Buying property in Singapore represents one of the most significant financial decisions you'll make in your lifetime. With the Singapore property market continuing to evolve in 2026, understanding the complete landscape—from eligibility requirements to financing options, legal processes, and post-purchase considerations—is essential for making informed decisions. This comprehensive guide walks you through every step of the property buying journey, providing you with the knowledge to navigate Singapore's sophisticated housing ecosystem confidently.

Understanding Singapore's Property Market in 2026

Singapore's property market in 2026 shows steady, moderated growth following years of government cooling measures and strategic supply management. Market analysts project the Residential Property Price Index could reach 231.00 points, reflecting approximately 9.6% growth from Q1 2025 levels. This translates to annual appreciation rates of around 3-4%, which major property consultancies have forecasted based on current economic conditions and supply-demand dynamics.

The government continues its commitment to housing stability through the Government Land Sales programme, planning to release more than 25,000 new private homes between 2025 and 2027. This measured approach aims to balance market stability with allowing sustainable appreciation, particularly in premium segments where land scarcity remains a defining factor.

How Different Property Types Are Performing

The performance of different property segments varies significantly based on supply constraints and buyer demographics. Landed properties, with only 73,000 units projected over the next 15 years compared to 500,000 condominium units, show the strongest appreciation potential at 4-6% annually. This fundamental scarcity, combined with wealth accumulation among established Singaporeans seeking larger homes for multi-generational living, continues to support premium pricing in this segment.

Non-landed residential properties, primarily condominiums, demonstrated robust performance with 4.74% year-on-year growth throughout 2025, outpacing landed properties which showed more modest 0.38% quarter-on-quarter gains. The Central Region maintains premium pricing due to limited land availability and strong domestic demand. Notably, Singaporean buyers now comprise 89% of new non-landed private home sales transactions, the highest proportion since records began in 1995.

An important market development for 2026 involves HDB flats reaching Minimum Occupation Period (MOP). The number of flats completing their MOP will nearly double from 7,000-8,000 units in 2025 to approximately 13,480 units in 2026. This surge in supply, particularly concentrated in Punggol, Tampines, and Toa Payoh, creates increased resale inventory. For buyers, this represents enhanced selection and potentially better negotiating leverage. For sellers, competitive pricing becomes crucial to stand out in a more crowded marketplace.

| Property Segment | Expected 2026 Growth | Typical Monthly Payment | Best Suited For |

|---|---|---|---|

| HDB 4-Room BTO (Non-Mature) | 2-3% | $1,400 - $1,800 | First-time buyers, young families starting homeownership |

| HDB 4-Room Resale (Mature) | 1-2% | $2,400 - $3,000 | Buyers seeking immediate occupancy in established areas |

| Executive Condominiums | 2-3% | $3,600 - $5,600 | Couples exceeding HDB income limits, first private property |

| Mass Market Condos | 3-4% | $4,800 - $7,200 | HDB upgraders, professionals seeking facilities |

| Prime Region Condos | 4-5% | $10,000 - $14,000 | High net worth buyers, investment diversification |

| Landed Properties | 4-6% | $10,000 - $16,000 | Large families, generational wealth building |

Step 1: Determine Your Eligibility

Understanding your eligibility forms the critical foundation of your property purchase journey. Singapore's housing framework operates on tiered citizenship classifications, each with distinct access rights and financial obligations.

Citizenship Status and Property Access

Singapore Citizens enjoy the broadest property access. Citizens can apply for HDB flats through Build-To-Order (BTO) launches and purchase from the resale market. They can also buy Executive Condominiums after the Minimum Occupation Period and have unrestricted access to all private properties. This comprehensive access enables citizens to leverage government subsidies while maintaining flexibility for future property upgrades.

Permanent Residents face measured restrictions designed to prioritize citizen access to subsidized housing. PRs can purchase resale HDB flats subject to specific conditions—at least one owner must be a Singapore Citizen. However, PRs cannot apply for new BTO flats. They have full access to Executive Condominiums after the five-year MOP expires and can purchase private properties, though they incur a 5% Additional Buyer's Stamp Duty (ABSD) on their first property, rising to 25% for second properties and 30% for third properties.

Foreigners encounter the most stringent limitations. Foreign nationals are restricted entirely to private condominiums and landed properties, with the latter requiring specific approval from the Singapore Land Authority. The government imposes a substantial 60% ABSD on all foreign purchases, effectively making Singapore property accessible primarily to ultra-high net worth international buyers. Foreigners cannot purchase HDB flats or Executive Condominiums under any circumstances.

