Property Investment Singapore - Educational Guide

IMPORTANT DISCLAIMER

This content is for educational and informational purposes only and does not constitute financial, investment, or legal advice. We are not licensed financial advisers under Singapore's Financial Advisers Act.

• No Investment Advice: Information provided should not be relied upon for investment decisions

• No Guarantees: Past performance does not guarantee future results

• Professional Consultation Required: Consult licensed professionals before making investment decisions

• Regulatory Compliance: Property investments are subject to Singapore regulations including ABSD, SSD, and other measures

• Risk Warning: All property investments carry risk of loss

The content creator is not responsible for any investment decisions made based on this information.

Property transactions in Singapore involve complex regulatory frameworks and significant financial considerations. However, understanding these processes through education remains valuable for potential property owners. Furthermore, renovation knowledge helps property owners make informed decisions about improving their homes.

Additionally, successful property ownership requires comprehensive market knowledge and careful planning. Moreover, understanding regulatory frameworks like ABSD and Option to Purchase agreements proves essential for anyone considering property ownership. Therefore, this educational guide focuses on factual information and process understanding rather than specific recommendations.

Currently, the Singapore property market operates under strict government oversight with various cooling measures in place. Consequently, property owners need disciplined approaches combining market understanding with renovation expertise to maintain their properties effectively.

Understanding Property Ownership and Renovation Process

Property Ownership Process Definition

Property ownership in Singapore involves acquiring real estate for personal use or long-term holding. Unlike passive investments, property ownership often requires active maintenance through renovations and improvements. First, potential owners research available properties and market conditions. Next, they complete legal processes including Option to Purchase agreements. Finally, many owners undertake renovations to improve functionality and appeal.

However, Singapore's regulated market requires long-term commitment due to Seller's Stamp Duty (SSD) rules. Nevertheless, when executed properly with professional guidance, property ownership contributes to personal wealth building while enhancing neighborhoods.

Complete Property Process: Step-by-Step Educational Guide

Property acquisition in Singapore follows a structured legal process requiring careful planning. Initially, interested parties conduct thorough market research to understand available options and pricing trends. Subsequently, they perform comprehensive property inspections before purchase to assess renovation requirements accurately.

Next, buyers secure financing through bank loans while considering stamp duties and acquisition costs. Additionally, they develop detailed renovation budgets focusing on necessary improvements like kitchens and bathrooms. Furthermore, they hire reliable contractors from HDB's Directory of Renovation Contractors for regulatory compliance.

After purchasing, owners execute renovations efficiently while planning for long-term ownership. Meanwhile, they maintain their properties through regular upkeep and strategic improvements. Finally, if they choose to sell after the minimum holding periods, they work with professionals to optimize presentation.

Option to Purchase (OTP) Agreements in Property Transactions

Option to Purchase agreements serve as crucial legal instruments in Singapore property transactions. Essentially, OTP grants exclusive rights to purchase property at agreed prices within specified timeframes. For private properties, option periods typically span 14 days, while HDB flats allow 21 calendar days.

Additionally, OTP requires option fees: 1% of purchase price for private properties (capped at S$1,000 for HDB flats). Furthermore, once granted, sellers cannot offer the property to other buyers during the option period. Therefore, OTP provides security for potential buyers while allowing due diligence time.

Moreover, understanding OTP terms proves essential for successful property transactions. Key components include property details, purchase price, option period duration, and special conditions. Consequently, interested parties should engage conveyancing lawyers to review OTP agreements before signing.

Property Types: Understanding Available Choices

Singapore offers diverse property types for different ownership needs. HDB flats provide affordable entry points with historical appreciation potential after Minimum Occupation Period (MOP). Meanwhile, condominiums attract buyers seeking amenities and broader location choices including some foreign ownership possibilities.

In contrast, landed properties represent premium ownership with limited supply and historical price appreciation. However, they require larger capital commitments and higher renovation budgets. Additionally, specialized properties like conservation shophouses offer unique opportunities but demand expert knowledge.

For renovation planning, different property types require specific approaches. Therefore, consider RCS renovation packages starting from S$5,590 for comprehensive improvements across all property categories.

Financial Considerations and Regulatory Framework

Acquisition Costs: ABSD, SSD, and Legal Requirements

Acquisition costs significantly impact property ownership affordability in Singapore. Firstly, Buyer's Stamp Duty (BSD) starts at 1% for first S$180,000, increasing progressively. Additionally, Additional Buyer's Stamp Duty (ABSD) adds substantial costs: Singapore citizens pay 20% on second properties and 30% on subsequent purchases.

Furthermore, foreign buyers face 60% ABSD rates with restrictions on landed property purchases. Meanwhile, legal fees range S$1,800-S$5,000 depending on property type. Moreover, Option to Purchase fees equal 1% of purchase price initially.

