Tampines remains one of Singapore's most sought-after residential estates heading into 2026, balancing mature township infrastructure with continuous development that keeps the area dynamic and desirable. As Singapore's HDB resale market enters a phase of moderation following years of rapid appreciation, Tampines offers unique opportunities for both first-time buyers and upgraders seeking value in an established regional centre.

This comprehensive guide explores everything you need to know about buying Tampines resale flats in 2026—from current pricing trends and upcoming MOP projects to neighbourhood analysis and expert investment strategies.

Tampines HDB Resale Market Overview 2026

The Tampines resale market in 2026 operates within a broader context of moderated price growth across Singapore's HDB sector. After 22 consecutive quarters of uninterrupted price increases since Q2 2020, the market is experiencing a significant deceleration that creates more balanced conditions for buyers.

National Context: HDB Resale Market 2026

Understanding the national trend provides essential context for Tampines-specific dynamics. HDB resale prices grew just 0.4% in Q3 2025—the slowest pace in nearly five years—following extraordinary gains of 54.9% since early 2020. Year-to-date growth through September 2025 stood at 2.9%, substantially lower than the 9.7% appreciation recorded in 2024.

Market analysts project that HDB resale prices could rise between 1% to 5% in 2026, with most estimates clustering around 1-3% annual growth. This moderation reflects increased supply as more BTO flats reach their Minimum Occupation Period (MOP), alongside affordability constraints that naturally limit aggressive price escalation.

Despite slower price growth, transaction volumes remain robust. Resale activity increased 1.7% quarter-on-quarter in Q3 2025, and million-dollar HDB transactions hit a record high of 472 units in a single quarter. This paradox of slowing price growth coupled with sustained transaction volumes suggests market resilience rather than collapse.

Tampines-Specific Market Dynamics

Tampines demonstrates particular resilience within this national context due to several competitive advantages:

Established Infrastructure - As one of Singapore's three regional centres alongside Woodlands and Jurong East, Tampines benefits from comprehensive amenities including Our Tampines Hub, multiple shopping malls, and extensive commercial facilities that support both lifestyle quality and property values.

Superior Connectivity - Tampines offers unmatched transport options with three MRT lines serving the estate: the East-West Line (EWL), Downtown Line (DTL), and the future Cross Island Line (CRL) Phase 1, expected to open in 2030. This connectivity positions Tampines favourably for both owner-occupiers and investors seeking rental yields.

Employment Proximity - Strategic location near Changi Business Park, Changi Airport, and expanding industrial zones in Pasir Ris and Loyang creates a live-work-play environment that supports property demand across economic cycles.

According to market analysis, Tampines ranks among the top transaction volume leaders alongside Sengkang, Woodlands, and Yishun—estates that were once considered secondary choices but have emerged as primary residential destinations.

Tampines Resale Price Trends: Current Data

Understanding current pricing provides the foundation for informed buying decisions in 2026. You can check the latest HDB resale transaction prices using HDB's official portal, which is updated daily with registered resale applications.