HDB Flat Eligibility: What You Need to Qualify

The Housing Development Board maintains strict eligibility criteria to ensure public housing serves genuine housing needs rather than investment speculation. To qualify for an HDB flat, at least one applicant must hold Singapore Citizenship, while the other applicant can be either a Citizen or Permanent Resident. Applicants must be at least 21 years old, though singles face a higher threshold of 35 years for standalone applications under the Single Singapore Citizen Scheme.

Income Ceilings for 2026

Income ceilings play a crucial gatekeeping role in HDB eligibility. As of 2026, families and couples applying for BTO flats must not exceed $14,000 in combined monthly household income. Extended families and multi-generational applicants enjoy a higher $21,000 ceiling, acknowledging the additional financial responsibilities of supporting elderly parents or adult children. Singles face a $7,000 monthly income ceiling for both BTO applications and resale flat purchases qualifying for government grants.

These income ceilings, last revised in 2019, are currently under government review to align with economic trends and wage growth. The Ministry of National Development has indicated willingness to raise these thresholds when conditions warrant, and potentially lower the singles eligibility age from 35 when BTO supply increases sufficiently.

Property Ownership Restrictions

HDB eligibility requires demonstrating genuine housing need. All applicants and occupiers listed must not own any private residential property locally or overseas. Additionally, applicants must not have disposed of any private property within the preceding 30 months. This cooling period prevents property flipping and ensures HDB flats serve as primary residences rather than speculative assets.

Private property owners seeking to purchase HDB flats must commit to disposing of their private property within six months of receiving keys to their HDB flat, ensuring no dual property ownership.

Using Official Government Resources

Before beginning your property search, start with the official HDB Flat Portal at homes.hdb.gov.sg. This comprehensive platform centralizes all information about BTO launches, resale flat listings, eligibility requirements, and grant applications. The portal allows you to filter searches by budget, location, flat type, and remaining lease duration.

The HDB portal also features a helpful Housing Budget Calculator that provides accurate loan estimates from both HDB and participating financial institutions. This tool helps determine your maximum affordable purchase price based on your current income, CPF balances, and existing debt obligations, incorporating current HDB loan rates and Mortgage Servicing Ratio requirements.

Understanding Financing Options: HDB Loans vs Bank Loans

HDB Concessionary Loans

HDB concessionary loans offer maximum 75% Loan-to-Value (LTV) ratios, but only for properties where the remaining lease can cover the youngest buyer to age 95. This lease consideration becomes increasingly important for older resale flats, where shortened leases reduce both loan quantum and resale value. The current HDB concessionary loan rate stands at 2.6% per annum, significantly below most bank mortgage rates which range from 3.3% to 3.8% for comparable tenures.

However, HDB loans require buyers to meet stricter income ceilings and cannot be used for properties exceeding certain valuation limits. The Mortgage Servicing Ratio (MSR) caps HDB loan repayments at 30% of gross monthly household income.

Bank Loans

Bank loans provide maximum 55% LTV for first property purchases, with progressively stricter limits for subsequent properties. This lower LTV compared to HDB loans necessitates larger down payments but offers flexibility for higher-value properties and buyers exceeding HDB income ceilings.

All property financing, regardless of source, must comply with the Total Debt Servicing Ratio (TDSR), which limits all debt obligations—including property loans, car loans, personal loans, and credit card debt—to 55% of gross monthly income. This prudential measure prevents overleveraging and protects borrowers from financial distress during economic downturns or interest rate increases.

Step 2: Choose Your Property Type

HDB Flats: Singapore's Affordable Housing Foundation

HDB flats remain Singapore's most affordable and accessible housing option. The government plans to launch 55,000 Build-To-Order units between 2025 and 2027. BTO flats offer substantial government subsidies but require patience, with typical waiting periods ranging from 3 to 5 years depending on flat type and location. Non-mature estates like Tengah and Punggol generally complete faster, while mature estates with superior amenities command longer queues.

The official HDB Flat Portal provides comprehensive information on each development, including flat layouts, facilities, transport connectivity, and estimated completion dates. You can compare different projects, view floor plans, and understand the neighborhood amenities before submitting applications.

Resale HDB Flats

Resale HDB flats provide immediate occupancy, eliminating waiting periods entirely. However, they command premium prices reflecting instant availability, established neighborhoods, and often renovated conditions. With 13,480 HDB flats reaching MOP in 2026—nearly double 2025's numbers—resale inventory will expand significantly, giving buyers enhanced selection and potentially better negotiating leverage.