Consequently, these expenses significantly affect total ownership costs and must be calculated accurately. Therefore, factor all acquisition costs into financial planning before committing to purchases. All rates subject to change - consult current MAS and IRAS guidelines.

Renovation Costs: 2025 Market Data

Renovation represents significant value-creation opportunities for property owners in Singapore. Based on 2025 data from RCS, new condominiums typically require S$40,000-S$100,000 for renovations, while resale units need S$80,000-S$105,000. For HDB flats, new BTO units typically need S$30,000-S$70,000, whereas resale units require S$50,000-S$95,000.

Historically, kitchens and bathrooms have shown strong renovation value in Singapore properties. RCS offers kitchen packages from S$5,590 (Standard) to S$6,190 (Premium), with comprehensive bathroom renovation packages available. Additionally, improvements like neutral color schemes and quality flooring tend to appeal to broader audiences.

Moreover, space-maximizing designs particularly benefit smaller units. Therefore, focus renovations on improvements that enhance functionality rather than personal preferences alone. Costs subject to market fluctuations - obtain current quotes.

Understanding ROI Calculations and Ownership Metrics

Calculating financial returns helps property owners understand their total costs of ownership. First, understand the basic calculation: Final Sale Price minus Purchase Price, Acquisition Costs, Renovation Costs, Holding Costs, and Selling Costs equals Net Result.

Additionally, calculate percentage returns by dividing Net Result by Total Cash Invested, then multiplying by 100%. Furthermore, consider industry guidelines like the 70% Rule as reference: properties performing well historically traded at maximum 70% of After-Repair Value minus renovation costs.

Meanwhile, holding costs accumulate during ownership including mortgage interest, property taxes, and maintenance fees. Consequently, longer holding periods increase total ownership expenses through ongoing costs. Therefore, plan ownership strategies carefully to manage these expenses. Historical performance does not guarantee future results.

Taxation and Ownership Rules

Taxation significantly impacts property ownership strategies in Singapore. Notably, capital gains from property sales generally remain tax-free unless IRAS classifies activities as "property trading." Furthermore, IRAS applies "Badges of Trade" criteria including transaction frequency and holding periods.

Meanwhile, CPF funds can partially finance purchases within stipulated limits. However, CPF usage affects cash flow planning and eventual sale proceeds. For foreign buyers, substantial restrictions apply including higher ABSD rates and landed property limitations.

Consequently, understanding these rules proves essential for structuring property ownership properly. Therefore, consult tax professionals and legal advisers before implementing any property strategies. Tax regulations subject to change - verify current requirements.

Educational Analysis of Market Conditions

New Launch vs Resale Properties

Choosing between new launch and resale properties presents different ownership approaches. New launch properties typically involve buying during project launch with 3-4 year waiting periods before possession. Firstly, new launches sometimes offer early-bird pricing and potential appreciation during construction.

In contrast, resale properties allow immediate possession and renovation opportunities. Additionally, they often provide larger spaces than new launches, particularly in mature estates. Moreover, resale properties enable immediate improvements through renovation, while new launches primarily rely on market appreciation.

For renovating resale properties, specialized packages from RCS address unique challenges of older homes with comprehensive solutions. Therefore, choose ownership approach based on personal needs, capital availability and risk tolerance. Market conditions vary - consult current data.

Singapore Property Market Overview 2025

Singapore's property market demonstrates resilience with various factors affecting growth patterns. Currently, industry analysts have observed moderate price movements with historical data showing varied performance across different periods. Meanwhile, HDB resale prices show different patterns with Q1 2025 recording various percentage changes.

Additionally, supply-side factors continue influencing market dynamics with HDB launching 19,600 BTO units this year. Furthermore, demand patterns reflect genuine homebuyer needs rather than purely speculative activity. Moreover, interest rate changes affect affordability while supporting different market conditions.

Nevertheless, government cooling measures continue monitoring market conditions. Consequently, potential property owners should prepare for possible additional regulatory changes if market conditions warrant intervention. Historical data only - future performance not guaranteed.

Infrastructure Impact: Educational Overview

Major infrastructure developments influence property market dynamics in Singapore. Firstly, Cross Island Line phases will enhance connectivity, with historical data showing infrastructure projects affecting nearby property values differently over time. Additionally, URA Master Plan 2025 focuses on mixed-use developments and vertical zoning.

Meanwhile, Greater Southern Waterfront transformation will convert 2,000 hectares into residential and commercial spaces. Moreover, nearby areas may benefit from Thomson-East Coast Line connectivity and development spillover effects.

Consequently, properties near infrastructure developments have historically experienced various market responses. Therefore, consider infrastructure factors when evaluating properties for ownership and renovation. Past infrastructure impact does not predict future results.