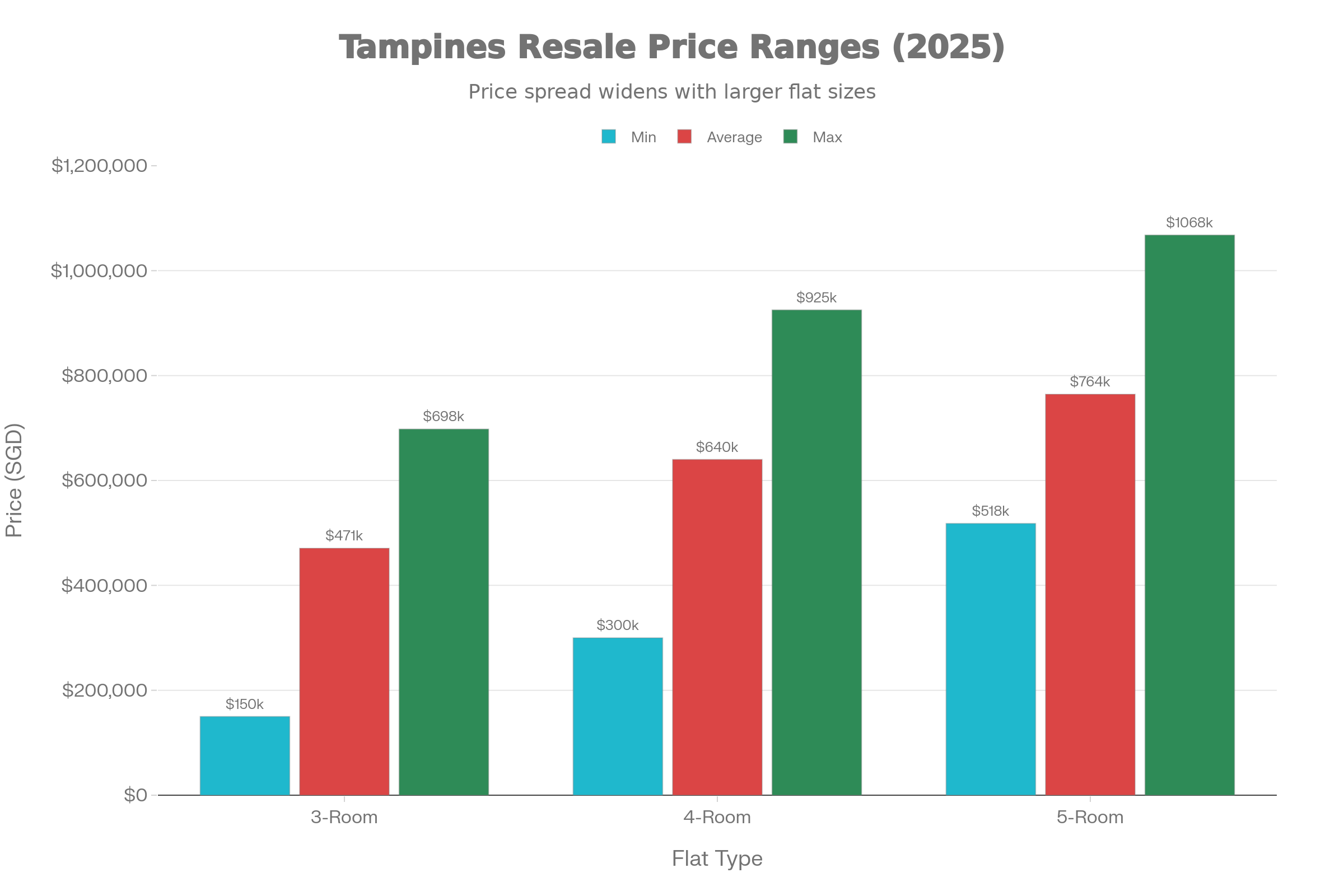

Price Breakdown by Flat Type

| Flat Type | Average Price | Price Range | Transactions (3 Years) |

|---|---|---|---|

| 2-Room | S$285,000 - S$350,000 | S$180,000 - S$420,000 | Limited |

| 3-Room | S$470,932 | S$150,000 - S$698,000 | 1,247 |

| 4-Room | S$640,031 | S$300,000 - S$925,000 | 2,589 |

| 5-Room | S$764,293 | S$518,000 - S$1,068,000 | 1,394 |

| Executive | S$923,686 | S$707,900 - S$1,208,000 | 207 |

Data Source: HDB Resale Statistics (Last 3 Years Aggregated)

Key Insights:

Entry-Level Accessibility - Three-room flats in Tampines average around S$470,000, making them accessible for first-time buyers and eligible singles. Older flats in less central locations can be found in the S$400,000-S$450,000 range, though these typically come with shorter remaining leases (60-70 years).

Four-Room Sweet Spot - The most actively traded segment, 4-room flats average S$640,000 but demonstrate wide price variation. Standard Model A flats in older blocks (built 1980s-1990s) typically range from S$550,000 to S$650,000, while newer Model A1/A2 units in better locations command S$700,000 to S$850,000. Premium units near MRT stations or in sought-after clusters like Tampines Central can reach S$900,000+.