Private Condominiums: Enhanced Living with Greater Flexibility

The private condominium market offers enhanced facilities including swimming pools, gyms, function rooms, tennis courts, and 24-hour security. Condominium owners enjoy full rental freedom without Minimum Occupation Periods, enabling immediate investment returns if desired.

The private market demonstrated robust momentum with 10,624 new home sales in the first eleven months of 2025, representing 64.2% year-on-year growth. This surge reflects pent-up demand from HDB upgraders and young professionals seeking proximity to business districts and premium facilities.

Mass Market vs Prime Region Condominiums

Mass market condominiums in suburban locations like Jurong, Woodlands, and Sengkang offer entry points from $1.2 million for 800-900 square foot units. These developments typically sit near MRT stations, offering convenience for working professionals while maintaining relative affordability.

Prime region condominiums in Districts 9, 10, and 11 command premiums exceeding $2,000 per square foot, with three-bedroom units typically starting from $2.5 million. These properties appeal to high net worth individuals prioritizing central locations, prestigious addresses, and proximity to premium amenities.

Executive Condominiums: Bridging HDB and Private Housing

Executive Condominiums occupy a unique middle ground between HDB flats and fully private condominiums. Developed by private developers but sold with HDB eligibility conditions and government subsidies, ECs serve first-time private property buyers who have exceeded HDB income ceilings but seek more affordable entry than mass market condos.

ECs face a five-year Minimum Occupation Period before owners can sell to Singapore Citizens and PRs, and a ten-year period before selling to foreigners. After ten years, ECs are fully privatized with no ownership restrictions. This hybrid structure appeals to young couples with combined income between $14,000 and $16,000 monthly—above HDB limits but seeking better value than fully private properties. EC prices typically range from $900,000 to $1.4 million depending on location and development stage.

Landed Properties: The Ultimate in Space and Privacy

Landed properties represent Singapore's most supply-constrained housing segment. With only 73,000 landed units projected over the next 15 years versus 500,000 condominiums, this fundamental scarcity supports sustained value appreciation. Landed properties serve primarily as generational wealth vehicles for established Singaporean families rather than first-time purchases.

The substantial capital requirements, typically exceeding $2.5 million for entry-level terraced houses and $4 million for semi-detached homes, place this segment beyond reach for most young families. However, for high net worth individuals prioritizing space, privacy, and long-term asset preservation, landed properties offer unmatched lifestyle benefits and consistent appreciation.

Step 3: Calculate Your True Property Budget

Down Payment Requirements

Down payment requirements form the largest upfront capital hurdle for most property purchases. For a typical $1,000,000 condominium, buyers must prepare a minimum 25% down payment totaling $250,000. This breaks down into a mandatory 5% cash component of $50,000, with the remaining 20% ($200,000) eligible for CPF Ordinary Account utilization subject to availability.

The 75% Loan-to-Value ratio means buyers secure $750,000 in financing. A 25-year loan at 3.5% interest generates monthly repayments of approximately $3,750, excluding property tax, maintenance fees, and insurance.

Using Your CPF for Property Purchase

Central Provident Fund savings provide Singaporeans and Permanent Residents with powerful property financing tools, subject to important safeguards protecting retirement adequacy. Members can utilize CPF Ordinary Account savings for down payments, monthly installments, and legal fees. For detailed information on housing withdrawals and current limits, visit the official CPF website at cpf.gov.sg.

CPF Changes for 2026

From 2026, significant CPF changes take effect that impact property financing. The monthly income ceiling rises to $8,000, increasing maximum annual CPF contributions to $35,520. This expanded contribution base allows higher earners to accumulate larger Ordinary Account balances available for property purchases.

Members aged 55 and above must set aside their Basic Retirement Sum (currently $102,900 for 2026) before utilizing additional CPF for property purchases. Those without property covering them to age 95 must set aside the Full Retirement Sum ($206,000 for 2026). The Enhanced Retirement Sum option ($309,000) provides higher monthly payouts for members prioritizing retirement income over property equity.

An important consideration: while CPF accelerates homeownership, accrued interest must be refunded upon property sale, reducing net proceeds. Strategic buyers balance CPF utilization against cash reserves to maintain financial flexibility.

Understanding Stamp Duties

Buyer's Stamp Duty (BSD)

Buyer's Stamp Duty represents a significant transaction cost computed on the higher of actual purchase price or market valuation. The progressive rate structure applies marginal rates to different value tranches, similar to income tax calculations. For complete information on current rates and calculations, visit the Inland Revenue Authority of Singapore (IRAS) BSD page.