Renovation Planning and Value Creation

High-ROI Renovation Areas

Kitchen and bathroom renovations historically show strong value creation in Singapore properties. Modern, functional kitchens significantly impact buyer perception and property functionality. Therefore, consider quality countertops like quartz or sintered stone for lasting appeal.

Similarly, updated bathrooms with contemporary fixtures create strong property features. RCS offers kitchen packages from S$5,590 and comprehensive bathroom solutions with transparent pricing. Additionally, flooring upgrades provide immediate visual impact while strategic space modifications create popular open-concept layouts.

Furthermore, lighting improvements enhance space perception with relatively modest investment. Ultimately, focus renovations on improvements that enhance property functionality for broadest appeal. Renovation value varies by property and market conditions.

Smart Technology and Energy Efficiency

Smart home features increasingly appear in modern Singapore properties. Consequently, consider incorporating smart lighting, security systems, and air-conditioning controls during renovations. Additionally, energy-efficient features provide dual benefits: lower operating costs and enhanced functionality.

Initially, install energy-efficient air conditioning systems with inverter technology for utility savings. Furthermore, LED lighting throughout properties reduces consumption while providing better illumination. Moreover, water-efficient fixtures appeal to environmentally-conscious users.

Meanwhile, strategic space reconfiguration adds functional value beyond renovation costs. Therefore, create flexible spaces accommodating modern needs like work-from-home requirements. Technology trends change - verify current market preferences.

Risk Management and Common Challenges

Market Risks and Regulatory Changes

Market volatility presents various risks in Singapore property ownership. Although Singapore's market rarely experiences dramatic downturns, price fluctuations occur regularly. Additionally, regulatory changes like cooling measures can emerge with minimal notice, altering market conditions.

Furthermore, interest rate fluctuations directly impact holding costs and market affordability. Meanwhile, global economic factors increasingly influence local property markets. Moreover, supply increases through government land sales affect different market segments.

Consequently, successful property owners maintain financial buffers for extended holding periods. Therefore, consider diversification strategies to mitigate concentration risks and market volatility. Market conditions unpredictable - prepare for various scenarios.

Renovation Challenges and Cost Management

Renovation challenges frequently affect property ownership budgets and timelines. Initially, hidden problems like structural issues or faulty wiring often emerge during renovation, causing budget increases. Additionally, contractor reliability problems lead to delays and quality issues.

Furthermore, material shortages or price increases can unexpectedly affect costs. Meanwhile, permit delays from authorities lengthen project timelines. Moreover, neighbor complaints in condominiums can trigger restrictions or work stoppages.

For minimizing risks, establish detailed contracts with milestone payments. Additionally, maintain contingency budgets of 15-20% above estimates for unexpected costs. RCS provides fixed-price packages with transparent pricing to reduce uncertainty. Renovation costs vary - obtain multiple quotes.

Property Presentation and Ownership Transition

Property Presentation and Staging

Effective property presentation significantly impacts selling price and timeline when owners decide to sell. Firstly, professional home staging creates emotional connections through tasteful furniture arrangement. Additionally, professional photography showcases property's best features effectively.

Moreover, virtual tours and 3D walkthroughs have become common marketing tools. Furthermore, compelling property descriptions highlighting key features attract qualified viewings. Meanwhile, strategic listing timing based on market cycles can maximize exposure.

For renovated properties, emphasize quality improvements and materials used during ownership. Therefore, highlight kitchen and bathroom upgrades specifically, as these areas strongly influence buying decisions. Market response varies - results not guaranteed.

Understanding Target Buyers

Creating appropriate marketing approaches for various buyer segments helps when selling properties. For instance, emphasize different features for different buyer types - functionality for families versus convenience for professionals. Moreover, tailor marketing to specific demographics based on property characteristics.

For family-friendly properties, showcase proximity to schools and parks. Conversely, for properties targeting young professionals, emphasize connectivity and lifestyle amenities. Additionally, professional agents with renovation knowledge better communicate value-added improvements.

Therefore, select agents understanding renovation quality and effectively highlighting features like energy efficiency and smart home technology. Buyer preferences vary - adapt approaches accordingly.

Frequently Asked Questions

What is the minimum budget for property ownership in Singapore?

Minimum budget depends on property type and renovation scope. For HDB properties, expect S$400,000-S$600,000 purchase price plus S$30,000-S$70,000 renovation costs. Additionally, factor ABSD (20% for second properties), legal fees (S$1,800-S$5,000), and holding costs. Therefore, total initial costs typically range S$500,000-S$800,000 for HDB properties. Prices subject to market changes - verify current costs.

How long does Option to Purchase (OTP) last in Singapore?

