credit score (obtain from Credit Bureau Singapore)

-

Calculate your TDSR to ensure it doesn't exceed 55%

Understanding TDSR (Total Debt Servicing Ratio):

TDSR = (Total monthly debt obligations / Gross monthly income) × 100%

Your TDSR should not exceed 55% for property loans. This includes all existing loans, credit card minimum payments, and the new loan you're applying for.

Step 3: Prepare Required Documents

Gather all necessary documents before starting your application:

For Employed Individuals:

-

NRIC (front and back copies)

-

Latest 3 months computerized payslips

-

Latest 15 months CPF contribution history statement

-

Latest 3 months bank statements

-

Income tax notice of assessment (if applicable)

For Self-Employed/Business Owners:

-

NRIC (front and back copies)

-

Latest 2 years Income Tax Notice of Assessment (NOA)

-

Business registration documents (if applicable)

-

Latest 6 months business bank statements

-

Financial statements or management accounts

For Home Loans, Additional Documents:

-

Option to Purchase (OTP) from seller

-

Property valuation report from approved valuers

-

Sales and Purchase Agreement (after OTP exercise)

-

HDB Resale Application acknowledgment (for HDB flats)

-

Property floor plans

Step 4: Apply Through Official Channels Only

UOB provides several secure application methods:

Online Application (Recommended):

-

Visit the official UOB website: https://www.uob.com.sg

-

Navigate to the loan type you need (Personal/Home/Renovation)

-

Click "Apply Now"

-

Use SingPass MyInfo for automatic data filling

-

Complete the online application form

-

Upload required documents

-

Submit application

Benefits of online application:

-

24/7 availability

-

Instant approval for existing customers (during business hours 8:30 AM - 9:00 PM)

-

Automatic data population via MyInfo

-

Secure document upload

-

Application tracking

UOB TMRW Mobile App:

Existing UOB customers can apply directly through the TMRW mobile banking app:

-

Download UOB TMRW from App Store or Google Play

-

Log in with your credentials

-

Navigate to "Borrow" section

-

Select loan type and follow application steps

-

Submit digitally

Visit UOB Branch:

For personalized consultation, visit any UOB branch:

-

Bring all required documents

-

Speak with a personal banker or mortgage specialist

-

Get professional advice on suitable loan packages

-

Submit application with assistance

-

Ask questions and clarify doubts

UOB Customer Service Hotline:

-

Personal Loan Enquiries: +65 6668 2087 (Mon-Fri, 9:30 AM - 6:00 PM)

-

Home Loan Enquiries: +65 1800 222 2121 (24-hour banking hotline)

-

General Banking: +65 6222 2121

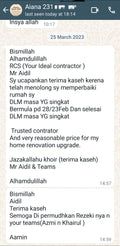

CRITICAL WARNING: Only apply through official UOB channels. Never respond to unsolicited calls, SMS, or WhatsApp messages offering guaranteed loan approvals. Licensed banks like UOB will never contact you first to offer loans or request upfront payments before approval.

Step 5: Application Review & Verification

After submission, UOB will:

-

Verify your identity: Through NRIC and SingPass verification

-

Conduct credit assessment: Check your credit report from Credit Bureau Singapore

-

Verify income: Cross-check with CPF, IRAS, and provided documents

-

Assess repayment ability: Calculate TDSR and affordability

-

Conduct property valuation: For home loans only

-

Internal approval process: Credit committee review for larger amounts

Processing Timeline:

-

Personal Loan: Instant to same-day approval for existing customers

-

Renovation Loan: 1-2 business days

-

Home Loan (In-Principle Approval): 1-3 business days

-

Home Loan (Final Approval): 2-4 weeks after IPA

You'll be notified via SMS and email about your application status. You can also track your application online through UOB Internet Banking or TMRW app.

Step 6: Receive Letter of Offer

Upon approval, UOB will issue a Letter of Offer containing:

-

Approved loan amount

-

Interest rate (per annum and EIR)

-

Loan tenure

-

Monthly installment amount

-

Processing fees (if any)

-

Early repayment fees

-

Late payment charges

-

Terms and conditions

-

Validity period of offer (typically 30 days)

Important: Read Everything Carefully

Do not rush to sign. Review every clause including:

-

Total interest payable over the loan tenure

-

Total amount repayable

-

Penalties for late payment

-

Early termination fees

-

Lock-in period (if any)

-

Insurance requirements (for home loans)

-

Conditions precedent

If anything is unclear, contact UOB customer service for clarification before signing.