For residential properties, the first $180,000 incurs 1% BSD, followed by 2% on the next $180,000. The next $640,000 attracts 3%, followed by 4% on the subsequent $500,000. Properties valued between $1.5 million and $3 million face 5% on that increment, with amounts above $3 million taxed at the highest 6% marginal rate.

Example: A $1,000,000 condominium purchase generates $24,600 in BSD, calculated as $1,800 on the first tier, $3,600 on the second tier, and $19,200 on the third tier. This represents approximately 2.46% effective tax rate on the total purchase value.

Additional Buyer's Stamp Duty (ABSD)

Additional Buyer's Stamp Duty serves as Singapore's primary cooling measure, deterring property speculation and multiple property accumulation. The rates vary dramatically based on buyer citizenship status and existing property holdings. For current ABSD rates and regulations, refer to the IRAS ABSD page.

Singapore Citizens purchasing their first property enjoy zero ABSD, preserving affordability for genuine homeownership. However, second properties incur 17% ABSD, rising to 25% for third and subsequent properties.

Permanent Residents face immediate ABSD obligations, paying 5% on their first property purchase—a $50,000 charge on a $1,000,000 purchase. Second properties jump to 25% ABSD, while third properties reach 30%.

Foreigners and corporate entities face the steepest ABSD at a flat 60% and 65% respectively, regardless of property count. A foreign buyer purchasing a $1,000,000 condominium pays $600,000 in ABSD alone, plus $24,600 in BSD, totaling $624,600 in stamp duties before legal fees or financing costs.

Other Purchase Costs

Legal Fees

Legal fees for property conveyancing vary between HDB and private transactions. HDB resale transactions using HDB-appointed solicitors cost between $288 and $2,300 depending on transaction complexity. Private property conveyancing typically costs approximately $2,500, covering title searches, document preparation, stamp duty lodgement, and completion formalities.

Agent Commissions

Property agents command commissions typically ranging from 1% to 2% of transaction value plus GST, though seller-side commissions usually cover this cost. Buyers should clarify co-broking arrangements upfront to avoid unexpected obligations.

Valuation and Administrative Fees

Property valuation fees range from $150 for basic HDB flats to $400 for complex private properties. Banks charge processing fees between $500 and $1,000 for mortgage applications. HDB administrative fees add $40 to $80 for resale applications.

Monthly Ownership Costs: A Realistic Example

Understanding total monthly obligations enables realistic affordability assessment. Consider a $1,200,000 suburban condominium of 800 square feet:

Monthly Obligations:

-

Mortgage payment (25-year loan at 3.5%): $4,800

-

Maintenance and sinking fund: $350

-

Property tax (owner-occupied): $200

-

Home and mortgage insurance: $80

-

Total monthly obligation: $5,430

The Total Debt Servicing Ratio requirement of 55% means buyers need minimum gross household income of $9,873 monthly ($118,473 annually) to qualify for this purchase, assuming no other significant debt obligations.

Understanding Property Tax

Property tax in Singapore operates on Annual Value—the estimated annual rental income if the property were leased in its current condition. Owner-occupied residential properties benefit from progressive rates significantly more favorable than non-owner-occupied properties. For detailed information on current property tax rates and calculations, visit the IRAS Property Tax page.

For 2026, the government grants generous one-off property tax rebates, providing 15% rebates for owner-occupied HDB flats and 10% rebates capped at $500 for owner-occupied private properties.

Should You Rent or Buy? A Strategic Analysis

The decision between renting and buying represents one of the most consequential financial choices facing Singapore residents.

Comparing Upfront Capital

Renting requires minimal upfront capital—typically two months' rent as security deposit plus one month advance rent, totaling approximately $6,000 to $12,000 for a typical two-bedroom condominium. This low barrier enables young professionals and expatriates to access quality housing without substantial savings.

Buying demands massive upfront capital. A $1,000,000 condominium requires $250,000 down payment, $24,600 BSD (for Singapore Citizen first property), $2,500 legal fees, and approximately $10,000 for miscellaneous costs. Total upfront outlay exceeds $287,000—nearly 30 times the capital required for renting.

Monthly Payment Comparison

Monthly rent for a typical suburban condominium ranges from $2,500 to $4,000, covering only occupancy costs. Tenants bear no maintenance obligations, property taxes, or major repair responsibilities.