Million-Dollar Territory - Executive apartments and select 5-room flats in prime locations have entered the million-dollar club. In September 2025, a 5-room flat at 862 Tampines Street 83 sold for S$1.068 million, setting a new estate record. These premium transactions typically involve units with excellent locations, long remaining leases (85+ years), and extensive renovations.

Factors Influencing Tampines Prices

Remaining Lease - Lease decay significantly impacts pricing, particularly for flats built in the 1980s-1990s. Buyers should ensure the remaining lease covers the youngest buyer until age 95 to maximize CPF usage and loan eligibility according to HDB's resale eligibility criteria.

Proximity to MRT - Flats within 5-10 minutes walking distance to Tampines, Tampines West, Tampines East, or Simei MRT stations command premiums of S$30,000-S$80,000 compared to less accessible blocks.

Floor Level and Orientation - Higher floors (10th floor and above) with unblocked views command S$10,000-S$30,000 premiums. Corner units and those with favourable orientation (avoiding afternoon west sun) also attract price premiums.

Renovation Status - Well-renovated units can command S$40,000-S$80,000 premiums over similar unrenovated flats, though buyers should assess whether renovation styles align with personal preferences to avoid immediate re-renovation costs.

Tampines Neighbourhood Guide: Where to Buy in 2026

Tampines encompasses diverse neighborhoods, each offering distinct characteristics, amenities, and value propositions. Understanding these micro-markets helps buyers identify locations aligned with their priorities and budgets.

(see the generated image above)

Tampines Central (Streets 11, 12, 22, 32, 41, 42, 81, 82, 83, 84)

Character: The commercial and civic heart of Tampines, offering unmatched convenience and urban lifestyle.

Key Amenities:

-

Tampines MRT Interchange (EWL/DTL)

-

Tampines 1, Century Square, Tampines Mall (3 major malls within walking distance)

-

Our Tampines Hub (community facilities, library, swimming complex, hawker centre)

-

Tampines Regional Library

-

Multiple bus interchanges

Price Point: Premium. Four-room flats typically range from S$650,000 to S$850,000, with select units exceeding S$900,000.

Best For: Convenience-focused buyers, investors seeking rental yield from proximity to employment centres, and retirees wanting car-lite lifestyles with excellent public transport and amenities within walking distance.

2026 Outlook: Sustained demand driven by location advantages. New BTO launch at Tampines Street 62 (near MRT) in February 2026 will add competitive supply, potentially moderating resale appreciation in immediately adjacent blocks.

Tampines North (Streets 61, 71, 72, 73, 82, 83)

Character: Newer estate clusters with modern designs and amenities, positioned for future growth.

Key Amenities:

-

Proximity to upcoming Cross Island Line Tampines North station (2030)

-

United World College of South East Asia

-

Tampines GreenRidge Park Connector

-

Newer commercial clusters with contemporary F&B options

Price Point: Mid-to-high range. Four-room flats in newer blocks (built 2010s) range from S$620,000 to S$750,000.

Best For: Families seeking newer flats with longer leases (85-90+ years remaining), buyers prioritizing future connectivity improvements from CRL, and those valuing modern estate planning with better-designed common spaces.

2026 Outlook: Strong appreciation potential driven by CRL construction progress and increasing maturity of amenities. MOP projects reaching the market in 2026 will provide rental investment opportunities as these newer units attract tenants seeking contemporary housing.

Tampines West (Streets 41, 42, 43, 44, 45, 46, 81, 91, 92)

Character: Balanced offering of convenience, value, and family-friendly environment.

Key Amenities:

-

Tampines West MRT (DTL)

-

Temasek Polytechnic

-

Tampines Round Market & Food Centre (popular hawker centre)

-

Multiple primary schools (Tampines Primary, Gongshang Primary)

-

Tampines West Community Club

Price Point: Good value. Four-room flats range from S$550,000 to S$680,000, offering size and location at more accessible price points than Central clusters.

Best For: Families prioritizing value and space, buyers seeking proximity to educational institutions, and those wanting neighborhood amenities without Central cluster price premiums.