Step 7: Sign and Accept the Offer

Once you're satisfied with the terms:

Digital Signing:

-

Most personal and renovation loans can be signed digitally

-

Use SingPass for e-signature authentication

-

Complete within the validity period

Physical Signing:

-

For home loans, you may need to visit the branch

-

Bring your NRIC for verification

-

Sign in front of bank officer

-

Collect copies of all signed documents

After Signing:

-

You'll receive a copy of the signed Letter of Offer

-

Confirmation SMS/email will be sent

-

Loan account will be created in the system

Step 8: Loan Disbursement

For Personal/Renovation Loans:

-

Funds are typically disbursed within 1 business day after signing

-

Money is transferred directly to your designated bank account

-

You'll receive SMS notification when funds are credited

-

Start making monthly repayments according to schedule

For Home Loans:

-

Disbursement is made according to payment schedule

-

For completed properties: Upon completion of legal documentation

-

For under-construction properties: Progressive disbursement based on construction milestones

-

CPF portion will be deducted automatically if applicable

-

First monthly installment starts in the following month

Singapore MAS Regulations & Consumer Protection

Understanding the regulatory framework protects you as a borrower:

MAS Unsecured Credit Limit Rules

Since June 1, 2019, the Monetary Authority of Singapore enforces:

-

Borrowing cap: Maximum 12 times monthly income for all unsecured facilities combined

-

Coverage: Includes personal loans, credit cards, overdrafts, and credit lines

-

Suspension rule: If you exceed the limit for 3 consecutive months, lenders must suspend all unsecured credit

-

Income verification: Banks must obtain income documents to verify your income

This regulation protects consumers from over-borrowing and prevents excessive debt accumulation.

MAS Property Loan Regulations

For residential property financing:

Loan-to-Value (LTV) Limits:

-

First property loan: Up to 75% (25% downpayment)

-

Second property loan: Up to 45% (55% downpayment)

-

Third and subsequent: Up to 35% (65% downpayment)

-

Minimum 5% must be paid in cash (cannot use CPF)

Total Debt Servicing Ratio (TDSR):

-

Maximum 55% of gross monthly income

-

Includes all debt obligations (loans, credit cards, etc.)

-

Calculated using actual/implied interest rates

Loan Tenure:

-

Maximum 30 years for HDB loans

-

Maximum 35 years for private property loans

-

Subject to borrower reaching age 75

These rules prevent property speculation and ensure borrowers don't overextend financially.

Banking Act & Consumer Protection

The Banking Act (Chapter 19) provides:

-

Confidentiality: Your financial information is protected

-

Fair lending practices: Banks must assess suitability before granting loans

-

Clear disclosure: All fees and charges must be transparently disclosed

-

Complaint mechanisms: Formal channels to address disputes

Personal Data Protection Act (PDPA)

Your personal data is protected under PDPA:

-

Banks can only collect necessary information

-

Data must be used only for stated purposes

-

You have right to access and correct your data

-

Banks must protect data from unauthorized access

For more information on MAS regulations, visit: https://www.mas.gov.sg

Why UOB Bank Loan is Safe & Legitimate

Licensed & Regulated Institution

UOB holds a full bank license from MAS and has been operating in Singapore since 1935. The bank is:

-

Listed on Singapore Exchange (SGX)

-

Supervised by MAS with regular audits

-

Required to maintain capital adequacy ratios

-

Subject to strict compliance requirements

-

Part of Singapore's deposit insurance scheme

Transparent Terms

Unlike illegal money lenders or loan scams:

-

All interest rates are clearly stated upfront

-

No hidden fees or charges

-

Comprehensive Letter of Offer before disbursement

-

Fixed monthly installments (for fixed-rate loans)

-

Clear breakdown of principal and interest

Zero Upfront Fees

Legitimate banks like UOB:

-

Never ask for payment before loan approval

-

Do not charge "processing fees" upfront (fees deducted from loan amount if applicable)

-

Will never request deposits or "good faith" payments

-

Don't require you to purchase products to get loan approval

Red Flag: If anyone asks you to pay money before receiving a loan, it's a scam.