Monthly ownership costs for the same property total $5,430, including $4,800 mortgage payment, $350 maintenance fees, $200 property tax, and $80 insurance. This represents 35-115% higher monthly outlay compared to renting, though mortgage payments build equity while rent payments generate zero asset accumulation.

When Does Buying Make Financial Sense?

For a $1,200,000 condominium appreciating at conservative 3% annually, the breakeven period typically ranges between 4 and 6 years. Initial years favor renting due to massive upfront costs and early mortgage periods dominated by interest rather than principal repayment.

By year five, accumulated equity from principal repayment and capital appreciation typically exceeds cumulative rent saved plus foregone investment returns on the down payment. Property value grows to approximately $1,391,000, while outstanding mortgage declines to approximately $645,000, generating net equity around $746,000 against initial $287,000 outlay.

However, transaction costs complicate shorter holding periods. Selling within three years incurs agent commissions, legal fees, and foregone stamp duties, potentially totaling $50,000 to $75,000.

| Factor | Renting | Buying |

|---|---|---|

| Upfront Capital | $6,000 - $12,000 | $287,000+ |

| Monthly Payment | $2,500 - $4,000 | $5,430 |

| Equity Building | None | Principal + appreciation |

| Flexibility | High (6-24 month leases) | Low (MOP, transaction costs) |

| Renovation Control | Limited | Full control within regulations |

| Maintenance Risk | Landlord bears | Owner responsible |

Key Decision Factors:

Duration of intended stay represents the primary decision driver—buying becomes advantageous for stays exceeding 5 years, while renting suits shorter horizons. Down payment availability constrains many aspiring buyers, as accumulating 25% capital plus stamp duties requires years of disciplined savings.

Income stability matters critically given TDSR requirements. Job seekers, entrepreneurs, and professionals in volatile industries may prefer rental flexibility. Life stage considerations also influence decisions—young professionals value mobility for career opportunities, while families prioritize stability and renovation control.

The Legal Process of Buying Property

Step-by-Step Transaction Workflow

Step 1: Offer to Purchase

Property transactions commence with the buyer submitting a Letter of Intent accompanied by a good faith deposit, typically 1% of purchase price for private properties. For HDB resale transactions, both buyer and seller must obtain valid Housing Financial Eligibility (HFE) letters from the HDB Flat Portal demonstrating loan approval and financial capacity.

Step 2: Option to Purchase Period

Upon accepting the offer, sellers grant an Option to Purchase valid for 14 to 21 days. Buyers pay the option fee, typically 1% for private properties. This exclusive option period enables buyers to conduct comprehensive due diligence including property valuation, legal title searches, and final mortgage confirmation without risk of losing the property.

Step 3: Exercise of Option

Buyers exercise the Option by signing and remitting the remaining deposit, totaling 5% of purchase price for private properties. This legally commits both parties to the transaction, triggering preparation of sale and purchase agreements and formal mortgage applications.

Step 4: Completion and Key Collection

The completion period, typically 8 to 12 weeks for private properties and 12 to 16 weeks for HDB transactions, involves finalizing mortgage disbursement, settling stamp duties, and lodging transfer documents. Lawyers coordinate the simultaneous exchange of remaining purchase funds for property keys.

Government Agencies Involved

Singapore Land Authority (SLA)

The Singapore Land Authority manages all land-related matters including property registration, survey services, and title issuance. All property transfers must be registered with SLA to establish legal ownership. The agency's online STARS eLodgment platform streamlines document submission, typically completing registrations within two weeks. For information on registration fees, visit the SLA Fee Schedule.

Inland Revenue Authority of Singapore (IRAS)

IRAS administers all property-related taxes including Buyer's Stamp Duty, Additional Buyer's Stamp Duty, Seller's Stamp Duty, and annual Property Tax. Buyers must pay all applicable stamp duties within 14 days of exercising the Option to Purchase. Failure to meet these deadlines incurs penalties and interest charges.

Housing Development Board (HDB)

For HDB transactions, the Housing Development Board oversees eligibility verification, resale processing, and flat management. All HDB purchases require formal applications through the HDB Flat Portal, with both buyers and sellers submitting required documentation electronically.

Central Provident Fund Board (CPF)

The CPF Board administers housing withdrawals for down payments and monthly installments. Members must submit property details and valuation reports to obtain withdrawal approvals, ensuring withdrawals comply with valuation limits and retirement adequacy requirements.

Post-Purchase: Planning Your Renovation

Why Renovation Planning Matters

Most properties, whether newly completed BTOs or resale units, require at least modest renovation to align with personal preferences and functional needs. Proper planning prevents cost overruns, contractor disputes, and extended timelines.