2026 Outlook: Steady demand supported by strong fundamentals. DTL connectivity and polytechnic proximity support rental demand from students and young professionals. Gradual appreciation expected in line with overall market trends (2-3% annually).

Tampines East (Streets 21, 22, 23, 24, 25, 32, 33, 34)

Character: Mature residential neighborhoods emphasizing quieter, family-oriented living with strong school networks.

Key Amenities:

-

Tampines East MRT (DTL)

-

Tampines Mart (24-hour supermarket and amenities)

-

Ngee Ann Secondary School

-

St. Hilda's Primary School

-

Bedok Reservoir Park proximity

Price Point: Moderate. Four-room flats range from S$580,000 to S$700,000, depending on age and condition.

Best For: Families prioritizing education access (proximity to popular schools), buyers seeking quieter residential environments away from commercial intensity, and those valuing nature access with Bedok Reservoir nearby.

2026 Outlook: Stable demand driven by school proximity. Education-focused buyers provide consistent demand base. MRT accessibility supports property values despite competition from newer estate clusters.

Simei (Streets 1, 2, 3, 4, 5)

Character: Distinct subzone with quieter, more suburban feel while retaining Tampines connectivity advantages.

Key Amenities:

-

Simei MRT (EWL)

-

Eastpoint Mall

-

Changi General Hospital proximity

-

Multiple primary and secondary schools

Price Point: Value-oriented. Four-room flats range from S$530,000 to S$650,000, offering lower entry points than core Tampines clusters.

Best For: Budget-conscious buyers seeking Tampines association at lower prices, families valuing school networks, and those working in Changi area seeking shorter commutes.

2026 Outlook: Gradual appreciation as Simei benefits from overall Tampines infrastructure improvements. Hospital proximity supports rental demand from healthcare workers.

Planning Your Resale Flat Renovation Budget

One of the most significant yet often underestimated costs when buying a Tampines resale flat is renovation. Unlike BTO flats with fresh finishes, resale units—particularly those 15-30 years old—typically require substantial updating to meet modern living standards and personal preferences.

Typical Renovation Costs for Tampines Resale Flats

3-Room Resale Flats: S$25,000 - S$40,000

-

Basic renovation: S$25,000 - S$30,000

-

Mid-range renovation: S$30,000 - S$35,000

-

Premium renovation: S$35,000 - S$40,000+

4-Room Resale Flats: S$30,000 - S$50,000

-

Basic renovation: S$30,000 - S$38,000

-

Mid-range renovation: S$38,000 - S$45,000

-

Premium renovation: S$45,000 - S$50,000+

5-Room Resale Flats: S$35,000 - S$60,000

-

Basic renovation: S$35,000 - S$45,000

-

Mid-range renovation: S$45,000 - S$52,000

-

Premium renovation: S$52,000 - S$60,000+

Common Renovation Requirements for Older Tampines Flats

Older resale flats (20+ years) often require comprehensive work:

Electrical Rewiring - Essential for safety and to support modern electrical loads from air-conditioning, smart home devices, and multiple appliances. Budget S$3,000-S$5,000.

Plumbing Replacement - Aging pipes may leak or have reduced water pressure. Complete plumbing overhaul costs S$2,500-S$4,000.

Kitchen & Bathroom Hacking - Completely removing old tiles, cabinets, and fixtures to install fresh modern finishes. This is the most substantial cost component.

Waterproofing - Critical for bathrooms and kitchen to prevent leakage issues that could affect neighbors below. Professional waterproofing with warranty costs S$800-S$1,500 per bathroom.

Transparent Renovation Packages for Tampines Resale Buyers

Many Tampines resale buyers appreciate the convenience and cost certainty of fixed-price renovation packages rather than managing multiple contractors with unpredictable final costs.