Legal Recourse

All UOB loan agreements:

-

Are legally binding contracts under Singapore law

-

Can be enforced through Singapore courts

-

Provide clear dispute resolution mechanisms

-

Are regulated by MAS guidelines

Professional Customer Support

UOB provides:

-

Dedicated customer service hotlines

-

Branch support nationwide

-

Online chat assistance

-

Email support

-

Complaint handling processes

-

Financial advisory services

How to Avoid Loan Scams in Singapore

Loan scams are prevalent, especially targeting those who need urgent financing. Here's how to protect yourself:

Common Loan Scam Red Flags

🚨 Warning Signs:

-

Unsolicited Contact: Random calls, SMS, or WhatsApp messages offering guaranteed loans

-

Upfront Payment Requests: Asking for "processing fees," "insurance," "GST," or "admin charges" before approval

-

Too Good to Be True: Promises of instant approval without credit checks or income verification

-

Pressure Tactics: "Limited time offer," "Apply now or lose opportunity," urgency to decide immediately

-

No Physical Office: Cannot provide legitimate office address or only operates online/via messaging apps

-

Unprofessional Communication: Poor grammar, spelling errors, unofficial email addresses (e.g., Gmail)

-

Requests for SingPass/Banking Credentials: Asking for passwords, OTP, or online banking login details

-

Not MAS Licensed: Cannot provide valid bank license or moneylender license number

-

Suspicious Terms: Extremely low interest rates not matching market rates or no clear loan agreement

-

Cash Transactions: Requesting payments via unconventional methods (iTunes cards, cryptocurrency, cash deposits to personal accounts)

How to Verify Legitimacy

✅ Always Verify:

-

Check MAS License: Visit https://www.mas.gov.sg and search the Financial Institutions Directory

-

Verify Company: Search ACRA BizFile for company registration details

-

Official Website: Only visit official bank websites (e.g., www.uob.com.sg, not uob-loans.com or similar)

-

Physical Branches: Legitimate banks have multiple physical branches you can visit

-

Call Official Number: Use phone numbers listed on official bank websites, not numbers provided in SMS/emails

-

Check Reviews: Research company reputation on trusted platforms

Protect Yourself

✅ Safety Tips:

-

Never share your SingPass password or OTP with anyone

-

Don't disclose banking credentials over phone or email

-

Always read and understand loan agreements before signing

-

Compare multiple loan offers from licensed institutions

-

Be suspicious of unsolicited loan offers

-

Report suspicious activity to Singapore Police Force

-

Use ScamShield app to block scam calls and SMS

-

If in doubt, visit a bank branch physically

What to Do If You're Scammed

If you believe you've fallen victim to a loan scam:

-

Stop all communication with the scammer immediately

-

Don't make further payments regardless of threats

-

Report to Police: File a report at any police station or online at https://www.police.gov.sg

-

Report to OCBC: If money was transferred, contact your bank immediately

-

Report to ScamAlert: Visit https://www.scamalert.sg

-

Seek help: Contact Credit Counselling Singapore at 6225 5227 for advice

For more information on avoiding loan scams, visit: https://www.ocbc.com/personal-banking/security/secure-banking-ways/loan-scams.page

Using Your UOB Loan for Home Renovation

If you're planning to use your UOB personal loan or renovation loan for home renovation, it's crucial to engage a licensed and reputable contractor.

Why Choose a Licensed Renovation Contractor

Using an unlicensed or unverified contractor risks:

-

Poor workmanship and project abandonment

-

Permit violations and HDB/BCA penalties

-

No warranty or after-sales support

-

Payment disputes with no legal recourse

-

Safety hazards from improper electrical/plumbing work

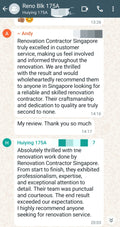

RCS Renovation Contractor Singapore: Your Trusted Partner

Renovation Contractor Singapore (RCS) is a fully HDB-licensed contractor specializing in residential renovation projects for HDB flats, condominiums, and landed properties.

Why RCS?

-

HDB Licensed: Registered in HDB Directory of Renovation Contractors (verifiable)

-

BCA Registered: Compliant with Building & Construction Authority regulations

-

Established Since 2017: 8+ years of proven track record

-

350+ Completed Projects: Successfully completed renovations across Singapore

-

Transparent Pricing: All package prices published online with itemized quotations

-

Zero Permit Violations: Perfect compliance record with HDB and BCA

-

12-Month Warranty: Comprehensive warranty on all completed works

-

One-Stop Service: Design, permits, renovation, and handover

-

Licensed Tradesmen: Qualified electricians, plumbers, and builders

RCS Renovation Services:

1. HDB Flat Renovation

Complete packages for 3-room, 4-room, and 5-room HDB flats including BTO and resale units.