Realistic Renovation Budgets for 2026

HDB Flat Renovations

For a typical 4-room HDB flat spanning 90 to 100 square meters, comprehensive renovation covering all rooms ranges from $35,000 to $65,000. This includes kitchen renovations with new cabinets and countertops ($8,000-$15,000), bathroom upgrades with retiling and fixtures ($6,000-$12,000 per bathroom), living room improvements including flooring and built-in furniture ($12,000-$20,000), and bedroom carpentry ($8,000-$15,000).

Basic package renovations start around $30,000, covering essential works including painting, basic flooring, simple kitchen cabinets, and standard bathroom fixtures. Mid-range renovations from $45,000 to $55,000 incorporate better quality materials, more extensive built-in furniture, and enhanced finishes. Premium renovations exceeding $65,000 feature designer fixtures, imported tiles, custom carpentry, and sophisticated lighting systems.

Condominium Renovations

Private condominiums typically command higher renovation budgets due to larger floor areas and premium material selections. A 1,000 square foot condominium undergoes comprehensive renovation ranging from $60,000 to $120,000 depending on scope and specifications.

Condominium renovations require Management Corporation approval, adhering to prescribed renovation hours (typically Monday to Saturday, 9 AM to 6 PM), and obtaining necessary permits for major works.

Professional Renovation Packages

For homeowners seeking comprehensive solutions with transparent pricing, established renovation contractors offer tiered packages designed for different budgets and preferences.

Renovation Contractors Singapore provides detailed renovation packages:

Essential Package ($30,000 - $35,000)

-

Painting for all rooms with standard paint

-

Basic vinyl flooring throughout

-

Simple melamine kitchen cabinets with laminate countertop

-

Basic bathroom retiling with standard fixtures

-

Essential electrical works

Classic Package ($45,000 - $55,000)

-

Premium painting with two-tone feature walls

-

Engineered wood flooring for living/dining areas

-

Quality kitchen cabinets with quartz countertop

-

Premium bathroom fixtures with rain shower

-

Extended carpentry including TV console and shoe cabinet

-

Upgraded lighting including downlights

Premium Package ($65,000 - $75,000)

-

Designer paint schemes with textured feature walls

-

Full engineered wood flooring including bedrooms

-

Custom kitchen cabinetry with premium countertops

-

Luxury bathroom upgrades with designer tiles

-

Extensive custom carpentry including wardrobes for all bedrooms

-

Smart home integration including lighting control

Room-by-Room Renovation Costs

Kitchen Renovations

Kitchen renovations represent substantial investments, with complete overhauls ranging from $15,000 to $35,000. This includes demolition, new cabinet installations with soft-close mechanisms, quartz or solid surface countertops, backsplash tiling, upgraded appliances, and plumbing works.

Bathroom Renovations

Bathroom renovations cost between $8,000 and $18,000 per bathroom, covering waterproofing, floor and wall retiling, shower screen installation, vanity cabinets, toilet bowls, faucets, and accessories. Proper waterproofing is critical—cutting costs here risks water seepage affecting neighboring units.

Living Room Improvements

Living room improvements including flooring, feature walls, built-in TV consoles, and lighting typically range from $15,000 to $30,000. Flooring choices significantly impact budget—vinyl represents the most economical option at $3-$6 per square foot, laminate ranges $5-$10, while engineered wood commands $10-$18 per square foot.

Bedroom Carpentry

Bedroom carpentry for wardrobes, study tables, and storage solutions averages $6,000 to $12,000 per room depending on complexity and materials. Custom built-in wardrobes maximize space utilization in compact Singapore homes.

HDB Renovation Permits and Regulations

Mandatory Permit Requirements

HDB flat renovations require formal permits for structural works, hacking, plumbing, and electrical modifications. Contractors must apply for permits through the HDB Online Business Portal before commencing works. Unauthorized renovations risk substantial fines up to $200,000 and potential rectification orders.

Prohibited works include removing or hacking structural walls, columns, and beams; installing unauthorized grilles or awnings; hacking bomb shelter walls; and modifying plumbing risers. These restrictions protect building structural integrity and ensure resident safety.

Renovation Hours

HDB strictly enforces renovation hours to minimize disruption. Permitted hours run Monday through Saturday from 9 AM to 6 PM, with Sunday and public holiday work entirely prohibited. Violations generate neighbor complaints and enforcement actions including stop-work orders.