RCS Renovation Contractor Singapore specializes in HDB resale renovations with transparent, comprehensive packages:

Complete Kitchen + 2 Bathrooms Package

-

Starting from S$24,990 (overlay method)

-

Starting from S$24,990 (hacking method with full demolition)

-

Includes: Complete hacking, waterproofing, tiling, 20-foot cabinet system, plumbing, electrical points, fixtures

-

Timeline: 6-8 weeks

Whole House Transformation Package

-

From S$29,890 - S$39,390 (comprehensive 5-room renovation)

-

Includes: Kitchen hacking, 2 bathrooms, flooring for all rooms, wardrobes, electrical upgrades, painting

-

Save S$11,610 - S$21,110 versus buying services separately

-

12-month comprehensive warranty

Kitchen-Only Packages (if focusing budget)

-

Basic Kitchen Cabinet: From S$5,590

-

Complete Kitchen Package: From S$11,290

-

Premium Kitchen with Hacking: From S$13,190

Why Fixed-Price Packages Work:

-

No surprise costs or hidden charges

-

Professional HDB renovation permit handling

-

Coordinated workflows reduce timeline

-

12-month warranty coverage

-

Single point of contact simplifies project management

For Tampines buyers planning renovations, getting a detailed quotation early in the home-buying process helps ensure your total investment (purchase price + renovation) stays within budget.

💬 Planning a Tampines resale renovation? Get a free consultation and 3D design preview: WhatsApp +65 8784 8742

MOP Projects Reaching Tampines Market in 2026

One of the most significant factors influencing Tampines resale dynamics in 2026 is the influx of Build-to-Order (BTO) flats reaching their five-year Minimum Occupation Period (MOP). These units create both opportunities and competitive pressure in the resale market.

Supply Context

Market analysis indicates that Tampines will see approximately 2,500 flats reaching MOP eligibility in 2026, ranking among the top three estates alongside Punggol (3,500 units) and Queenstown (2,500 units) for MOP supply influx.

Key MOP Projects in Tampines

GreenRidge (Streets 61, 62, 63) - Completed in 2019-2020, these modern 4-room and 5-room flats feature contemporary designs and landscaping that attract buyers seeking newer units without waiting for BTO balloting outcomes.

GreenWeave (Streets 71, 72) - Another northern cluster project reaching MOP, offering similar modern amenities and longer lease periods (88-90 years remaining).

Tampines GreenForest (Streets 82, 83, 84) - Central location projects with excellent connectivity to Tampines MRT, though proximity to commercial areas may result in higher ambient noise levels.

Impact on Resale Market

Increased Supply - MOP units expand buyer options, potentially moderating price appreciation for older resale flats as buyers weigh newer MOP alternatives against established resale units.

Price Segmentation - Expect clearer differentiation between "newer resale" (units 5-15 years old from MOP sales) and "mature resale" (units 20+ years old). This segmentation allows buyers to target specific value propositions.

Rental Investment Opportunities - Owners of MOP units entering the resale market may opt to rent out their flats, increasing rental supply and potentially moderating rental rate growth in Tampines.

February 2026 BTO Launch: Future Supply Pipeline

HDB announced plans to launch approximately 4,600 BTO flats in February 2026 across six projects in Bukit Merah, Sembawang, Tampines, and Toa Payoh, alongside 3,000 Sale of Balance Flats (SBF).

Tampines BTO Project Details

Location: Tampines Street 62, near Tampines MRT station

Expected Category: Plus or Prime, given the premium location near MRT interchange

Significance: This launch represents the first major BTO project in central Tampines in several years, addressing pent-up demand from residents preferring new flats in this established regional centre.

Impact on Resale Market:

-

Near-term (2026-2027): Minimal impact as BTO buyers wait 5 years for MOP

-

Medium-term (2031+): When these flats reach MOP, they will add premium-location supply that competes with existing central Tampines resale units

-

Buyer psychology: Some potential resale buyers may opt to ballot for this BTO, temporarily reducing resale demand in immediate vicinity

Investment Outlook: Should You Buy Tampines Resale in 2026?

The decision to purchase a Tampines resale flat in 2026 depends on individual circumstances, investment horizons, and objectives. Here's a balanced analysis:

Factors Supporting Tampines Investment

Infrastructure Momentum - Ongoing Cross Island Line construction enhances long-term connectivity value. When CRL Phase 1 opens in 2030, Tampines will be among Singapore's best-connected estates with three MRT lines, as outlined in URA's Master Plan.