OTP duration varies by property type. For private properties, option periods typically last 14 days, while HDB flats allow 21 calendar days from granting date. Option expires at 4pm on the final day. During this period, sellers cannot offer property to other buyers. If buyers don't exercise OTP, they forfeit the option fee.

What renovation costs should I expect for property improvements?

Renovation costs vary significantly by property type and condition. New condominiums require S$40,000-S$100,000, while resale units need S$80,000-S$105,000. HDB renovations range S$30,000-S$70,000 for BTO and S$50,000-S$95,000 for resale. RCS offers transparent packages starting from S$5,590 for kitchen renovations. Always maintain 15-20% contingency budgets for unexpected costs. Costs fluctuate with market conditions.

Which renovations provide good value for property owners?

Kitchen and bathroom renovations historically show strong value creation in Singapore properties. Kitchen upgrades with quality countertops and modern fixtures significantly impact property functionality. Bathroom renovations with contemporary finishes create appealing features. Additionally, flooring upgrades, strategic lighting, and space-maximizing designs often provide good returns. Focus on improvements enhancing property functionality. Value varies by property and market conditions.

How does ABSD affect property ownership strategies?

ABSD significantly impacts property ownership costs in Singapore. Singapore citizens pay 20% ABSD on second properties and 30% on subsequent purchases. Foreign buyers face 60% ABSD rates. These substantial costs must be factored into ownership calculations. Additionally, ABSD affects holding strategies as multiple property ownership becomes more expensive. ABSD rates subject to government changes.

What are Seller's Stamp Duty (SSD) implications for property sales?

SSD applies to property sales within specific holding periods. For residential properties, SSD rates are 12% (Year 1), 8% (Year 2), and 4% (Year 3). These penalties significantly impact property sale proceeds. Therefore, property owners typically hold properties minimum 4 years to avoid SSD. This requirement makes property ownership a medium-term commitment rather than short-term holding. SSD rates and periods subject to regulatory changes.

How do I find suitable properties for ownership?

Finding suitable properties requires comprehensive research approaches. Conduct comparative market analysis comparing asking prices with recent transactions. Explore emerging neighborhoods showing development potential. Focus on properties from motivated sellers facing relocation or timing pressures. Analyze price differences between new launches and resale properties in same vicinity. Market conditions vary - verify current opportunities.

What financing options exist for property ownership in Singapore?

Property ownership financing includes bank mortgages, CPF funds (within limits), and renovation loans. Bank loans typically require 25% down payment for investment properties. Renovation loans offer varying interest rates with processing fees. HDB doesn't provide specific renovation loans - these come from banks. For furnishing and appliances, consider personal loans or credit card installment plans. Financing terms subject to change - verify current rates.

What permits are required for renovation works?

HDB renovation permits are required for structural alterations, hacking works, and electrical modifications. Permit applications must be submitted by HDB-licensed contractors from Directory of Renovation Contractors (DRC). Approval typically takes 3 weeks. Simple applications may be approved faster, while complex renovations take longer. Private property renovations may require BCA permits for major structural changes.

How does property ownership in Singapore compare to other investments?

Property ownership in Singapore offers tangible assets with historical performance varying significantly over time. However, it requires substantial capital, involves transaction costs, and demands active management. Additionally, minimum holding periods due to SSD affect liquidity. Consider diversification across REITs, stocks, and bonds for balanced portfolios. Property ownership suits individuals with substantial capital and renovation knowledge. Past performance does not guarantee future results - consult licensed financial advisers.

Conclusion: Educational Summary

Property ownership in Singapore offers learning opportunities when approached with proper education and realistic expectations. Firstly, conduct thorough research before any purchase, analyzing locations, price trends, and comparable properties. Additionally, maintain accurate financial projections including all acquisition costs, renovation expenses, and holding costs.

Furthermore, focus on functional renovations rather than personal preferences alone. Moreover, build strong professional networks including reliable agents, contractors, and lawyers. Meanwhile, maintain adequate financial reserves for unexpected costs and extended holding periods.

Most importantly, understand and comply with all regulatory requirements, particularly ABSD, SSD, and renovation permits. Lastly, view property ownership as long-term commitment requiring patience, expertise, and professional guidance for successful outcomes.

Remember: This guide provides educational information only. Always consult licensed financial advisers, legal professionals, and qualified contractors before making any property-related decisions. Market conditions, regulations, and costs change regularly - verify current information before proceeding.

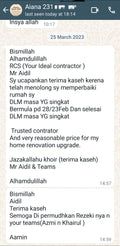

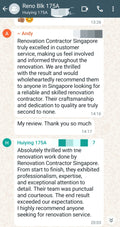

This educational content was prepared by RCS renovation specialists. For renovation services and transparent pricing, contact our licensed contractors from HDB's Directory of Renovation Contractors.