Choosing Renovation Contractors

Due Diligence Essentials

Selecting reliable renovation contractors represents one of the most critical post-purchase decisions. Poor contractor choices result in cost overruns, delays, and substandard workmanship. Conduct thorough due diligence including reviewing portfolios, checking HDB registration status, verifying BCA licenses, and interviewing at least three contractors.

Request detailed quotations itemizing all works, materials, and timelines. Clarify payment schedules tied to completion milestones rather than large upfront payments. Verify that contractors carry adequate insurance and maintain consistent communication throughout the renovation period.

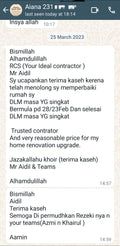

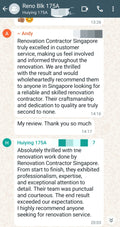

Benefits of Established Firms

Established renovation contractors provide comprehensive services including space planning, design consultations, permit applications, project management, and post-renovation support. Professional contractors bring valuable experience navigating HDB regulations, managing subcontractor coordination, and delivering quality outcomes within agreed budgets.

For specialized guidance on different renovation scenarios, Renovation Contractors Singapore offers comprehensive resources including their 4-room resale renovation guide which addresses unique challenges of renovating older units, and their complete renovation laws guide covering all regulatory requirements.

Renovation Cost Planning

Detailed cost planning prevents budget overruns and ensures realistic financial preparation. Professional contractors provide comprehensive cost breakdowns by category—structural works, flooring, painting, electrical, plumbing, carpentry, kitchen, bathrooms—helping homeowners prioritize expenditures aligned with budget constraints.

For comprehensive renovation planning resources, visit the Renovation Contractors Singapore full renovation guide which covers design considerations, material selection, contractor evaluation, and project management best practices.

Common Mistakes to Avoid

Overextending Your Budget

The most common mistake first-time buyers make involves overextending budgets to purchase properties beyond comfortable affordability. Maximizing borrowing capacity leaves no buffer for interest rate increases, income disruptions, or unexpected repairs. Conservative buyers target mortgage payments consuming no more than 25-30% of gross income, preserving financial flexibility.

Ignoring Hidden Costs

Beyond mortgage payments, property ownership generates ongoing costs including property taxes, maintenance fees, insurance, major repairs, and eventual renovation needs. New buyers sometimes focus exclusively on purchase price while neglecting these additional obligations that can add 15-25% to monthly housing costs.

For a $1,200,000 condominium, annual hidden costs include $4,200 maintenance fees, $2,400 property tax, $960 insurance, and approximately $2,000-$3,000 for utilities and minor repairs—totaling $9,500 to $10,500 annually or $800-$875 monthly beyond mortgage payments.

Choosing Contractors Based Solely on Price

Choosing renovation contractors based solely on lowest price frequently results in poor outcomes. Unrealistically low quotes often indicate inferior materials, inexperienced workers, or hidden charges that emerge mid-project. Request detailed itemized quotations, verify contractor licenses and insurance, review past project portfolios, and speak with previous clients.

Red flags include demands for large upfront payments exceeding 30% of contract value, vague quotations without itemization, reluctance to provide references, and contractors without proper HDB registration or BCA licenses.

Misunderstanding Leasehold Implications

Singapore's predominantly leasehold land tenure system means most properties have finite lifespans, typically 99 years from initial development. Older resale properties with 60-70 years remaining lease face accelerated depreciation as they approach the critical 60-year threshold where HDB loans become unavailable and bank financing becomes restricted.

Properties with remaining leases unable to cover the youngest buyer to age 95 face reduced loan quantum, requiring larger down payments. Buyers should carefully assess lease decay implications for both current financing and future resale prospects.

Neglecting Resale Value

While personal preferences drive property selection, future resale prospects should influence decisions. Properties in excellent locations with good transport links, established schools, and comprehensive amenities command premium prices and sell faster. Prime locations near MRT stations, top primary schools, and commercial amenities consistently outperform fringe locations during market downturns.

Unusual layouts, niche design features, and properties in less connected areas face longer marketing periods and potential price discounts during resale. Ground floor units, units facing highways, and properties with problematic feng shui orientations may appeal to specific buyers but limit the overall buyer pool.

Frequently Asked Questions

Can foreigners buy property in Singapore?

Yes, but with significant restrictions. Foreigners can freely purchase private condominiums without approval requirements. However, landed property purchases require Singapore Land Authority approval under the Residential Property Act, which is rarely granted except for designated Sentosa Cove properties. Foreigners face 60% Additional Buyer's Stamp Duty on all purchases. Foreigners cannot purchase HDB flats or Executive Condominiums under any circumstances.