Packages Starting From:

-

BTO Basic Package: S$7,690

-

3-Room HDB Package: S$12,990

-

4-Room HDB Package: S$15,990

-

5-Room HDB Package: S$19,990

Learn more: https://renovationcontractorsingapore.com/blogs/news/hdb-renovation-packages-singapore-guide-2025

2. Kitchen Renovation

Modern kitchen renovation with quality cabinets, countertops, appliances, and fixtures.

Packages Starting From:

-

Basic Kitchen Package: S$5,590

-

Standard Kitchen Package: S$8,990

-

Premium Kitchen Package: S$13,990

Includes: kitchen cabinets, countertop, hood & hob, sink, backsplash, lighting, and plumbing.

Learn more: https://renovationcontractorsingapore.com/blogs/news/kitchen-renovation-singapore-2025-from-s-5-590-rcs

3. Bathroom Renovation

Complete bathroom renovation with waterproofing, tiling, sanitary fittings, and fixtures.

Packages Starting From:

-

Basic Bathroom Package: S$9,990

-

Standard Bathroom Package: S$12,990

-

Premium Bathroom Package: S$16,990

Includes: hacking, waterproofing, tiling, toilet bowl, basin, shower set, accessories, and lighting.

4. Carpentry Works

Custom built-in furniture including wardrobes, TV consoles, shoe cabinets, and storage solutions.

Services include:

-

Custom wardrobes with sliding/swing doors

-

TV feature walls and consoles

-

Study tables and bookshelves

-

Kitchen cabinets and island

-

Shoe cabinets and storage units

-

Platform beds with storage

Learn more: https://renovationcontractorsingapore.com/blogs/news/rcs-carpentry-contractor-singapore-renovation-services

5. Complete Home Renovation

Full turnkey renovation service from design consultation to project handover.

Comprehensive Services:

-

Interior design consultation

-

Space planning and layout

-

3D visualization

-

HDB/BCA permit application and approval

-

Demolition and hacking works

-

Masonry and tiling

-

Carpentry and built-in furniture

-

Electrical and lighting installation

-

Plumbing and sanitary works

-

Painting and finishing

-

Flooring installation

-

Air-conditioning installation

-

Project management and coordination

-

Final cleaning and handover

Learn more: https://renovationcontractorsingapore.com/blogs/news/singapore-renovation-guide-2025-hdb-bto-condo-complete

6. HDB Renovation Permits

RCS handles all renovation permit applications and approvals:

-

Application submission to HDB

-

Technical drawings and floor plans

-

Structural assessment (if required)

-

Permit approval follow-up

-

Compliance with HDB renovation guidelines

-

BCA permit for structural works (if needed)

Learn more about HDB permits: https://renovationcontractorsingapore.com/blogs/news/hdb-renovation-permit-complete-guide-2025

RCS Service Areas

RCS serves all HDB estates and private properties across Singapore:

North Region: Woodlands, Sembawang, Yishun, Admiralty, Marsiling, Canberra

Central Region: Toa Payoh, Bishan, Ang Mo Kio, Serangoon, Hougang, Sengkang, Punggol

East Region: Tampines, Pasir Ris, Bedok, Simei, Tanah Merah, Changi

West Region: Jurong East, Jurong West, Clementi, Bukit Batok, Choa Chu Kang, Bukit Panjang

South Region: Queenstown, Tiong Bahru, Redhill, Bukit Merah, Alexandra

How to Verify RCS Credentials

HDB License Verification:

-

Visit HDB InfoWEB: https://services2.hdb.gov.sg/web/fi10/edir.html

-

Search for "Renovation Contractor Singapore" or "RCS"

-

Verify registration number and license status

BCA Registration:

Check BCA Contractors Registry for valid registration and trade categories.

Company Registration:

Search ACRA BizFile to verify business registration and company details.

Project Portfolio:

View completed projects and customer testimonials on the RCS website and social media platforms.