Established Amenities - Unlike developing estates where promised amenities may take years to materialize, Tampines offers immediate access to comprehensive facilities that support quality of life and property values.

Regional Centre Status - Government designation as a regional centre ensures continued infrastructure investment and economic activity that supports property demand.

Rental Yield Potential - Proximity to Changi Business Park, Changi Airport employment, and educational institutions creates steady rental demand. Four-room flats in good locations can achieve S$2,800-S$3,500 monthly rental, translating to 4-5% gross yields.

Moderated Price Entry - After years of rapid appreciation, 2026's slower growth environment allows buyers to enter without the urgency-driven premiums that characterized 2021-2023 markets.

Considerations and Risks

Increased MOP Supply - Approximately 2,500 flats reaching MOP in Tampines in 2026 creates competitive supply that may limit near-term appreciation, particularly for older flats far from MRT stations.

Lease Decay - Older blocks (built 1980s-1990s) face accelerating lease value depreciation as remaining leases drop below 70 years. Buyers should carefully assess lease implications for long-term value retention.

Affordability Ceiling - With four-room flat prices averaging S$640,000 and premium units exceeding S$850,000, affordability constraints limit the buyer pool, particularly for first-timers without parental support for Proximity Housing Grants.

Market Moderation - Projected 1-3% annual appreciation in 2026 means property investment returns will come primarily from rental yields rather than capital appreciation, requiring realistic expectations about investment performance.

Buyer Strategy Guide: Maximizing Value in 2026

For buyers committed to purchasing Tampines resale flats in 2026, strategic approaches can optimize outcomes:

Financial Preparation

Grant Maximization - First-time buyers should maximize CPF Housing Grant (up to S$80,000), Enhanced Housing Grant (up to S$80,000), and Proximity Housing Grant (up to S$30,000 if living near parents in Tampines/neighboring estates). Combined grants can reduce cash requirements by up to S$190,000.

Loan Assessment - Get in-principle approval (IPA) before viewing to understand realistic budget. Use HDB's legal fees enquiry facility to estimate transaction costs.

Renovation Budget - Allocate S$30,000-S$50,000 for renovation of older flats requiring rewiring, hacking, and modernization. Factor this into total investment costs when comparing prices. Consider transparent renovation packages for cost certainty.

Property Selection Criteria

Remaining Lease Priority - Target flats with remaining leases that cover youngest buyer until age 95 (for maximum CPF usage) or at minimum age 85 (for reasonable long-term value retention).

MRT Proximity Balance - Flats within 5-10 minutes walk to MRT command premiums but offer superior convenience and future resale liquidity. Assess whether this premium aligns with your commuting patterns and priorities.

Value Clusters - Tampines West and Simei offer better value propositions than Central clusters while maintaining good connectivity. Consider whether convenience premium justifies higher Central prices for your specific lifestyle.

School Proximity (for Families) - If prioritizing education, verify school proximity using MOE's distance-based admission criteria. Premium paid for school proximity only delivers value if children actually gain admission.

Negotiation Strategies

Market Knowledge - Research recent transactions for comparable units using HDB's Resale Price portal. Knowledge of actual transaction prices (vs. asking prices) strengthens negotiation position.

Timing Leverage - Sellers facing financial pressures or relocation deadlines may accept below-asking offers. Patient buyers willing to wait for motivated sellers can achieve 3-5% discounts versus eager buyers.

Conditional Offers - Structure offers contingent on satisfactory inspection outcomes, allowing renegotiation if significant defects emerge during viewing or professional inspection.

Cash vs. CPF Mix - Sellers sometimes prefer buyers using more CPF (faster transaction) versus those requiring maximum cash-over-valuation (COV) financing. Understand seller motivations to structure attractive offers.

Tampines vs. Alternative Estates: Comparative Analysis

Understanding how Tampines compares to competing estates helps buyers assess relative value:

Tampines vs. Bedok

Similarities: Both are mature eastern estates with EWL MRT connectivity and comprehensive amenities.