How much down payment do I need for a condominium?

Condominium down payments require minimum 25% of purchase price, split into two components. The mandatory cash portion represents 5% of purchase price. The remaining 20% can be paid through CPF Ordinary Account savings subject to availability. For a $1,000,000 condominium, buyers need $50,000 cash plus $200,000 from CPF or additional cash, totaling $250,000 down payment. Banks finance the remaining 75% ($750,000) subject to income qualification and credit evaluation.

What government grants are available for first-time buyers?

Singapore Citizens purchasing their first property can access various government grants depending on property type and household income. The Enhanced CPF Housing Grant provides up to $80,000 for first-timer families purchasing 4-room or smaller BTO flats, with amounts varying by income level. The CPF Housing Grant for resale flats offers up to $50,000 for families and $25,000 for singles. Proximity Housing Grants provide $20,000 to $30,000 for buyers choosing to live near or with parents. First-Timer Grants for BTO purchases provide $10,000 to $30,000 depending on flat type. Visit the HDB Grants Page for current grant amounts and eligibility criteria.

Do I need a lawyer for property purchases?

Yes, legal representation is mandatory for all property transactions in Singapore. Lawyers conduct title searches ensuring clear ownership, prepare and review sale and purchase agreements, calculate and lodge stamp duties, arrange mortgage documentation, and handle completion formalities. For HDB transactions, buyers can use HDB-appointed solicitors at subsidized rates between $288 and $2,300. Private property transactions typically cost around $2,500 for conveyancing services.

What renovation permits are required for HDB flats?

HDB renovation permits are mandatory for structural works including hacking non-structural walls, electrical works adding power points or lighting circuits, plumbing works modifying pipe configurations, and installation of built-in fixtures. Contractors must apply for permits through the HDB Online Business Portal before commencing works, typically requiring 7-14 days for approval. Simple cosmetic works like painting, changing curtains, or installing loose furniture do not require permits. Unauthorized renovations risk fines up to $200,000 and potential rectification orders. Professional contractors handle all permit applications as part of their comprehensive service.

Your Property Purchase Checklist

Financial Preparation

-

Complete comprehensive income and expense analysis

-

Accumulate full down payment including cash and CPF components

-

Budget for stamp duties, legal fees, and renovation costs

-

Obtain In-Principle Approval from banks or HDB

-

Review long-term financial commitments

-

Maintain emergency fund covering 6-12 months expenses

Eligibility Verification

-

Confirm citizenship status and property access rights

-

Verify household income within applicable ceilings

-

Ensure no disqualifying property ownership or recent disposals

-

Validate age requirements for applications

-

Check CPF minimum sum requirements

Property Due Diligence

-

Conduct physical inspection noting defects and required repairs

-

Review floor plans against actual measurements

-

Verify remaining lease duration and financing implications

-

Research neighborhood amenities, schools, and transport links

-

Assess future development plans affecting property value

-

Review past transaction prices and market trends

Legal and Documentation

-

Engage qualified conveyancing lawyer

-

Review Option to Purchase terms carefully

-

Verify seller ownership through title search

-

Confirm no outstanding property taxes or maintenance arrears

-

Understand buyer and seller obligations

-

Verify property tax assessment

Post-Purchase Planning

-

Develop comprehensive renovation budget and timeline

-

Research qualified contractors through referrals and reviews

-

Understand renovation regulations and permit requirements

-

Plan temporary housing during major works

-

Budget for furnishing and move-in costs

-

Coordinate utility connections and address registration

Final Thoughts

Singapore's property market in 2026 offers compelling opportunities for well-prepared buyers who understand eligibility requirements, conduct thorough financial planning, and approach transactions with discipline. The combination of moderate price appreciation, sustained economic growth, and comprehensive government housing programs creates favorable conditions for genuine homeowners building long-term wealth.

Whether you're a first-time buyer navigating BTO applications, an upgrader assessing private condominium options, or a high net worth individual considering landed property investments, success requires comprehensive research, realistic financial assessment, and engagement with qualified professionals.

By leveraging government resources including HDB's housing calculators, IRAS's stamp duty information, CPF's housing scheme guidelines, and SLA's property registration services, combined with professional guidance from established service providers like Renovation Contractors Singapore for post-purchase renovations, buyers can navigate Singapore's complex property landscape with confidence and achieve their homeownership aspirations within sustainable financial frameworks.