How to Engage RCS for Your Renovation

Step 1: Initial Consultation

-

Contact RCS via phone, WhatsApp, or email

-

Discuss your renovation requirements and budget

-

Schedule a site visit and measurement

Step 2: Quotation & Design

-

Receive detailed quotation with itemized breakdown

-

Review 3D designs and floor plans

-

Request revisions until satisfied

-

No obligation to proceed if not satisfied

Step 3: Contract Signing

-

Review and sign renovation contract

-

Clear payment terms and schedule

-

Project timeline and milestones

-

Warranty terms and conditions

Step 4: Permit Application

-

RCS submits permit application to HDB/BCA

-

Obtain necessary approvals (typically 2-4 weeks)

-

Cannot start work without valid permits

Step 5: Renovation Works

-

Project commencement according to schedule

-

Regular updates and site inspections

-

Quality control at each stage

-

Address any concerns promptly

Step 6: Completion & Handover

-

Final inspection and walkthrough

-

Rectification of any issues

-

Handover with warranty documentation

-

After-sales support and service

Contact RCS Renovation Contractor Singapore

Office Address:

31 Woodlands Close #03-06

Woodlands Horizon

Singapore 737855

Phone/WhatsApp:

+65 8784 8742

Email:

rcs@renovationcontractorsingapore.com

Website:

https://renovationcontractorsingapore.com

Operating Hours:

Monday to Saturday: 9:00 AM - 6:00 PM

Sunday: Closed (or by appointment)

Social Media:

-

Facebook: Renovation Contractor Singapore

-

Instagram: @renovationcontractorsg

Get a Free Quote:

Visit the contact page to submit your renovation requirements: https://renovationcontractorsingapore.com/pages/contact

Complete Renovation Guide & Resources

For comprehensive information about renovation in Singapore, explore these helpful guides:

Planning Your Renovation:

-

Complete Singapore Renovation Guide 2025: https://renovationcontractorsingapore.com/blogs/news/singapore-renovation-guide-2025-hdb-bto-condo-complete

-

HDB Renovation Rules & Guidelines: https://renovationcontractorsingapore.com/blogs/news/hdb-renovation-guide-2025-complete-rules-permits-amp-budget-calculator-singapore

-

How to Choose the Right Contractor: https://renovationcontractorsingapore.com/blogs/news/best-renovation-contractor-singapore-7-steps

Avoiding Scams:

-

Singapore Renovation Scam Verification Guide: https://renovationcontractorsingapore.com/blogs/news/singapore-renovation-contractor-scam-verification-guide

-

HDB Licensed Contractors List: https://renovationcontractorsingapore.com/blogs/news/hdb-licensed-contractors-singapore-2025-guide

Specific Renovation Projects:

-

Kitchen Renovation Packages: https://renovationcontractorsingapore.com/blogs/news/kitchen-renovation-packages-singapore

-

Bathroom/Toilet Renovation Guide: https://renovationcontractorsingapore.com/blogs/news/toilet-renovation-singapore-5-days-9990-hdb-guide

-

BTO Renovation Complete Guide: https://renovationcontractorsingapore.com/blogs/news/hdb-renovation-contractors-singapore-2025-expert-guide

Helpful External Resources

Banking & Financial Information:

-

UOB Personal Loan: https://www.uob.com.sg/personal/borrow/personal-financing/personal-loan.page

-

UOB Home Loan: https://www.uob.com.sg/personal/borrow/property-loans/private-home-loan.page

-

MAS Consumer Banking: https://www.mas.gov.sg

-

MoneySmart Loan Comparison: https://www.moneysmart.sg/personal-loan

-

SingSaver Personal Loans: https://www.singsaver.com.sg/personal-loan

Government Resources:

-

HDB Renovation Guidelines: https://www.hdb.gov.sg

-

BCA Regulations: https://www.bca.gov.sg

-

Credit Bureau Singapore: https://www.creditbureau.com.sg

-

ScamShield: https://www.scamshield.org.sg

-

Singapore Police Force: https://www.police.gov.sg

Consumer Protection:

-

CASE (Consumers Association of Singapore): https://www.case.org.sg

-

Financial Industry Disputes Resolution Centre (FIDReC): https://www.fidrec.com.sg

-

Credit Counselling Singapore: https://www.ccs.org.sg

Important Disclaimer

Please Read Carefully:

This article is provided for informational and educational purposes only and should not be construed as financial, legal, or professional advice. All financial decisions should be made based on your personal circumstances after consultation with qualified financial advisors, lawyers, or other licensed professionals.