Differences: Bedok offers slightly lower entry prices (4-room average ~S$600k vs. S$640k) but lacks Tampines's regional centre status and DTL connectivity. Tampines provides superior amenities concentration (Our Tampines Hub vs. distributed Bedok facilities).

Verdict: Tampines offers better long-term value for slight price premium, particularly for buyers prioritizing convenience and future connectivity (CRL).

Tampines vs. Pasir Ris

Similarities: Eastern location, EWL connectivity, established residential character.

Differences: Pasir Ris offers more spacious layouts and beach/park access but less central location and fewer employment options. Tampines provides superior commercial amenities and job accessibility.

Verdict: Choose Pasir Ris for lifestyle-focused priorities (nature, space); choose Tampines for convenience and career accessibility.

Tampines vs. Punggol

Similarities: Both feature modern HDB designs (newer clusters) and waterfront amenities.

Differences: Punggol offers newer flats with longer leases but less established commercial ecosystem and single MRT line (NEL/LRT). Tampines provides mature infrastructure and superior connectivity.

Verdict: Punggol suits buyers prioritizing lease length and modern designs; Tampines suits those prioritizing established amenities and connectivity options.

Tampines vs. Sengkang

Similarities: Both are high-transaction-volume estates with modern infrastructure.

Differences: Sengkang offers slightly lower prices but relies heavily on NEL/LRT. Tampines provides superior connectivity (3 MRT lines) and regional centre amenities.

Verdict: Tampines offers better connectivity value; Sengkang may suit buyers maximizing purchasing power with moderate trade-off in convenience.

Future Developments Impacting Tampines

Understanding pipeline developments helps buyers assess long-term value trajectory:

Cross Island Line Phase 1 (Expected 2030)

The upcoming Tampines North and Tampines stations on the CRL will transform connectivity, reducing travel times to western regions and enhancing Tampines's position as a cross-island hub. Properties near these future stations should see appreciation acceleration as opening approaches.

Tampines Regional Centre Master Plan

URA's Master Plan 2025 outlines continued development of Tampines as a regional centre, including additional commercial, employment, and community facilities that support property values.

Integrated Developments

Upcoming mixed-use developments in Tampines (Tampines Avenue 11 project, various EC launches) will enhance commercial vibrancy and attract higher-income residents, creating positive spillover effects for nearby HDB resale values.

Conclusion: Tampines Resale Outlook 2026

Tampines enters 2026 as a mature, well-connected regional centre offering balanced opportunities for both owner-occupiers and investors. The moderated price growth environment creates more favorable buyer conditions compared to the urgency-driven markets of 2021-2023, allowing careful property selection and negotiation.

Key takeaways for 2026:

Price Expectations: Anticipate 2-3% annual appreciation, significantly below historical rates but positive nonetheless. Focus on location quality and long-term fundamentals rather than short-term speculation.

Supply Awareness: Approximately 2,500 MOP flats entering the market create competitive pressure, particularly for older resale units. Newer resale or well-maintained older units will differentiate themselves more clearly.

Connectivity Value: Tampines's three-MRT-line advantage (with CRL construction progressing) positions the estate favourably for long-term value retention compared to single-line suburbs.

Value Clusters: Tampines West and Simei offer accessible entry points while maintaining connectivity advantages, representing sweet spots for value-conscious buyers.

Renovation Planning: Budget S$30,000-S$50,000 for comprehensive resale flat renovation. Consider transparent fixed-price packages from HDB-registered contractors for cost certainty and peace of mind.

For buyers with realistic expectations about moderate appreciation, solid rental yields, and long-term holding horizons, Tampines resale flats in 2026 offer compelling value in Singapore's most established eastern regional centre.

Disclaimer:

This article is for informational purposes only and does not constitute financial, legal, or investment advice. Property buyers should conduct independent research, verify all information with official sources, and consult licensed professionals before making purchase decisions. Resale prices, renovation costs, and market conditions are subject to change. All pricing information is accurate as of December 2025 and may vary based on individual circumstances.

For HDB resale procedures and eligibility, please refer to (https://www.hdb.gov.sg).