Regarding Financial Information:

-

All information about UOB bank loans, interest rates, fees, and terms are based on publicly available information as of October 2025 and are subject to change without notice

-

Actual interest rates, loan amounts, and terms may vary based on individual credit assessment and bank policies

-

There is no guarantee of loan approval—all applications are subject to the bank's credit evaluation and approval process

-

The author and publisher are not affiliated with, endorsed by, or sponsored by United Overseas Bank (UOB) or any financial institution mentioned

-

We do not receive any commission or compensation for loan applications made through official channels

Regarding Loan Applications:

-

Always verify current rates, terms, and eligibility requirements directly from official UOB channels before applying

-

Borrowing is a serious financial commitment—only borrow what you can comfortably afford to repay

-

Late or missed payments may result in penalties, interest charges, and negative impact on your credit score

-

Consider your long-term financial stability before taking on debt

-

Seek professional financial advice if you're unsure about any aspect of borrowing

Regarding MAS Regulations:

-

All regulatory information is based on publicly available MAS guidelines as of October 2025

-

Regulations may change—always check the latest updates on https://www.mas.gov.sg

-

This article does not constitute legal interpretation of any regulations

-

For specific regulatory questions, consult with legal professionals or contact MAS directly

Regarding Renovation Information:

-

RCS Renovation Contractor Singapore information, pricing, and services are provided for reference purposes only

-

This article does not constitute an endorsement or recommendation of any specific contractor

-

Pricing mentioned is indicative and based on publicly available information—actual costs may vary based on project scope, materials, and specifications

-

Always obtain official written quotations and conduct your own due diligence before engaging any contractor

-

Verify contractor licenses through official HDB and BCA channels independently

-

The author and publisher are not responsible for any disputes, losses, or damages arising from contractor engagement

-

Project outcomes, quality, and timelines may vary—review contracts carefully before signing

Regarding External Links:

-

All external links to third-party websites (including RCS) are provided for convenience only

-

The author and publisher do not control the content, accuracy, or availability of external websites

-

Visiting external links is at your own risk

-

No endorsement or affiliation is implied by the inclusion of external links

-

External websites may have their own terms of use and privacy policies

Regarding Scam Prevention:

-

While we provide tips to avoid scams, no method is 100% foolproof

-

Always exercise caution and common sense when dealing with financial matters

-

If you believe you've been scammed, report to Singapore Police Force immediately

-

The author and publisher are not liable for any losses resulting from scams or fraudulent activities

General Liability:

-

The author and publisher make no representations or warranties regarding the accuracy, completeness, or reliability of the information provided

-

Information may become outdated as banks change policies and regulations evolve

-

Use of this information is at your own risk

-

The author and publisher shall not be liable for any direct, indirect, incidental, consequential, or punitive damages arising from the use of this information

-

This article does not create any professional-client relationship

Important Reminders:

-

Always read and understand all loan agreements and contracts before signing

-

Never share sensitive information like SingPass passwords, OTPs, or banking credentials

-

Only deal with licensed and regulated financial institutions

-

Report suspicious activities to relevant authorities

-

Seek independent professional advice for significant financial decisions

-

Be aware that your individual circumstances may differ significantly from examples provided

Data Accuracy:

-

While efforts have been made to ensure information accuracy, errors or omissions may occur

-

Information presented reflects our understanding as of the publication date

-

No guarantee is made regarding the currentness or applicability of information to your specific situation

By reading this article, you acknowledge that:

-

You understand this is general information and not personalized advice

-

You will verify all information independently before making decisions

-

You will not hold the author or publisher liable for any outcomes resulting from using this information

-

You will seek professional advice for your specific circumstances

-

You understand that financial products and services carry risks

For the most accurate and current information:

-

Visit official UOB website: https://www.uob.com.sg

-

Contact UOB customer service directly

-

Consult with licensed financial advisors

-

Verify all contractor licenses through official HDB/BCA channels

-

Check latest MAS regulations at https://www.mas.gov.sg

Last Updated: October 30, 2025

Note: This article will not be updated automatically. Always check official sources for the most current information.

Final Thoughts

Applying for a UOB bank loan in Singapore can be a straightforward and safe process when you:

✅ Understand the loan types and choose what fits your needs

✅ Meet all eligibility requirements and prepare proper documentation

✅ Apply only through official, licensed channels

✅ Read and understand all terms before signing

✅ Borrow responsibly within your repayment ability

✅ Avoid loan scams by recognizing red flags

✅ For renovations, engage licensed contractors like RCS

With proper planning, research, and due diligence, you can secure the financing you need for your goals—whether it's buying your dream home, renovating your living space, or meeting personal financial needs—all while staying protected under Singapore's robust financial regulatory framework.

Remember: Financial safety begins with making informed decisions and dealing only with licensed, regulated institutions.